Tesla Motors Inc. (Nasdaq: TSLA) stock is down more than 6% in afterhours trading today (Wednesday) despite the fact that the company beat earnings projections in the first quarter.

Tesla announced adjusted earnings per share (EPS) of $0.12 per share, which was above consensus estimates of $0.10 per share.

Tesla announced adjusted earnings per share (EPS) of $0.12 per share, which was above consensus estimates of $0.10 per share.

Revenue for the quarter was $713 million, which also beat consensus estimates of $699 million.

But as is always the case with Tesla, today's earnings report and TSLA stock's movement rely on much more than just revenue and EPS...

Looking Deeper at Tesla's (Nasdaq: TSLA) Earnings Report

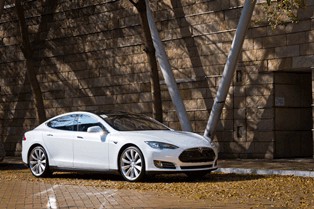

First, Tesla reported that it produced 7,535 Model S sedans in the first quarter, which was a quarterly record for the company. Production has increased by 15%. At the end of 2013, Tesla was producing 600 vehicles a week, and that is now up to 700. The company had previously stated that it wants to produce 1,000 vehicles per week by the end of 2014.

The company said it expects to produce 7,500 vehicles in the second quarter.

The company delivered 6,457 vehicles globally during that quarter, which beat consensus estimates for the quarter. However, that total was down from the 6,892 vehicles it delivered in Q4 of 2013. In the fourth quarter, TSLA had sales growth of 25% for its sedans, so a Q1 slip is moving the stock.

Despite the fact that it sold fewer vehicles than in Q4, the company maintains that it is still on track to reach its goal of delivering 35,000 vehicles globally in 2014.

The company also provided an update on Chinese expansion. Tesla made its first move into China last month when Chief Executive Officer Elon Musk hand-delivered Model S sedans at a public event in Beijing. At the time the company detailed its plan to build a supercharger network in the country and start manufacturing vehicles in China within the next few years.

"We plan to expand in China as fast as possible because we believe the country could be one of our largest markets within a few years," the company said. "We are also encouraged by how fast we have been able to develop our infrastructure in China when the proper support is in place."

The company has built one additional supercharger station in China to add to the three it previously operated.

To further expand global sales, the company stated today that it will be increasing the number of stores and service centers it operates globally by 75% this year. Company officials also announced that they plan to spend as much as $850 million in capital expenditures this year to increase production capacity, build more stores, and begin construction of the "Gigafactory."

Unfortunately for investors, the company provided no update on the Tesla Gigafactory. The company had previously stated that it would move forward with two locations to ensure the factory was built by 2017. Today, the company stated that it has not decided on locations and reiterated that it's still on track for 2017 completion.

"The progress Tesla is making on the Gigafactory is important to investors because that factory could be a game-changer for the auto industry and could change industrial storage capacity for power," Money Morning's Defense & Tech Specialist Michael A. Robinson said.

"I think it's just an absolutely brilliant move to have the groundbreaking at two locations," Robinson said. "If the environmental activists in one state try to slow down the factory, the company can just go elsewhere. It's another sign of a bold strategic thinker."

While TSLA stock is down in after-hours trading, here's what the long-term outlook is for TSLA stock...

Editor's Note: Tesla is engaged in a highly sensitive venture called BlueStar that could disrupt $737 billion of the U.S. economy and impact 98% of the population. Yet, few details concerning BlueStar have made their way into the press. However, a recent investigation uncovered some shocking revelations. Click here to continue reading this must-see story...

Tesla (Nasdaq: TSLA) Stock's Long-Term Outlook

Most of the financial numbers from today's report were in line with expectations, so it's surprising that the stock has dipped more than 6% after-hours. The slide is a continuation of the last two months for TSLA, which have seen the stock dip 21%. Despite that that sell-off, TSLA is still up 34% in 2014 and 269% in the last 12 months.

While the short-term performance is concerning for shareholders, Money Morning's Chief Investment Strategist Keith Fitz-Gerald says the long-term potential for TSLA stock is undeniable.

"I think Elon Musk is one of the most dynamic CEOs on the planet, and I believe he has the potential to make Tesla a $1,000 stock within the decade," Fitz-Gerald said.

"Tesla will start producing cars in China within the next few years and that's going to become a real boost to the bottom line because it will help the company avoid a 25% import tariff that many competitors have to deal with at the moment," Fitz-Gerald said. "I'm also excited about what Musk is doing with battery production, charging stations, and, of course, his willingness to take on the established auto sales model."

In the short term, investors can expect a volatile ride from TSLA stock. Tesla is truly a momentum play at the moment, and the stock could continue lower in the short term. Long term, Tesla's innovative business model and strategy should drive the stock higher for years.

How will you play Tesla stock following today's earnings report? Join the conversation on Twitter @moneymorning using #Tesla.

(MUST-SEE) IT'S THE EQUIVALENT OF "REINVENTING FIRE"

What Led a Military Think Tank to Make This Shocking Prediction?

A miraculous space-age technology has been developed that could revitalize $737 billion of the U.S. economy. And it could transform almost every facet of our lives. Click here for the amazing story...