Real estate websites Zillow Inc. (Nasdaq: Z) and Trulia Inc. (NYSE: TRLA) saw their stocks soar yesterday (Thursday) on rumors that the sector's top two leaders would merge. Z stock surged more than 15.3% to $145.76 and TRLA roared ahead 32.4% to $53.74 after the deal news broke.

But there is little supporting this rise for the long term.

The two real estate search engines are almost identical in what they do. They serve as a portal that connects potential homebuyers with real estate professionals, and together they lead the sector in real estate search traffic.

They are so similar, in fact, that at one point Zillow filed a lawsuit against Trulia, claiming that TRLA's property valuation tools infringed upon Z's patent of their signature "Zestimate" home value estimation service.

But their business purpose isn't the only thing these companies share; there's a more damaging common factor...

The Problem with the Z-TRLA Deal

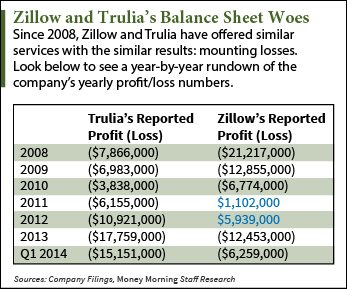

What many traders and industry analysts have noticed and commented on is that behind this deal - and surging share prices - are two money-losing businesses.

That's why both companies are awash with short sellers - traders taking out bets that the company's shares will fall - with 31.8% of Z shares and 36.7% of TRLA shares floated in short positions, according to FinViz.com.

Z has accumulated a deficit of $84.1 million. Since 2007, Z has turned a profit only twice - $1.1 million in 2011 and $5.9 million in 2012 - before posting another $12.5 million loss in 2013. In the first quarter of this year, Z has already lost another $6.3 million, on pace to top its biggest loss of $21.2 million in 2008.

Similarly, TRLA has an accumulated deficit of $64.9 million, and since 2008, hasn't had one profitable year. The second-largest online real estate website has seen a steady increase in losses since 2010, topping out in 2013 at $17.8 million in the red. Already in the first three months of 2014, TRLA is reporting losses of $15.2 million.

But what is further disconcerting about the two realtors are the macro factors...

Further Troubles in the Housing Market Will Hit Z, TRLA

"The underlying bet there is a bet on housing," Money Morning's Capital Wave Strategist Shah Gilani said. "I'm not buying anything in housing."

Housing is a questionable sector to go long on today. Despite optimistic numbers that may point toward a housing recovery since the bust in 2008, the prices aren't being bid up by the people who lost their homes in the crisis.

Instead the money is coming from institutional investors looking for yield in a low-rate environment and foreign investors looking to park their assets in the states.

"Middle Americans aren't buying homes in droves again," Gilani said. "It worries me a lot that middle-class Americans aren't buying houses."

The current spate of potential home buyers includes millennials looking for jobs after graduation, who are drowning in student loan debt. They don't have the cash or the credit to compete with institutional money flowing into real estate to help give home prices an even bigger lift.

"I don't see that class of people flush with money or readily able to get a lot of credit necessary to move the housing market higher," Gilani said.

With a ceiling on how far the current housing market can rise right now, any company dealing in real estate will have trouble sustaining long-term gains. That means Z and TRLA as investments, debt problems aside, are positioned to take a big hit if housing slides.

"They don't make sense if you don't think that the underlying marketplace is going to be robust," Gilani said. "I just don't see where the strength is in the big picture."

More from Shah Gilani: Outstanding U.S. student loan debt exceeds $1.2 trillion, and now those who owe are preyed on by a new parasitic source. Is the Great American Dream turning into a scam?