July retail sales data released today (Wednesday) was flat, suggesting the U.S. economy's third quarter will be weaker than expected.

The dismal July read was the weakest since January.

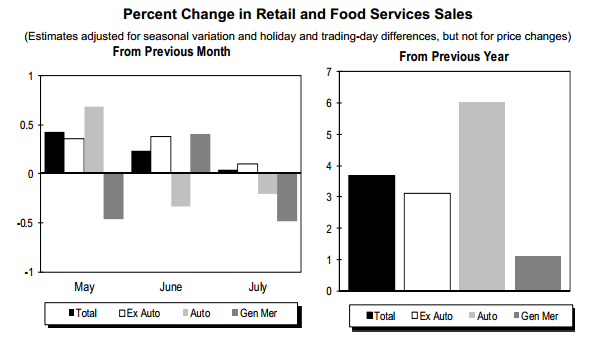

After a modest 0.2% gain in June, today's report from the U.S. Department of Commerce revealed U.S. retail sales remained stagnant last month, dragged downed by tepid sales of furniture, electronics, and appliances. And, for the second consecutive month, auto sales slipped in July.

After a modest 0.2% gain in June, today's report from the U.S. Department of Commerce revealed U.S. retail sales remained stagnant last month, dragged downed by tepid sales of furniture, electronics, and appliances. And, for the second consecutive month, auto sales slipped in July.

Excluding autos, retail sales rose 0.1% in July, missing forecasts that called for growth to hold steady at 0.4%, in step with June's pace. June's core sales were revised to 0.5% in June, from the previously reported rise 0.6%.

Core sales, which strip out automobiles, gasoline, building materials, and food services, and correspond most closely with the consumer spending component of gross domestic product (GDP), ticked up 0.1% in July. That hints toward a moderation in consumer spending in this year's third quarter.

Auto dealership receipts dipped 0.2% in July after declining 0.3% in June. Sales at non-store retailers, which include online sales, slipped 0.1%

Sales at clothing retailers rose 0.4% and receipts at sporting goods shops gained 0.2%.

Sales at electronics and appliance stores fell 0.1%, while sales at building materials and garden equipment suppliers rose 0.2%

Why U.S. Retail Sales Data Matters

Retail sales are closely watched because they are a key gauge of the health of the economy. They account for a major share of consumer spending - the backbone of the U.S. economy.

Since the start of the year, retail-sales reports have been disappointing to lukewarm, pulled down by weak wage growth and wary consumers.

Recent job gains and a modestly improving housing market were expected to eventually spur a more confident consumer.

July's report, however, is evidence that consumers remain tight-fisted.

That's doesn't bode well for retailers as we enter a crucial time period for retailers: back to school sales followed by the make-or-break holiday season.

The good news for consumers is that they can expect a flood of promotions as retailers are forced to compete on price over innovation. Clothing, shoe, and accessory retailers that face slumping sales will try harder to attract consumers who prefer to spend money on new products in technology.

Indeed, the expected Sept. 9 launch of Apple Inc.'s (Nasdaq: AAPL) souped-up iPhone 6 could steal some thunder from other retailers, according to Paul Lejuez, an analyst with Wells Fargo, as reported by The Wall Street Journal earlier this week.

After scouring government retail sales data for the months surrounding the launch of each iPhone, Lejuez found general merchandisers, as well as accessory, apparel, sporting goods, and shoe retailers, experienced slower sales across all categories.

It's not only Apple that stands to benefit.

According to the National Retail Federation, technology continues to grab a bigger chunk of back-to-school spending.

The NRF estimates total back-to-school spending will reach $26.5 billion this year.

A U.S. family with children in grades K-12 will shell out an estimated $669.28 over this year's back-to-school season, with much of that going toward electronics.

Additionally, savvy shoppers are also expected to wait one to two weeks before school starts before making a purchase, holding out for the best deals. The majority (76%) own a smartphone or tablet and are expected to hunt online for the best buys prior to making any purchase.

While purchases are forecast to rise 5% from the average $634.78 doled out last year, the amount is still below the $688.62 spent in 2012.

Investors: We're in the midst of a generational bull market, but there will be setbacks along the way. Learn how to protect yourself from market declines, and make more money on the recovery...

Related Articles:

- Wall Street Journal: Back-to-School = Back to Discounts

- National Retail Federation: Top 2014 Back to School and College Trends