After 117 years, the current London Silver Fix is shutting down.

In fact, we know it's going to happen on August 14th for certain.

Free marketeers are excited; for years many have maintained that silver prices are being manipulated.

Ted Butler, for one, publishes commentary with a special focus on the silver market. Ted's likely the most outspoken observer of daily silver futures price machinations anywhere.

Now comes confirmation that the London Silver Fix is finally closing shop.

That in itself isn't proof of manipulation, but the circumstances certainly raise some intriguing questions.

There are clues from its history worth studying - and profits to be made from its demise...

Gold, Silver, and the Historical "Fix"

Only a few months back I told you the London Gold Fix was likely on its way out. Now the odds are even better with its smaller sibling shuttering its operations in less than two months.

What's the big rush? Let's have a closer look.

The London Silver Market Fixing Ltd. currently operates with just three members: Deutsche Bank AG (USA) (NYSE: DB), HSBC Holdings Plc. (NYSE ADR: HSBC), and Bank of Nova Scotia (USA) (NYSE: BNS).

But in the wake of heightened scrutiny of the Gold Fix by market participants and regulators like Britain's Financial Conduct Authority and Germany's Federal Financial Supervisory Authority (BaFin), Deutsche has decided it was simply time to retire from both "Fixes."

That's right, retire. After an unsuccessful bid to sell its seats, Deutsche has said it would resign its spots. With only two members left in the Silver Fix, participants said they simply couldn't function properly.

Why would Deutsche leave in such haste? Maybe it has something to do with the 20 (or more) pending class-action lawsuits, alleging a conspiracy to manipulate gold prices for their own benefit.

In any case, the UK Financial Conduct Authority convinced Deutsche to stay on until mid-August to ensure the silver benchmark system could wind down efficiently.

Ross Norman, Chief Executive Officer of Sharps Pixley (a London bullion broker that dates back to 1852 and was a member of the original London Silver Fixing group), told Kitco News that whatever replaces the current pricing mechanism is likely to be more transparent and technically derived.

CEO of the London Bullion Market Association (LMBA) Ruth Crowell said, "...the LBMA has launched a consultation in order to ensure the best way forward for a London silver daily price mechanism."

John Hathaway, senior managing director and portfolio manager of the Tocqueville Gold Fund, recently said the London Gold Fix is an archaic system that needs a "complete overhaul," and if oil and most other commodities don't get "fixed," then why should gold?

Indeed, why should it... and by extension, why should silver?

Frankly, I'm of two minds on this one.

I'm hopeful that true price discovery will emerge. After all, that's what everyone dealing in gold - investors, speculators, and would-be manipulators - truly deserves.

I'm also a bit cynical that it may take considerable effort to get there. If manipulation exists, I'd expect the benefactors to resist losing their advantages.

That said, I'm an ardent believer in market forces.

If silver's price is in fact being manipulated, it can't go on forever. The bright side is, it's arguably holding silver prices artificially low... for now, providing would-be investors with the opportunity to buy in cheap. Despite that, silver was still up over 1,000% between November 2001 and April 2011.

Odds are, before long, physical demand will simply overwhelm the futures markets and any potential artificial price suppression.

In fact, we could already be well on our way...

Profit from Silver's Resurgence

Despite persistently low silver prices, demand for physical silver witnessed an all-time high in 2013.

Demand rose by 13% to a record 1.081 billion ounces, according to the World Silver Survey 2014 prepared by the Silver Institute.

And still, the bullion banks are heavily short.

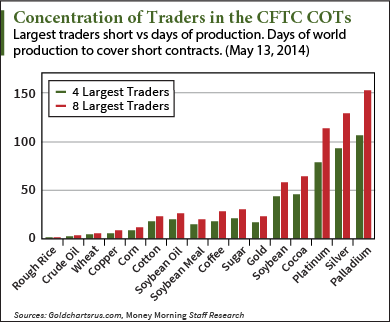

As you can see, silver is the major commodity with the most production required to cover short positions, currently at 150 days, or the equivalent of 41% of annual silver mined.

As market forces begin to reassert themselves, and they will, look for silver prices to rise in tandem.

As market forces begin to reassert themselves, and they will, look for silver prices to rise in tandem.

One attractive way to play the secular silver bull market is through an ETF of silver miners. Global X Silver Miners (NYSE Arca:SIL) is comprised of companies that mine, refine, or explore for the metal. It provides instant diversification within the space at a reasonable expense ratio of 0.65%.

But what I really like is how it acts as a call option on the silver price that never expires.

All the fundamental drivers for much higher silver prices are still intact, so now is a great time to position yourself for higher silver.

The end of the London Silver Fix could well be a major turning point, allowing unencumbered silver price discovery and a resumption of the silver bull.