Historically, low unemployment has led to faster wage growth. But that hasn't been the case over the last six years.

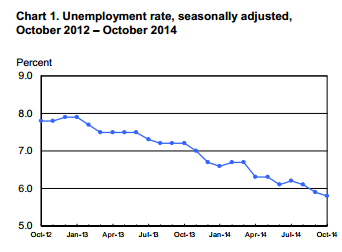

The October U.S. jobs report released today marks a six-year low in the unemployment rate. It has gone from as high as 10% in October 2009 to 5.8% today. Employers have added an average 227,000 jobs each month in 2014, up from 194,000 last year.

The October U.S. jobs report released today marks a six-year low in the unemployment rate. It has gone from as high as 10% in October 2009 to 5.8% today. Employers have added an average 227,000 jobs each month in 2014, up from 194,000 last year.

Wage growth, however, continues to seriously lag.

In the Bureau of Labor Statistics report on nonfarm payrolls released today (Friday), data showed average hourly wages barely budged. Average hourly wages in the private sectors inched up a meager 0.1%, or $0.03, in October, after falling a penny in September.

That leaves year-over-year wage growth unchanged at 2%. That's well below pre-recession gains of 3.5% to 4.5% and is barely keeping pace with inflation.

Holding back higher wages are U.S. employers' overall labor costs, including pay and benefits, like healthcare costs. Those high costs aren't likely to change, so future wage growth is unlikely.

And in spite of several years of efforts by the U.S. Federal Reserve, including shrinking interest rates to rock-bottom levels and three rounds of quantitative easing, the central bank hasn't been able to bring back rising wages. In fact, October's report suggests the U.S. central bank won't be in any great hurry to hike interest rates despite a declining unemployment rate.

Profit Alert: Over time you can make more money in dividends than you paid to buy the stocks that produce them. Get today's best dividend strategy for building wealth in the low-yield era.

In short, workers (aka consumers) are in no better shape now than they were several years ago. In fact, with costs for goods and services rising across the board, it's fair to say they're in worse shape.

And despite an uptick in consumer confidence - last week it hit its highest level in seven years - stagnant pay holds back consumer spending, hampering a full economic recovery.

What today's report tells us then is that while an economic recovery has started, it has a long way to go...

Lack of Wage Growth Holds Back Recovery

"It appears that we are finally in the first stage of a labor market recovery," Steven Pressman, professor of finance and economics at Monmouth University in West Long Branch, N.J., told Money Morning.

Pressman said lower job loss numbers, higher GDP in Q3 2014, and lower business inventories point to more hiring ahead.

The second stage of recovery, however, has still not begun.

Pressman explained there continues to be a lag on a key macroeconomic indicator: large increases in new business formation. That, Pressman said, is a major reason the labor force participation rate remains at a four-decade low.

The third stage, where large demand for workers pushes up wages, is still nowhere in sight.

Note: Gold continues to be the best crisis hedge investment - but only if you know how to avoid buying fakes. Here are the seven best ways to tell if your gold is real.

"Wages and average weekly earnings have not changed much more than inflation in the past month, the past year, or the past several years," Pressman shared. "Median household income is still below its level from before the economic crisis and hasn't changed much in the past quarter century. We saw concerns about stagnant wages in the mid-term elections earlier this week. Voters in several states, including hardcore red states like Arkansas, Nebraska and South Dakota, all voted for large increases in the state minimum wage."

Waning wage growth aside, following are a dozen key takeaways from the October jobs report.

12 Highlights from the October Jobs Report

- Employers added 214,000 jobs in October. That missed consensus estimates of 233,000 and was down from (an initial read of) 248,000 in the prior month.

- The unemployment rate, expected to have held steady at 5.9%, ticked down to 5.8%. That's the lowest level since July 2008.

- The average work week edged up by 0.1 hour to 34.6 hours.

- The labor force participation rate, the percentage of working-age population employed or actively looking for work, eked up to 62.8% from 62.7%. Still, that's a low level last seen during the late 1970s.

- Restaurants and similar establishments added 42,000 jobs in October, compared with an average gain of 26,000 per month over the prior 12 months.

- Retail trade added 27,000 new jobs in October. Over the past year, the sector had boosted headcount by 249,000.

- Healthcare added 25,000 jobs in October, roughly in line with the prior 12-month average gain of 21,000.

- Employment in professional and business services continues to show signs of improvement, adding 37,000 jobs last month. Over the last 12 months, job gains in the sector have averaged 56,000.

- Manufacturing jobs increased by 15,000, while construction job growth grew by 12,000.

- Federal, state, and local governments increased headcount by 5,000.

- Job gains in other industries, including mining, lodging, wholesale trade, information, and financial activities, showed little change month over month.

- Upward revisions were made to the prior two months' jobs numbers by a collective 31,000. Job gains for August were revised to 203,000 from 180,000, reversing the month's initially dismal figure of 142,000. September's count was revised to 256,000 from 248,000.

Today's Top Investor Story: As of 2014, more than 52% of Americans have made a fatal trading mistake. They thought they were playing it safe by using this strategy, but the truth is... it cost them a lot of money. Today, our Capital Wave Strategist Shah Gilani - who has more than 30 years of trading experience - pulled back the curtain on one of the biggest threats to your money. If you learn this lesson, you'll never have to worry about losing money to it again...

Related Articles:

- NY Times:

Jobs Data Show Steady Gains Even as Voters Signal Anxiety

- USA Today:

Economy Adds 214,000 Jobs; Jobless Rate, 5.8%

- U.S. Bureau of Labor Statistics:

Employment Report