Sorry, no content matched your criteria.

Featured Story

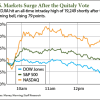

What the Italy Referendum Results Mean for the Markets

The Italy referendum results sent U.S. markets roaring to new highs on Monday intraday, with the Dow hitting a record 19,249 intraday.

The Italy referendum results sent U.S. markets roaring to new highs on Monday intraday, with the Dow hitting a record 19,249 intraday.