Sorry, no content matched your criteria.

Featured Story

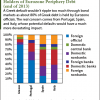

What Would a Grexit Mean for Investors?

A new bailout bill has been negotiated for Greece and a "Grexit" has been averted.

For now.

A new bailout bill has been negotiated for Greece and a "Grexit" has been averted.

For now.