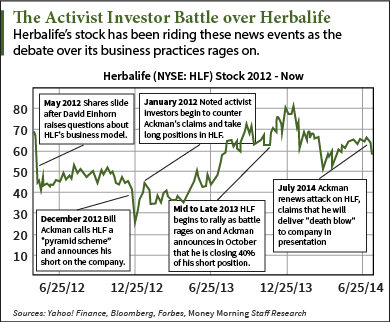

Bill Ackman, founder of Pershing Square Capital Management LLC, may consider his public condemnation of Herbalife Ltd. (NYSE: HLF) "the most important presentation" of his career, but you wouldn't think so looking at Herbalife stock today (Tuesday).

The nutrition company is up more than 25% following the presentation, after losing 11% on word yesterday (Monday) that Ackman was prepared to deliver the "deathblow" to HLF.

Ackman's public battle with HLF has touched off a clash among Wall Street's activist investor community.

In December 2012, Ackman accused the health supplement company of running a "pyramid scheme" through its complex sales structure that recruits hundreds of thousands of members to sell their products and blurring the lines between actual sales of its products and sales to its individual distributors. Among his claims is 88% of recruited salespeople make no money, and 96% make less than the minimum wage.

This put him at odds with noted investors Daniel Loeb of Third Point LLC and Carl Icahn of Icahn Enterprises LP (Nasdaq: IEP). As Ackman mounted a $1 billion short position in the company, activist investors took the other side and bought long.

In Tuesday's presentation, Ackman provided further evidence and expounded upon earlier claims that HLF was preying on poor minorities and impoverished countries to act as distributors, offering lofty promises that HLF sales will make them rich.

|

"[Herbalife CEO] Michael Johnson is a predator, and this is a criminal enterprise," Ackman said at his presentation at the AXA Equitable Center in New York.

But Ackman's plea failed to move this stock in his favor, and HLF shares took off.

Ackman isn't alone in betting against HLF. The current short float on HLF is a rather high 28.2%, against the S&P 500's average of just around 2%. In yesterday's trading, according to 10 different exchanges reporting short volume, shorts on HLF made up 57.8% of total trade volume.

And on the year as this activist investor face-off continues, the short-sellers have made out well. Herbalife stock, as of this morning, had dropped 31.3% (although that is quickly tightening based on today's rise).

While this has been a battle almost two years in the making between short sellers, activist investors, and a nutritional supplement company, the unusual history of HLF provides an interesting look at the company underlying this debate.

Herbalife's 30-Year Battle with Regulators, Poor Management, and Skeptics

Questions of HLF's business practices are not new, and have lingered above the head of the Los Angeles-based nutritional supplement company since its founding in the 1980s.

In 1985, a civil suit in Santa Cruz County Superior Court accused the company of making false weight loss claims for its meal replacement program and weight loss supplements, and for a pyramid scheme sales structure.

The U.S. Food and Drug Administration investigated the company for four years before HLF agreed to drop a menstrual cramp remedy and a stress reliever from its product line in 1986, the Washington Post reported. They also settled out of court with the Santa Cruz State Attorney General's Office for $850,000 in the civil suit.

HLF was shouldering these court challenges just months before they quietly went public after merging with Sage Court Ventures Inc. in 1986, the Wall Street Journal reported.

The skeptics continued to pile on to HLF. Then-Chief Executive Officer Mark Hughes further raised eyebrows when he hired his old boss, Larry Huff, in 1991 to help reverse a downward spiral in sales, according to Michael Gross's 2011 book Unreal Estate: Money, Ambition, and the Lust for Land in Los Angeles. Huff had spent time in federal prison on 63 counts of mail fraud for his involvement in a cosmetics scheme.

Hughes was a controversial figure, constantly sparring with regulators over health claims and his multi-leveling marketing program. He had a ninth-grade education and notably ripped into a panel of experts after he was summoned to a hearing at a U.S. Senate Permanent Subcommittee on Investigations to discuss the safety of his products.

''If they're such experts, then why are they fat?'' he said, the Vancouver Sunreported in 2000.''I've lost 16 pounds in the last few years.''

He died at age 44 in 2000 after a four-day drinking binge, with a blood alcohol level of 0.21 and a toxic level of antidepressants in his system, according to the New York Times. In the preceding months he tried to buy up the rest of HLF's outstanding shares for about $500 million, though couldn't finance the venture through loans and dropped his bid to take the company private once again.

Investors urged HLF to sell the company to the highest bidder about a year after the death of Hughes, as sales continued to stall and management began to face criticism. HLF was eventually bought by venture capitalists Whitney & Co. and Golden Gate Capital Inc. for $700 million in August 2002.

After a year of searching for a chief executive officer to fill the shoes of Hughes and bring stability to its management, HLF hired the current CEO Michael Johnson in 2003, a former Walt Disney Co. (NYSE: DIS) executive.

The face-off between HLF and the activist investors began under Johnson's tenure and can be traced back to a standard earnings call in May 2012.

On the call was Greenlight Capital CEO and founder David Einhorn, who asked questions regarding sales by the hundreds of thousands of distributors within the company, and actual sales to customers. The questions Einhorn raised spooked investors and caused HLF's shares to fall.

Ackman then raised the stakes in December of that year, announcing that the company was a pyramid scheme and that he was taking a short position on the company. Shares slid 12% on the announcement.

HLF management fired back, and said Ackman was trying to manipulate the market and appease short sellers who were looking just to profit off HLF's downfall. In fact, Ackman was up millions as the stock slid following a 343-slide presentation he gave attacking HLF's business model at a Manhattan event sponsored by the Sohn Conference Foundation. He alleged that the company was profiting more off its resellers than its actual product sales and targeting minorities with false promises of getting rich through sales of its products.

Enter Third Point LLC chief executive and New York hedge fund manager Daniel Loeb. Loeb, according to the NY Times, sought to counter Ackman's claims that HLF was "the best-managed pyramid scheme in the history of the world," by betting long on the company. Loeb took an 8.2% stake in the company.

Then billionaire investor Icahn joined the fray, excoriating Ackman on Bloomberg TV January 2013 for his handling of the HLF short positon.

"I have no respect for him and I don't like him and that's not a secret," Icahn told Bloomberg. "If you're short, you go short and hey, if it goes down you make money. You don't go out and get a roomful of people to badmouth the company. If you want to be in that business, why don't you go out and join the SEC?"

Icahn eventually took a $500 million stake in the company against Ackman's short in February 2013, and the company's shares opened the day after Icahn's announcement up 17%.

In November, Ackman told Bloomberg that he would take his short bet on HLF, "to the end of the earth," after having lost $500 million in his position. He has stood firm despite his current losses, and continued in today's presentation to attack HLF's predatory business practices that hit the poor the hardest.

"It's a tragedy. They don't realize they're being defrauded," Ackman said. "They are selling the American dream to these people."

More on Wall Street's most scandalous stories: Money Morning's Shah Gilani, editor of Wall Street Insights and Indictments, identifies scams on Wall Street twice a week for readers, and is now exposing this great American Dream turned scam......