Just about everyone knows Alan Greenspan. As central bankers go, he may just be the most famous ever. Even today, 1 in 6 Americans still think he's the current chair of the Federal Reserve.

As Fed chief from 1987 until 2006, Greenspan oversaw the latter part of the greatest stock bull in history.

For that, some called him "The Maestro."

From other quarters, the names are far less flattering. Many blame him for inflating massive stock and real estate bubbles, resulting in financial devastation across the economy.

Well, these days Greenspan is acting rather schizophrenic. In fact, you won't believe what he's saying now, unless you understand where he's coming from.

Given the havoc its wreaking on market stability (while ostensibly doing the opposite), it's absolutely critical to look back at Greenspan's handiwork to try to make sense of today's Federal Reserve maneuvering...

Greenspan Was Molded Decades Before Heading the Fed

Greenspan has been an economic adviser to two presidents and a director at several corporations, including JP Morgan & Co., as well as a director of the Council on Foreign Relations.

But his ideas about economics and money change dramatically depending on when you ask him, or where he works.

Back in the early 1950s Greenspan became a member of Ayn Rand's inner circle. His essay "Gold and Economic Freedom" was published in Rand's newsletter The Objectivist in 1966 and in her book, Capitalism: The Unknown Ideal in 1967. He even read Atlas Shrugged while it was being written.

In case you're confused, yes... it's the same Alan Greenspan.

In the "Gold and Economic Freedom" essay, he wrote: "... gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other."

He went on to say: "In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value."

Does this sound like a guy who would be in charge of the world's most powerful central bank?

Remember, the raison d'être of central banks, and of course central bankers, is to promote and defend a system of fiat money creation and debt. Gold is neither of those. Actually it's the complete opposite. It's the anti-fiat money and anti-credit.

It's not perfect, but it's still the best money that fiat money can buy.

Greenspan knows it. He's always known it.

Now, no longer obliged to toe the Fed's line, he's again free to say what he really thinks.

Which has him back to extolling the virtues of gold, a topic he was outspoken on before selling out to the dark side of central banking...

Recycling a Tired Stance

"The Maestro" recently shared his thoughts through an op-ed piece in Foreign Affairs magazine, published by the Council on Foreign Relations.

That's the same publication that brought us the "brilliant" article we recently discussed in Money Morning, suggesting the Fed should print and give cash directly to citizens.

In Greenspan's piece, "Golden Rule: Why Beijing Is Buying," he suggests:

If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country's currency could take on unexpected strength in today's international financial system. It would be a gamble, of course, for China to use part of its reserves to buy enough gold bullion to displace the United States from its position as the world's largest holder of monetary gold. (As of spring 2014, U.S. holdings amounted to $328 billion.) But the penalty for being wrong, in terms of lost interest and the cost of storage, would be modest.

Greenspan is even on the pro-gold standard bandwagon:

The broader issue - a return to the gold standard in any form - is nowhere on anybody's horizon... For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation... If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute.

Here's a guy who's as connected as one gets in the realm of central banking, and yet he's extolling the virtues of gold as money, suggesting a return to a gold standard. Heck, he even thinks China ought to beef up its gold reserves, enough to overtake the U.S. as the largest owner of gold.

Why? Because he realizes that's what it would take to partially back China's currency, the renminbi, with gold, or at least challenge the dollar's status as world reserve currency. He also appreciates that it's a strategy that would be impossible to implement without sufficient gold.

In fairness, as Fed chief, Greenspan did display some affinity towards the precious metal.

In fact, he even followed his own system of a "virtual gold standard" for years, a principle he eventually abandoned the moment it became inconvenient...

The "Virtual Gold Standard" Was Quietly Cultivated

Greenspan recounts how, back in the 1990s at a G-10 governors' meeting, the discussion was all about the European counterparts itching to sell off their gold.

They knew their simultaneous dumping risked depressing the gold price. So they set up the first Central Bank Gold Agreement in 1999, whereby 15 European central banks agreed to limit sales to 400 metric tons annually over the next 5 years. Curiously, Greenspan points out that Washington abstained.

Clearly he was the savviest of the bunch, knowing that gold is the ultimate form of payment, something a central bank should never sell unless it's absolutely necessary.

Understanding the positive effects of gold as money, Greenspan devised his own method to reap the benefits.

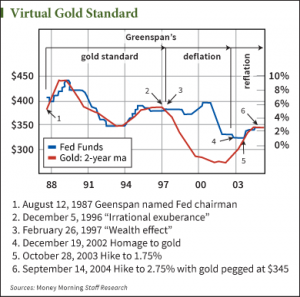

While heading the Federal Reserve, Greenspan appears to have imposed a "virtual gold standard," at least according to Donald Luskin of Trend Macrolytics.

Gold, it seemed, acted as the barometer. As its rising price signaled inflation, Greenspan would raise the funds rate. As gold's price fell, he would inject liquidity by lowering the funds rate.

Gold, it seemed, acted as the barometer. As its rising price signaled inflation, Greenspan would raise the funds rate. As gold's price fell, he would inject liquidity by lowering the funds rate.

But in 1997, that relationship was severed.

The Maestro dropped his "virtual gold standard," and raised rates as gold prices fell, and vice versa.

That fueled the blow-off phase of the dot-com bubble and its inevitable crash. Greenspan then drastically cut rates again, inflating the housing bubble.

By 2006 Greenspan had exited, leaving the reins to Bernanke. The housing bubble soon popped, and we all know how that ended. On Ben's watch, the funds rate was slashed and has flat-lined near zero for the past five years running.

Smell any bubbles? Poor Janet.

Back to Alan...

Let's follow the Maestro's original advice. The fact remains that Greenspan knows sound money, and he recognizes the deleterious side effects of fiat money.

In testimony before the U.S. Banking Committee in 1999, Greenspan said, "Gold still represents the ultimate form of payment in the world." Later, when Maryland Senator Sarbanes asked him if he endorsed a return to the gold standard he replied: "I've been recommending that for years, there is nothing new about that."

Yet it's intriguing that for all the ambiguous talk Greenspan spewed out during his tenure, his thoughts on gold seem to be clear as crystal.

Greenspan summed it up best when addressing the Council on Foreign Relations back in 2010: "Fiat money has no place to go but gold... It signals problems with respect to currency markets. Central banks should pay attention to it."

Indeed they should. Indeed we all should. If you're ever going to follow any the Maestro's advice, follow that bit and ignore the rest.

It's just Fedspeak.