An axiom of investing is that those who get in on great opportunities early make the most money.

Knowing how to invest in frontier markets gives you one of those great, rare opportunities. And it's early enough in the game that most of the profits are still well off into the future.

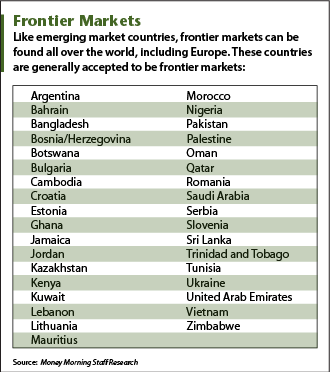

Frontier markets are not to be confused with emerging markets, which include such places as China, India, Mexico, and Chile.

Frontier markets are undeveloped countries like Kazakhstan, Vietnam, Croatia, and Ghana, where economic growth has only recently begun to sprout.

While generally more risky than emerging markets, they hold far more potential.

"The frontier markets still remain undiscovered," Jack Ablin, Chief Information Officer at BMO Private Bank, told Yahoo! Finance's Breakout. "I believe the frontier now is where emerging markets were 13 years ago."

Frontier markets may not go unnoticed much longer...

Investing in Frontier Markets: Where to Look

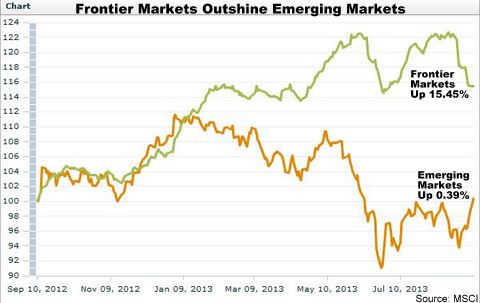

As a group - which includes anywhere from 25 to 36 countries, depending on who you ask - the frontier markets have significantly outperformed emerging markets over the past 12 months.

A comparison of the MSCI Frontier Markets and Emerging Markets Indexes shows that while emerging markets have been volatile, with less than a 1% gain to show for it, frontier markets are up more than 15%.

This is a reversal of a long-time trend; up until this year, emerging markets consistently outperformed frontier markets.

"Right now frontier is very exciting," Mark Mobius, executive chairman of the Templeton Emerging Markets Group, told CNBC. "These frontier markets, particularly in Africa, are growing at a tremendous pace... this is the place to be at this stage of the game."

Why Now Is the Time to Be Investing in Frontier Markets

While the idea of frontier markets dates back 20 years, outside money has not been pouring into these countries... yet.

While the idea of frontier markets dates back 20 years, outside money has not been pouring into these countries... yet.

That's because many of these countries carry higher risk as a result of political corruption and violence, and their markets often suffer from a general lack of liquidity.

All those factors tend to scare away investment, but the lack of foreign capital is part of what makes investing in frontier markets now such a big opportunity.

"I particularly like frontier markets because they are not as mainstream as emerging markets and therefore not as sensitive to hot money flows and investor sentiment," Ben Seager-Scott, senior research analyst at Bestinvest, told Investment Week. "When investors go into risk-off mode, they pull money out of EM, but that does not happen in frontier."

The other benefit to the low rate of foreign investment is that it has helped keep stock prices low despite remarkable growth.

Many of these economies are already growing at a healthy clip. Gross domestic product (GDP) in frontier markets averaged 6.9% in 2012 and is forecast to rise to 7.2% this year.

But unlike the case in most emerging markets, that strong growth has not been reflected in frontier market stock prices.

"This has led to unbelievably low valuations for these markets, which are trading at a huge discount to stocks in the Philippines and Indonesia, for example," Thomas Hugger, chief executive officer and fund manager of Hong Kong-based investment firm Asian Frontier Investments, told CNBC.

That just leaves the question of how retail investors can get frontier markets in their portfolios...

How to Invest in Frontier Markets

As with anything that promises big returns, investing in frontier markets is without doubt more risky than investing in U.S. stocks or even emerging markets.

That means investors should not go all in with frontier markets, but limit any investing to 10% or less of their portfolios. It's also a good idea to spread the risk among multiple frontier markets as a hedge in case things suddenly turn south in one of them.

For these reasons, and because investing in frontier markets is extremely difficult for retail investors at this point, the best approach here is to use exchange-traded funds (ETFs).

There are three ETFs primarily aimed at frontier markets right now:

- The iShares MSCI Frontier 100 ETF (NYSE Arca: FM) is weighted toward the Middle East (62.26%), with most of that spread between Kuwait, Qatar, and the United Arab Emirates (UAE). It's up 13.20% year to date.

- The PowerShares MENA Frontier Countries (Nasdaq: PMNA) is even more weighted to the Middle East (81%), with the rest focused on Africa. Kuwait, Egypt, UAE, and Qatar are the top holdings. PMNA is up 5.16% year to date.

- Guggenheim Frontier Markets (NYSE Arca: FRN), on the other hand, is mostly focused on Latin America (79.71%), with a big concentration in emerging market Chile (50.68%). Other countries with significant exposures include Colombia, Argentina, Kazakhstan, and Egypt. This fund has done poorly, however, and is down 15.74% on the year.

The more aggressive may want to invest in frontier markets individually, but only two of these countries have ETFs devoted mostly to them.

They would be Vietnam, with the Market Vectors Vietnam ETF (NYSE Arca: VNM), (71.66 weighted for the target country), and Nigeria, with the Global X Nigeria Index ETF (NYSE Arca: NGE) (weighted 80.45% for the target country).

As frontier markets attract more attention, more ETFs will spring up, and there will be more ways to invest in them - but not every frontier market will be a smart investment.

We asked Money Morning's Martin Hutchinson for some characteristics to watch for when looking for how to invest in frontier markets going forward:

- Countries that emphasize free markets over government control of the economy

- Minimal corruption

- Political freedom and democracy

- Few impediments to trade

- Low inflation

- Light, transparent, and even-handed regulation

With this in mind, there are several frontier markets to avoid.

"Argentina is corrupt and socialist. Bangladesh is super corrupt," said Hutchinson. "Lebanon has a civil war, though it's quite good when it hasn't. And Bosnia/Herzegovina stole citizens' savings in 1990s and never restored them, as did other former Yugoslav republics."

However, some frontier markets do pass Hutchinson's test.

"Bulgaria has the cheapest labor in the EU," he said. "Estonia is the best-run member of the EU. Nigeria's oil economy is growing like crazy, and is getting less corrupt. And Botswana is still the best-run country in Africa."

Note: When it comes to global investing, frontier markets are just one option. South America is another. And opportunities there are much easier to find now that four of the most promising economies in the region have banded together to form a powerful alliance...

Related Articles:

- Money Morning:

It's Like You're Investing in South Korea - Back in 1961 - CNBC:

Frontier Markets Feel the Love as Emerging Peers Crumble - Investment Week:

The Next Big Thing? Investors Switch from Emerging to Frontier Markets - Breakout:

Time to Get Long Vietnam? The Case for Owning Frontier Markets

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.