Sorry, no content matched your criteria.

Featured Story

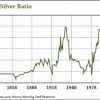

Gold/Silver Ratio Just Another Sign Prices Are Too Low

The gold/silver ratio is another indication that silver is grossly underpriced.

By 2014 average prices, the gold/silver ratio was 66-to-1. That number has only climbed in 2015. As of yesterday's closing spot gold price and spot silver price, the ratio was about 72-to-1. It's not just that the gold-silver ratio is five times its historical average that indicates that it's underpriced. It's also that its scarcity in relation to gold doesn't justify such a high ratio.

The gold/silver ratio is another indication that silver is grossly underpriced.

By 2014 average prices, the gold/silver ratio was 66-to-1. That number has only climbed in 2015. As of yesterday's closing spot gold price and spot silver price, the ratio was about 72-to-1. It's not just that the gold-silver ratio is five times its historical average that indicates that it's underpriced. It's also that its scarcity in relation to gold doesn't justify such a high ratio.