You may have heard some buzz recently about how the S&P 500 and the Dow are simply no longer correlated. In fact, they're more disconnected now than they've been in over 13 years.

And while this sounds more like some analytical jargon that really doesn't matter...

It's actually crucial to your portfolio's returns.

Here's why...

The Understated Significance of Correlation to Your Portfolio

When it comes to the financial markets, "correlation" is a statistic that measures the degree to which two securities move in relation to each other. It's computed into what's called the "correlation coefficient," with a value calculated between -1 and 1.

There are three types of correlation:

- Perfect Positive Correlation: This means that the correlation coefficient is exactly 1. This tells you that the two securities are moving in the same direction in the same manner.

- Perfect Negative Correlation: This means that the two correlation coefficient is -1. This tells you that the two securities are moving in opposite directions in the same manner.

- Zero Correlation: This means that there's no correlation between the two securities.

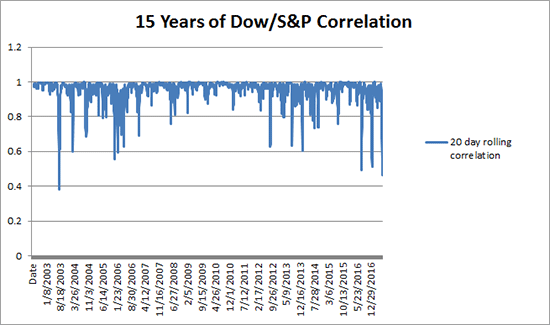

Typically, two of the major indices, the Dow Jones Industrial Average and the S&P 500, move together like they're running a two-legged race at the exact same rate of speed (positive correlation). But we're now seeing seeing the lowest level of correlation between them since April 4, 2003. In fact, their 15-year average correlation is nearly perfect at 0.9557, while their rolling, 20-day correlation is only at 0.4655.

In other words, the correlation between the Dow and S&P 500 just isn't what it used to be, thanks in part to the recent downturn in the tech sector and investors transferring their money out of those stocks and into bank stocks.

That's exactly why it's important to not just look at one index to get a gauge of the overall stock market. In fact, a lot of people tend to do this as a way of determining which funds to buy and sell (which is something I wouldn't encourage anyway). But given the huge disconnect we're seeing now - that strategy could prove to be detrimental - if not fatal - to your portfolio.

Instead, consider tracking the correlation of the funds you're interested in to get a sense of how closely they're moving with the major indices. That way, if a sector within a major index isn't as strong and is stalling the performance of the broader index, you're able to pinpoint those stocks that are just as strong.

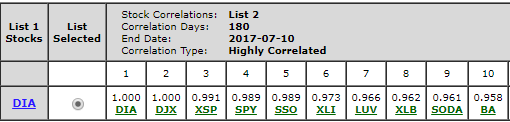

Now, I use my proprietary tools to scan for stocks that correlate the most to an index or exchange-traded fund (ETF). For example, this is what populated in a recent scan of highly correlated stocks...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Of these securities, the three "pure" stocks that are in the top 10 as far as their correlation to the SPDR Dow Jones Industrial Average ETF (NYSE Arca: DIA) are:

- Southwest Airlines Co. (NYSE: LUV)

- SodaStream International Ltd. (Nasdaq: SODA)

- Boeing Co. (NYSE: BA)

But you can do the same by using any asset correlation calculator, such as the Chicago Board Options Exchange Correlation Indicator, with the idea of looking for stocks showing more strength. As an investor, you can consider those stocks to add to your portfolio. As an options trader, you can consider call options trades, long-term anticipation securities (LEAPs), or even calendar spreads.

The Fastest Gains We've Ever Seen: All it takes is one simple move on Monday, and you are guaranteed, by law, to collect any profits before the market closes on Friday. Each fast move is specially designed to put you in position to double your money in four days. Of course, the gains on our best plays come even faster. Like the chance to close out two plays for a total of 221.3% profits over two days. Or when three trades added up to 297% gains in less than 24 HOURS. To see just how fast this works, go here now…

The post You Can No Longer Rely on the S&P 500 - Here's Why appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.