Imagine it's early 1939...

German troops occupy Bohemia and Moravia. Czechoslovakia ceases to exist.

Spanish national troops take Barcelona with Italy's help.

Adolf Hitler orders the German military to plan for the invasion of Poland.

French Foreign Minister Georges Bonnet proposes a "peace front" of France, the Soviet Union, Great Britain, Poland, and Romania to deter Germany.

The fourth and final bear market of the 1930s begins after an August buying panic that takes the Dow to a peak of 155.

If you're like most people, you can't shake the nagging feeling that something sinister is just around the corner.

After a decade of feckless political leadership, bailouts, and corporations that are getting bigger at your expense, your wallet is definitely pinched. Wages are flat to middling.

Your next move... uncertain.

Your temptation... to run for the hills.

Yet, in one of the greatest investing moves of all time, a single quiet and unassuming man named John Templeton borrows $10,000 and buys 100 shares of every stock trading on the New York Stock Exchange for under $1. All but four would turn out to be profitable investments.

Years later, he would go on to become an investing legend by refining and following the same strategy - "buying when others are despondently selling."

Every $10,000 invested with Templeton when he set up his fund turned into at least $2 million by the time he retired. Eventually, he became so wealthy he gave away more than $1 billion to charity.

Fast forward to today...

Change the names and places, and it's Russian strongman Vladimir Putin and North Korean dictator Kim Jong Un who threaten global stability. Farther south, ISIS is expanding its influence in a grotesque orgy of barbarity.

All the while, our politicians act as if they've got the situation under control, which is almost a guarantee that they don't. Once again, it's tempting to head for the hills.

But sitting on the sidelines is exactly what you don't want to do as an investor.

How do I know?

Because chaos almost inevitably produces the biggest profits.

Free Book: The secrets in this book helped one Money Morning reader make a $185,253 profit in just eight days. Learn how to claim your copy here…

Sir John Templeton waded into the markets on the eve of global chaos in 1939 because he knew that investors' emotions almost always get the better of them. He understood that they were driven to make exactly the wrong decisions over and over again - buying when they should be selling and selling when they should be buying.

You and I have talked about that many times over the years because investors are still prone to that counterproductive way of thinking. Investors who make emotional decisions doom themselves to poor returns, often trailing the returns of the markets by hundreds of percentage points over time, according to research from DALBAR Inc. and others.

Those who make logical decisions day after day become the real champions in the investing world.

There's something else we talk about a lot, too. And it's equally important, especially right now.

Templeton was so successful because he didn't just fling his money around. Like us, he preferred unglamorous stocks.

Sir John tapped into "must-have" investments - investments dealing in sectors humanity can't survive without - every chance he got, just like we do in all my investing services, from Total Wealth to the Money Map Report to High Velocity Profits.

Like you and me, Templeton hated gambling. He saw no need to take unnecessary risks.

But he understood clearly that calculated risks were part of the game, especially when it came to finding value others didn't see or recognize.

Were he alive today, I have no doubt that Sir John Templeton would be making the case just as I am that now is precisely the moment to invest in Russia.

I won't hold it against you if you recoil at the idea.

In fact, I'm counting on it, because that's what makes our timing so perfect... 99% of all investors are missing out and would never invest in Russia right now. So there's a true "first-mover" advantage.

The Boldest Call I Ever Made...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

I told my readers the same thing two years ago, shortly after Standard & Poor's downgraded Russian debt to barely above junk level. Investors had pulled more than $150 billion out of the Russian economy just months before, and even Russia's own finance minister was projecting a 4% contraction in the economy.

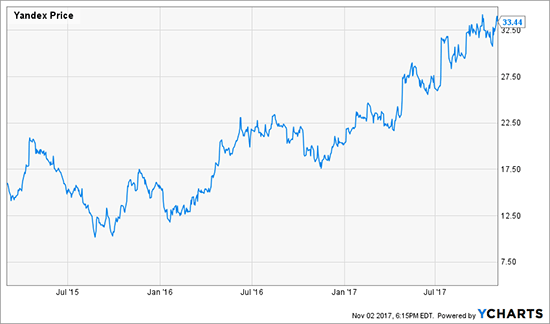

Headlines were plastered with negative Russian sentiment thanks to Putin's "War on the West," but I told subscribers to make their move on Yandex NV (Nasdaq: YNDX), the Russian equivalent of Google.

The stock had been on a downward trajectory as a result of the negative sentiment towards Russia, but it's shot up 108.7% in the time since.

The best part of all this?

Another "Templeton Moment" has just appeared...

While most investors are hauling their money out of Russia, my colleague - an expert in geopolitical relations and the oil and energy sector - has been tracking Russian moves against OPEC, particularly by pushing into Kurdistan.

It's a major development in the Russian attempt to control the global oil market and yet another potentially crushing blow to OPEC itself.

Here's your exclusive briefing on the situation - and how it could mean a major payday for those who move now.

The six "Unstoppable Trends" are a cornerstone of Keith's Total Wealth strategy. These trends are backed by trillions of dollars that neither the government nor Wall Street can derail or hijack. Anyone keyed into them can beat the market - especially with Keith as your guide. To learn more and get access to all of Keith's Total Wealth research and recommendations, just click here. It's absolutely free.

The post Your Next "Templeton Moment" Just Appeared appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.