Our team meets weekly to discuss the merits of various investment recommendations as well as the Unstoppable Trends we're following, but things got a little testier than normal when it came to Amazon and the "retail ice age" it's causing.

Barron's doesn't seem to think it's a big deal and even went so far as to declare that grocery stores and big-box home improvement stores are immune to Amazon's charge in last weekend's edition.

I wanted to bang my head on the desk!

There is no such thing as an "Amazon-Proof" retailer and any investor who makes the mistake of thinking there is may as well take his or her money to Vegas where at least they'll have fun losing it.

Here's how to make sure that'll never be you.

Mainstream Press or Mainstream Mess?

Barron's, one of the most widely respected financial publications in circulation - and one I love to read because it's so good - has offered not one, but two "head-to-wall-banging" statements about Amazon in recent weeks.

I don't know if it's a fear of change or just a human inability to understand it, but I cannot stress enough how poorly thought out some of the arguments are. Nor can I ignore the amount of money such failed logic will cost any investor who fails to understand the real impact Amazon has on our world.

First, Barron's argued that Amazon faces steep challenges in its emerging grocery business as it introduces new technologies to expedite deliveries and reduce the amount of time that customers need to be in a store actually buying products.

Barron's contention is that Americans like to go to - and spend time in - the grocery store. According to survey data, they state that fast checkout times just don't matter to consumers.

Bang! - that was the sound of my forehead as it hit my desk.

Then, just a few pages later, the newspaper wrote that home improvement retailers like The Home Depot Inc. (NYSE: HD) and Lowe's Companies Inc. (NYSE: LOW) have "virtually Amazon-proof" business models.

Bang! - my forehead hitting my desktop yet again.

The idea that a retail business model is immune to Amazon's charge is naïve at best and exceptionally shortsighted at worst. Either way, it's a costly notion.

The situation reminds me of Thomas Watson in 1943 when he said that he thought there was "a world market for maybe five computers." Or Spencer Silver, the chemist who said that "the literature was full of examples that said you can't do this" right before he invented the adhesive that made 3M Co.'s (NYSE: MMM) Post-it notes possible.

To be fair, I don't want to call out the writers at Barron's. Most of the arguments they advanced actually originated with Wall Street analysts who "cover" grocery store stocks and big-box retailers in a way that would make politicians green with envy.

Once again, Wall Street and the financial press are ignoring history.

When they're told that a disruptive company like Amazon can turn an industry on its side, they stick their fingers in their ears and scream the five most dangerous words in the English language... "it'll be different this time."

Right... and I've got a bridge to sell you...

After 20 years of watching Amazon become the disrupter of all disrupters, how can they possibly believe that there are Amazon-proof retailers?!

Lessons from History

There was a time that one could argue - as many did - that traditional and fashion retail companies had the same advantages Barron's has touted about the grocery and home improvement businesses.

Back in the 1990s, malls were packed. They were a popular destination for an entire generation of shoppers. I remember when it took longer to find a parking spot than it did to pick out a shirt.

Then technology showed up and a young man named Jeff Bezos lit the world on fire in July of 1995 when Amazon.com opened for business and billed itself as the "Earth's Biggest Book Store." By September 1996 - only 14 months later - the company had 100 employees and sales of more than $15.7 million.

Chances are you know the rest of the story like I do.

Here's where it really hits home and why I've decided to write to you on this topic today.

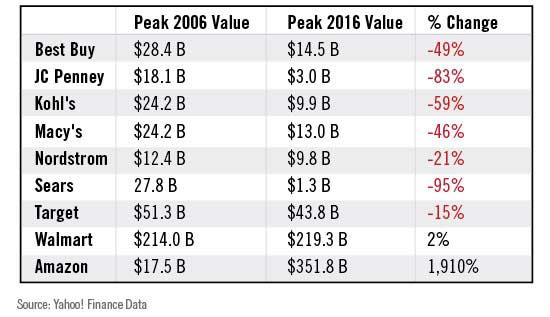

Take a look at this chart.

It's the peak market capitalization of eight iconic brick-and-mortar retailers - brands you know by heart - and Amazon.com Inc. (Nasdaq: AMZN) from 2006 and 2016.

See if you can spot the trend.

Red, red, red, and more red. The only other retailer posting positive capitalization growth over the last 10 years has been Walmart with a measly 2%. Meanwhile, Amazon's market capitalization increased by 1,910%.

JCPenney and Sears... they're closing stores and approaching a fiscal implosion that too many should have seen 10 years ago. These retail companies failed to understand their customers' taste and changes in shopping behavior.

Just this week, Payless ShoeSource filed for Chapter 11.

J. Crew just shut down its flagship Fifth Avenue shop and admitted it has $2 billion in debt - a large chunk of which is due next year.

More retailers have declared bankruptcy in the first three months of 2017 than they did for the entire 12 months of last year.

It's only a matter of time before Amazon figures out how to package groceries and lumber.

As I have said many times over and for many months now, "it's Amazon versus everybody else and any retailer without an Amazon defense strategy is living on borrowed time."

There are two ways to play this.

Longer term, there's no question you want to own shares of Amazon. The company has returned 4951.33% since it went public in May 1997, turning every $10,000 invested into more than $505,133 today.

Obviously, that's an expensive proposition - at about $900 a share, you can either buy 100 shares or a really nice house in the competitive San Francisco Bay area. Normally I'd suggest a Direct Stock Purchase plan as a way around this problem, but Amazon doesn't offer one at the moment.

So consider buying just a few shares at a time. Heck, buy even one if that's what you can afford. Then, throw away the proverbial key.

Amazon may well be the only company in the world today that you can buy today and expect to hold for the rest of your investing lifetime.

There's no doubt that Amazon will go up and down, but what makes it so very compelling is that the odds that Amazon will go out of business are virtually nil.

That means, in keeping with how we do things around here Total Wealth Style, you will be investing based on the certainty of growth rather than the uncertainty of risk.

Never forget that Wall Street has a vested interest in protecting what's in the rear-view mirror, but you have a vested interest in building wealth based on what's ahead.

Build Incredible Wealth: This investing strategy has uncovered more than 400 double- and triple-digit peak-gain winners. One pick alone could have turned $5,000 into $34,350. Click here to learn how to harness this for yourself…

The post What Barron's Is Missing: There's No Such Thing as an "Amazon-Proof" Retailer appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.