Sorry, no content matched your criteria.

Featured Story

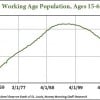

4 Charts That Show Japan Stock Market Rally Is Overdone

In Japan, stock market euphoria has taken hold.

The reality of the Japanese economy is much bleaker than the roaring Japanese stock market would have you believe.

Here are four charts that explain Japan's current crisis not reflected in this rally...

In Japan, stock market euphoria has taken hold.

The reality of the Japanese economy is much bleaker than the roaring Japanese stock market would have you believe.

Here are four charts that explain Japan's current crisis not reflected in this rally...