Wall Street veteran Art Cashin is one of those guys you want to pay attention to. He started his career at Thomson McKinnon in 1959 and became a member of the NYSE in 1964 at the tender age of 23. Today he's the director of floor operations for UBS at the Exchange.

There's very little Cashin hasn't seen over the years.

He's particularly good at recognizing patterns that often go unnoticed by younger analysts, especially those grounded in the latest technical data. So when he makes a comment like the one he did last Wednesday about the possibility of another correction, you want to take what he says very seriously for the same reasons I do.

Cashin told CNBC's "Squawk on the Street" that there's probably a "35% chance that we still have to retest earlier lows from a week and a half to two weeks ago." If you're doing the math in your head like I was when I heard him say that, he's talking about a retest of the lows that plunged markets into correction territory.

Most people, including the mainstream media, are focused on the 35% part of what he said or on the absolute numbers associated with a correction - most recently like a Dow at 23,360, an S&P 500 at 2,532, and a Nasdaq that hits 6,630.

What really matters, though, is what Cashin said next.

Pullbacks almost never end in a "V" shape - meaning it's rare to see them run straight higher after hitting new lows - as has happened. More typically, he continued, "you wind up with a little bit of a W."

My research agrees, as does my experience.

Urgent: Feds use obscure loophole to threaten retirees. If you have a 401(k), IRA, or any type of retirement account, this could cause you to miss out on $68,870 or more. Learn more…

It doesn't matter whether you are talking about a single instantaneous move or a more protracted one. The principle is the same - markets rarely bottom out after just one "test."

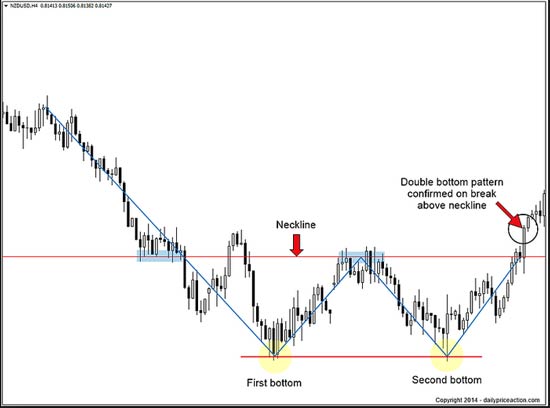

Chartists call this a "double bottom" - a term you'll hear now and then on TV or see in various technically inclined trading forums and presentations.

And here's an example of what a "double bottom" chart looks like:

To put that in context, here's what the S&P 500 looks like at the moment:

As you can plainly see, half of the "W" Cashin is talking about is missing - or to be precise, it hasn't formed yet but has a 35% probability of happening.

So, how do you play that possibility?

Most investors won't have a clue, which means odds are they'll get clobbered again as panic sets in when prices roll over.

You, on the other hand, will have an entirely different experience because of what we're discussing today.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The Total Wealth investment approach lends itself to both profits and protection of your money against unexpected market movements.

The six Unstoppable Trends ensure you and your money are lined up with trillions of dollars that will get spent practically no matter what happens in the world's financial markets, what the Fed does next, or even how Wall Street tries to hijack things in its own interest.

The companies making "must-have" products and services the world cannot live without that feed those trends further bolster the defensive nature of our recommendations because it is very unlikely they'll fail... even if the markets go to hell in a handbasket.

Best of all, Total Wealth Tactics like trailing stops, lowball orders, and rebalancing make sure you're always "buying low and selling high" for maximum profits even as others react to a correction by panicking. They're like built-in "risk mitigation" for lack of another way to describe 'em.

Here's how you put that together right now in the name of more profits, just in case Cashin's right.

First, review your portfolio immediately and put trailing stops under every investment you have. My rule of thumb is 25%, but feel free to tighten that up to 5%, 10%, or some other level that lets you capture profits that match your personal risk tolerance and objectives... if and when the markets roll over.

Doing so ensures that you're prepared ahead of time and frees you up from the emotional chaos that will pinch other investors caught in the heat of the moment if the selling starts in earnest.

If it doesn't (and Cashin's wrong), then guess what?

You're still "in to win" as the markets continue to rise, which means even bigger profits ahead!

I love that part, frankly!

Second, keep a short list of companies you want to buy if the markets suddenly put them "on sale." And enter the appropriate "lowball orders" to scoop them up if you get the chance. Think Amazon.com Inc. (Nasdaq: AMZN) at $1,100, or Apple Inc. (Nasdaq: AAPL) at $156, for example (they're currently trading at $1,491.29 and $173.66 as I type). Even lower prices work, too, so feel free to experiment as you develop your own "feel" for the markets.

Third, reorient your thinking. Big corrections are more often cause for celebration than fear. History shows very clearly that removing emotion from the equation is how you get ahead and stay in the hunt for gains. It's the difference between winning over time and losing instantly.

Learn to buy when everybody else panics and you will, too.

Get ahead, that is.

"Stunningly Massive" Profit Opportunities Now

Using a strategy derided as "crazy," this investment strategist gave his readers the chance to bank 313% in average gains over just one month last year (including partial and full closeouts).

And the gain opportunities are accelerating at an astonishing pace now…

The post What to Do If Art Cashin Is Right (About Another Correction) appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.