The Greece lenders continue to fight about the best way to handle a fourth bailout for the country, and the July 7 deadline is fast approaching.

And if a resolution is not agreed upon soon, the euro could plummet against the dollar. While this may rattle global markets in July, Money Morning Capital Wave Strategist Shah Gilani has a way for you to profit over 100% from the growing fears of a Greek default.

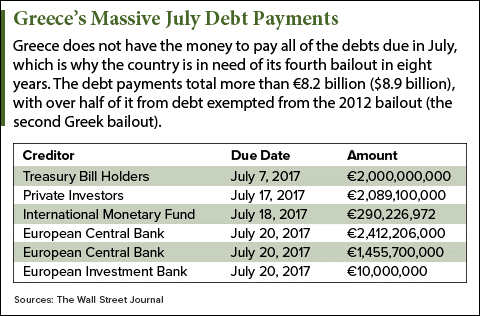

Between July 7 and July 20, Greece has six massive debt payments due. Those payments add up to €8.2 billion ($8.9 billion). However, Greece doesn't have the money to pay all of them.

That has left Greece's two main lenders, the International Monetary Fund (IMF) and the European Union (EU), at odds with each other over how to deal with the Greek financial crisis.

What Are Greece Lenders Fighting About?

At the core of the showdown over Greek debt is a difference in philosophy.

Germany (the main holder of Greek debt owed to the EU) wants Greece to implement more austerity measures to make sure that Greece has a surplus to pay debt. The austerity measures would increase taxes (and revenue to the government) while simultaneously cutting government spending.

Germany (the main holder of Greek debt owed to the EU) wants Greece to implement more austerity measures to make sure that Greece has a surplus to pay debt. The austerity measures would increase taxes (and revenue to the government) while simultaneously cutting government spending.

The problem with austerity measures is twofold.

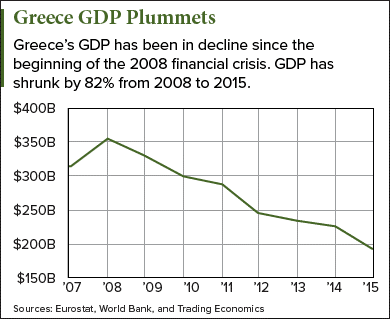

First, the Greek economy has been shrinking since 2008. Greece's GDP has dropped from $354.5 billion in 2008 to $194.9 billion in 2015. The austerity measures don't allow the Greek government to pump money into the economy to spur a recovery.

Don't Miss: These three stocks can make 2017 your most profitable yet.

Second, the IMF argues that even if Greece was able to hit Germany's tough austerity requirements, it still will not be able to pay its debt.

Under the current austerity measures, Greece must have a budget surplus of 3% of GDP, excluding debt payments. That means if GDP stays at about $200 billion for 2017, the government will only have a surplus of $6 billion to pay the $24.76 billion in debt payments that are due this year. That leaves about 75% of the debt payments unpaid unless Greece is able to get another bailout.

Greece has to make debt payments every year for decades, but this is the toughest year for Greece. This year's repayment total is €22.9 billion ($24.76 billion). Next year, the country only has €3.7 billion ($4 billion) in payments due. In fact, 2019 is the only other year until 2052 that Greece has more than €10 billion ($10.81 billion) in payments due.

By extending due dates and forgiving some of Greece's debt, the IMF argues that the country would be able to pay down its debt with the surplus. That would allow bailout money to go towards stimulating its economy rather than making debt payments.

However, if Greece's lenders don't come to a compromise, the potential for a Greek default will cause the euro to plummet.

In 2015, the euro dropped 3.82% in one month, leading up to and just after Greece's default on its payment to the IMF. While that may not sound like a lot, keep in mind currencies usually don't move very much at all. In fact, the euro lost only 2.73% to the dollar over the past 12 months.

If Greece's lenders can't come to an agreement, the fear is Greece would be forced out of the Eurozone if it defaults on EU debt. That could cause a long period of turbulence for the country, Europe as a whole, and world markets.

But at the end of the day, the banks have a problem if Greece can't pay, so there will be an agreement. When you owe as much as Greece does to individual institutions, they need to get their money back, even if it takes longer. If they don't, the financial institutions holding Greek debt could go under.

The other party that has a problem if Greece can't pay: Germany. The German economy depends on a single currency in the region so that it can export its goods. Something like a Greek exit from the Eurozone could spell trouble for German exports.

It will likely be a rocky road to get to an inevitable agreement, and markets don't like uncertainty.

That global uncertainty led Gilani to find this 100% profit opportunity. While others may be panicking, Gilani's euro trade will help you profit from this global uncertainty...

2 Ways to Profit as the Euro Tanks

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

While the markets don't like uncertainty, you can make a lot of money off of a potential panic sell-off from volatility. And given it's very likely that Greece will get another bailout, the euro's drop will be based on that uncertainty, not on actual events of declines in underlying value. This panic effect is likely to be amplified given that the Brexit officially started on March 29 (Wednesday).

The good news is there are two ways to play this volatility: the currency (and related ETFs) and the banks affected by the euro.

Shorting the euro is one way to play the currency, but not the most profitable. Gilani recommends the ProShares UltraShort Euro Trust ETF (NYSE Arca: EUO). That's because this ETF is leveraged for gains at a 3:1 ratio. A ratio of 3:1 means that for every $1 an investment moves, the ETF would move $3, making your return much larger.

But the most profitable way to play the euro is to buy call options on EUO. They are inexpensive to get into and will rise in price as the ETF rises. The trick is to make sure you get the right expiration date.

With the volatility expected to last until the end of July or early August, the best expiration date for the calls would be August. Any earlier and your options may expire before the profit opportunity ends. Buying options with too long of an expiration date means you will pay more for the investment, lowering your profit potential.

The second way to profit from the volatility in the Eurozone is to short the banks that operate with the euro. Instead of picking which bank(s) you think will be affected, you can short an ETF of all of them.

Gilani recommends the iShares MSCI Europe Financials (Nasdaq: EUFN). As the euro drops, bank stocks in the Eurozone will go down in price. By shorting EUFN, you can make money while the stock prices of Eurozone banks drop.

Another way to profit from the drop in EUFN is to purchase put options. These are inexpensive and will rise in price as the ETF drops in price. That allows you to profit from a falling EUFN price much like shorting the ETF.

No matter how you play the falling euro, keep in mind the drop is likely temporary. That's because Greece will likely get a bailout. If it doesn't happen before a default, the bailout will come shortly after.

Rare Gold Anomaly: The first time it created $1.25 billion in new wealth virtually overnight. The second time, it created a cash windfall of $6 billion - both times making in-the-know investors flat-out millionaires. And it's about to happen again, only this time we expect the cash windfall to reach $13 billion. If you take advantage of this rare gold anomaly right now, you, too, could walk away a millionaire. Details here...