Sorry, no content matched your criteria.

Featured Story

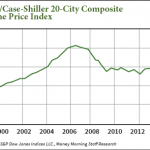

What Today's Case-Shiller Home Price Index Doesn't Show You About the Housing Market

The S&P/Case-Shiller Home Price Index, a widely followed benchmark for home prices, showed a slow growth in home prices amid an unimpressive housing recovery.

But given the factors underlying this recovery, and the activity in the housing market, this should come as no surprise.

Here's why this housing recovery just can’t seem to take off…

The S&P/Case-Shiller Home Price Index, a widely followed benchmark for home prices, showed a slow growth in home prices amid an unimpressive housing recovery.

But given the factors underlying this recovery, and the activity in the housing market, this should come as no surprise.

Here's why this housing recovery just can’t seem to take off…