You've spotted an unstoppable, trillion-dollar trend. You've identified the stock that's set to benefit most and made a trade using the tactics that will squeeze the most profit out of it.

Nicely done.

Now it's time for the final piece of the Total Wealth strategy.

Mention the words "risk management," and most investors get a look that's somewhere between bored and terrified. It's not that they don't want to control risk; they're just not sure how, and they don't make it a priority.

Yet, the most direct path to building a fortune is not losing your money in the first place.

All you really need is a handful of tools and the discipline to enforce them.

One you're probably already familiar with is a "trailing stop." They're usually automatic sell orders set at a specific percentage below the market price of the investment you hold, or at some predetermined dollar amount of risk on a given investment. While people typically think of trailing stops as downside protection, in fact, they can be used to lock in profits, too. That's why I recommend using them on almost every investment.

But few people use what I call "Ultimate Trailing Stops."

The Most Direct Path to Building a Fortune

Before I show you the power of Ultimate Trailing Stops, we need to spend a minute talking about why risk management matters.

As I said, the most direct path to building a fortune is not losing money.

I know that sounds obvious, but it's not to the vast majority of folks.

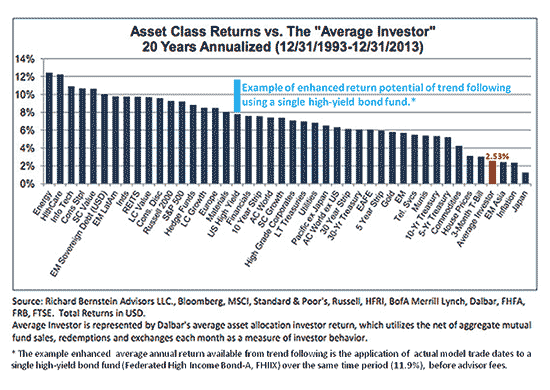

DALBAR data shows that individual investors consistently underperform the broader markets. Over time, they fall farther and farther behind, eventually dooming themselves to terrible results that they'll never make up.

Many investors like to think that this is because they haven't found the next "Google," or "Apple," or "Microsoft." I suppose that's true on some level, but in reality, there's plenty of opportunity. So much so, in fact, that from 1993 to 2013 almost every investment sector outperformed the average individual investor who achieved an annualized return of just 2.53% over the same time frame.

That's why I started Total Wealth.

That's why I started Total Wealth.

With the six trends, the right tactics, and a few risk management tools, chances are you won't be left behind - and, in fact, you may even beat the market for years to come.

Must See: What do billionaires Peter Lynch, President Trump, and a retired cop from Northridge have in common? They've all benefited enormously from a curious Great Depression-era "program." And even though most have no idea this exists, it could be worth $68,870 or more to the average American. Continue reading…

Truth be told, there are thousands of ways to prevent losses. This isn't anything new, and there's certainly no lack of literature on the subject. In fact, a quick spin around the Internet reveals tens of thousands of articles covering everything from simple trailing stops to esoteric methods like synthetic hedging, which you'll need a PhD in astrophysics to understand. That's NOT what I'm talking about here.

What I am talking about is installing another layer between you and the proverbial "sell button."

Here's a great place to start.

How to Use Ultimate Trailing Stops

Like many investors, I want to make money every day with everything I own. I realize that's not always possible, but that doesn't stop me from trying. Chances are, you feel the same way, or you wouldn't be here.

But what matters is how I approach the markets.

From the moment I wake up to the moment I go to bed, I think about what's going to cause me to lose money. That may surprise you, but it shouldn't. Many professional traders are the same way. They know that profits will come if they can consistently identify what will cause them to lose money, and they take steps to avoid it.

For me, that's ultimately a very simple process - hence the moniker "Ultimate Trailing Stop."

Here's how it works.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

I ask myself every single day if the reasons why I bought something are still there and still true.

If the answer is YES, then I'm content to hold on through thick and thin. I'm not concerned about short-term market fluctuations and, in most cases, will actually use any decline to buy more because I am confident that capital is a creative force and that the markets will continue to grow as earnings do.

If the answer is NO, then I'm gone like the wind in that old J.J. Cale song, "Call Me the Breeze."

In that sense, an Ultimate Trailing Stop gives you the perspective needed to buy, hold, and ultimately sell any investment successfully and, more importantly, as profitably as possible over time.

Here are some examples of what could trigger an Ultimate Trailing Stop.

Is the CEO still in place, and do I like his vision as a leader?

For example, I loved Steve Jobs, the founder of Apple Inc., but I don't have confidence in his replacement, Tim Cook. Apple's earnings are slowing. The company oozes MBAs rather than innovation these days. The entire marketing strategy is based on "me, too," from Apple Pay to the iPhone. It's all a game of catchup to me. So I won't go near the company anymore and have recommended shorting it several times when the technicals merited a high-probability move.

Has there been a game-changing development in the industry that obviates the product suite?

Tesla Inc. springs to mind here as the "game changer." I think Elon Musk is the most innovative CEO on the planet and that his vision is very threatening to Detroit and to the conventional auto industry in general. So I'm perfectly happy to recommend Tesla, even though it's clearly going to be a bumpy ride.

Is price in line with value?

When I recommend buying stocks, for example, I formulate an opinion as to what I think something is worth. If a stock increases to that point, I'm the first one to recommend scaling out or rebalancing into other holdings that are undervalued. My goal is not so much to set a hard and fast target, as it is to enter a range and stay there.

Obviously, I've just scratched the surface here.

I can think of a whole host of other questions you may want to add to your own list, depending on your individual perspective, risk tolerance, and time horizon.

Has something changed for the worse?

Do I have to sell because I need the money?

Will selling help me rebalance to buy more upside?

If I don't want to buy it today, why am I not selling?

Is the smart money leaving?

There is no single answer that's right for everybody. Ultimately, that depends on you - pun absolutely intended. The Ultimate Trailing Stop is the mental backdrop behind any investment decision. It's uniquely yours and tremendously personal.

The point is, again, I'm really not concerned with short-term market gyrations. I'm talking about investments here - not trades. So most of my questions are fundamental and oriented to the longer-term approach that leads to profits over time. You may have a different perspective.

In practice, you may not need to check your Ultimate Stops every day, like I do. In fact, you may not want to, lest you risk letting your emotions get the better of you. You may want to revisit once a year to see if your Ultimate Trailing Stop has been triggered on any of your investments.

You Could Earn 313% Average Weekly Gains Thanks to This Simple Method

You can turn a small stake into $815,588 in just one year with our new, fast-money research service.

The "accelerator trading strategy" is designed to take the emotion out of trading - and to help you make money.

And it works.

This year, I've already shown my readers 45 triple-digit gains. In October, accelerator trades averaged 313% gains a week, including full and partial closeouts.

Don't wait. Space is limited, and I'm releasing four new moneymaking recommendations every week. Get your shot at 313% average weekly gains here…

The post Why I Run "Ultimate Trailing Stops" on All My Investments appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.