On Monday, Tesla Inc. (Nasdaq: TSLA) hit its 52-week high - just one week after becoming the most valuable automaker in America.

It's not the only one, though. There are actually 126 stocks trading at or near all-time highs.

But don't worry about figuring out which ones to add to your portfolio right now...

These eight are the cream of the crop.

Buying High to Sell Higher

Before we get started, I want to spend a minute on the misconception that buying stocks at 52-week highs is something you should avoid (which is based on the idea that they have nowhere to go but down in price). This simply isn't true. And too often, this myth is exactly why investors miss out on enormous growth and profit opportunities. In fact, when investors buy these stocks (and continue buying), it only strengthens the stock, propelling it higher - even after a pullback.

That's the basis behind the adage "buy high and sell higher," made popular by Investor's Business Daily editor William O'Neil. O'Neil revealed historically proven data that stocks trading at their highs have momentum on their side, and a new high can beget more upward price action. This could be due to folks rushing in because they don't want to miss out on the stock, or it could be due to a belief in the strength of the stock. But the bottom line is new money will continue to drive stocks at their 52-week highs even higher.

So it's important to not let the fear of buying high stand in the way of easy profits.

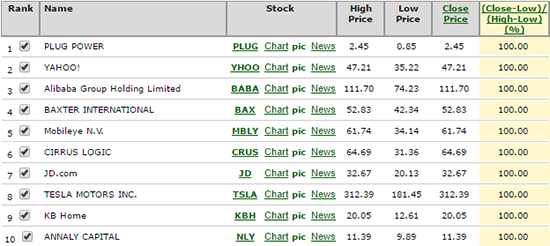

Now, you can track stocks trading at 52-week highs on virtually any financial website, such as Barchart.com (which provides real-time and delayed intraday stock and commodities price action). I use my own proprietary tools to search for stocks that are at, near, or making new 52-week highs. And here's what my scan revealed as of the time of writing:

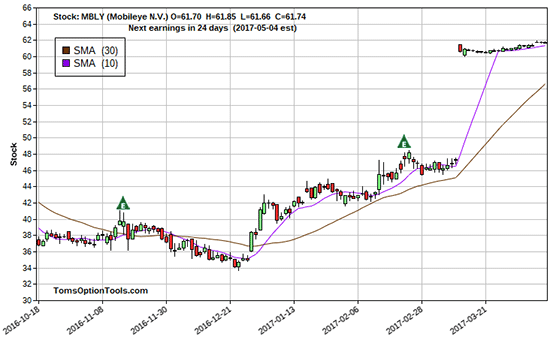

As you you can see, there are actually 10 stocks on this list instead of eight. But when I looked through the charts to see if any of these stocks aren't actually worth pursuing, Mobileye NV (NYSE: MBLY) popped up as a company that's been or is about to be acquired:

And sure enough, Intel Corp. (Nasdaq: INTC) is in the process of trying to buy the Israeli application software company.

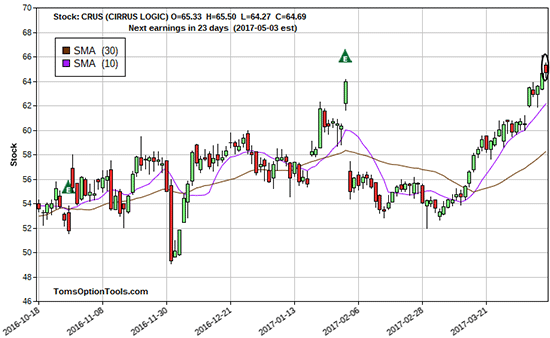

The other one I determined was a stock not worth pursuing is Cirrus Logic Inc. (Nasdaq: CRUS).

As you can see in the price chart below, CRUS made a new high but then reversed and closed lower. And any stock that makes a bearish reversal after a new high day is one you'll want to stay away from.

So these are your top eight stocks to watch right now:

And you've got a couple ways to play them: buying the stock outright or trading options.

Buying the Stock Outright

While you can certainly buy just a single share of stock, it can be costly - especially when you factor in fees. So for comparison purposes, here's the math on purchasing 100 shares of each stock listed above:

| PLUG @ $2.45 x 100 = $245

YHOO @ $47.21 x 100 = $4,721 BABA @ $111.70 x 100 = $11,170 BAX @ $52.84 x 100 = $5,284 JD @ $32.67 x 100 = $3,267 TSLA @ $312.39 x 100 = $31,239 KBH @ $20.05 x 100 = $2,005 NLY @ $11.39 x 100 = $1,139 |

Your total cost? $59,070.

Trading Options (Specifically Long Calls at Least 90 Days from Expiration)

Unlike buying and holding, trading options lets you control 100 shares of the stock at a much lower cost - up to 90% or more in most cases. It's basically like renting the stock.

So here's a look at how much you'd pay trading long calls of each of the top eight stocks:

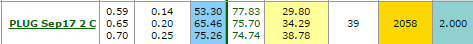

- PLUG 1 contract of the September 2017 $2 Call @ 0.70 = $70

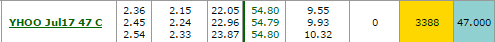

- YHOO 1 contract of the July 2017 $47 Call @ $2.54 = $254

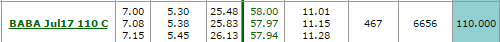

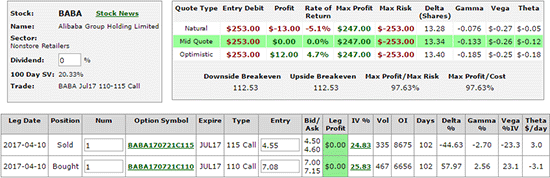

- BABA 1 contract of the July 2017 $110 Call @ $7.15 = $715

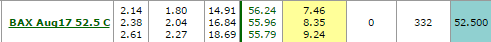

- BAX 1 contract of the August 2017 $52.50 Call @ $2.61 = $261

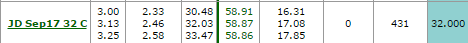

- JD 1 contract of the September 2017 $32 Call @ $3.25 = $325

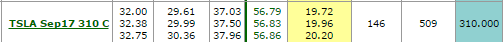

- TSLA 1 contract of the September 2017 $310 Call @ $32.75 = $3,275

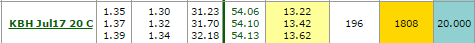

- KBH 1 contract of the July 2017 $20 Call @ $1.39 = $139

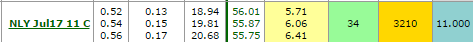

- NLY 1 contract of the July 2017 $11 Call @ 0.56 = $56

And your total cost? $5,095. That's over a 91% cut in your cost - simply by trading options.

And if you want to cut your cost even more - consider using debit call spreads or bull call spreads. Both strategies allow you to hedge an option by both buying-to-open and selling-to-open call options with the same expirations but different strike prices at the same time, on the same order ticket. This further reduces your risk, which caps your potential upside but increases your probability.

Here's an example...

You buy-to-open a July 2017 $110 call and sell-to-open a July 2017 $115 call for a total cost (or net debit) of $253 ($2.53 x 100 shares) per contract.

The difference in the spread (between the call you bought and call you sold) is $500 ($5.00 x 100 shares) and the most you could make offset by the cost of the trade. So even if BABA takes off and ramps to the heavens, you will likely leave money on the table. But realize with the Bullish Loophole Strategy, you don't need that type of price move. All you need is for BABA to be trading above the sold strike of the spread, $115, at expiration to realize max profitability for this trade.

Whichever method you choose, be sure to speak with your broker or financial advisor to determine what's most suitable for your portfolio.

Don’t Miss: This investing strategy has delivered 217 double- and triple-digit peak-gain winners since 2011. And you can get access for just pennies a day. Learn more…

The post Your Eight Most Lucrative Stock Plays Right Now appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.