China's ambitions for superpower prominence are no secret.

But that requires recognition on the world stage.

Inevitably, that also means a greater role for China's currency, the yuan, in the global finance arena.

There are clear and visible signs that China's currency is on the march to that global position, yet until now they've been underreported.

It's an unstoppable trend, and we can take advantage by taking these critical steps...

The U.S. Economy Remains King... but the Gap Is Narrowing

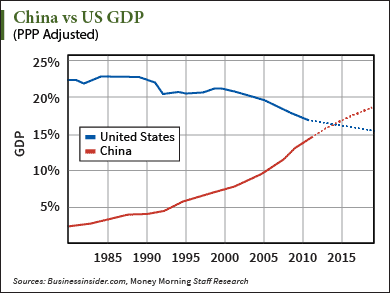

According to the International Monetary Fund (IMF), China has overtaken the United States as the world's largest economy. China's GDP is $17.6 trillion, versus America's at $17.4 trillion. The comparison, however, depends on the concept of purchasing power parity (PPP).

According to the International Monetary Fund (IMF), China has overtaken the United States as the world's largest economy. China's GDP is $17.6 trillion, versus America's at $17.4 trillion. The comparison, however, depends on the concept of purchasing power parity (PPP).

Essentially, it works like this: placing salaries and living costs on a similar footing, the two countries' purchasing power is compared.

By this measure, China has moved ahead of the United States, as you can see in the graph above.

By this measure, China has moved ahead of the United States, as you can see in the graph above.

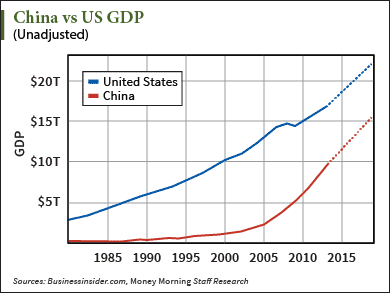

Is this the end of U.S. dominance? It's not that simple. Chinese GDP per capita remains less than 25% of American levels. So the U.S. is still the largest economy by the more common measure of pure output, as you can see in the graph at right.

On that basis, America is still ahead, but the gap is narrowing

Despite a slowing rate of GDP growth, China is still in the neighborhood of 7%, nearly triple the U.S. rate.

Europe Is Increasingly Exposed to the Yuan

Back in mid-October anonymous sources at the European Central Bank (ECB) indicated that the Governing Council would deliberate on the idea of buying Chinese yuan to include in their mix of reserve currencies. This makes perfect sense. After all, the European Union is China's single largest customer, accounting for $280 billion in imports to the EU last year. In terms of total trade, China is the European Union's second most important partner (after the United States), representing a whopping $428 billion in annual trade.

Europe's currency has been weakening considerably over the past six months against the U.S. dollar, even hitting a two-year low of $1.24 recently. Thanks to ECB president Mario Draghi's ongoing pledges to stimulate through bond-buying ad nauseam, it appears the euro's weakening trend is not ending anytime soon.

On the other hand, the yuan has gained strength against the U.S. dollar, moving up 2% since early June. Against the euro, the yuan has gained 6% in 2014.

For the ECB to include yuan as one of its reserve currencies therefore makes perfect financial sense. It's a form of diversification into a currency that's clearly gaining relevance, and which the union's members need to pay their largest supplier of goods and services.

ECB Executive Board member Yves Mersch said in February, "Due to the size of China's economy and its importance in global trade and, potentially, finance, the renminbi might ultimately come to challenge the U.S. dollar. The authorities and investors need to prepare for a world in which the renminbi will play a much more important role."

Former EBC president Jean-Claude Trichet recently co-chaired the International Finance Forum (a think tank) in Beijing. According to Trichet, "The global economy and global finance is at the turning point in a way... New rules have been discussed not only inside the advanced economies, but with all emerging economies, including the most important emerging economies, namely, China."

What China's Gold Stockpiling Means

China's central bank, the People's Bank of China, last updated its official gold holdings in 2008. All we know officially is that China has 1,050 tonnes of gold.

Given that China has vaulted into a top gold producer spot at 430 tonnes of annual output (all of which stays at home), and that its imports are some 2,000 tonnes per year, odds are there's a lot more gold there by now.

By some estimates, China's stash is up around 4,000 tonnes. If that's the case, then its holdings are surpassed only by the U.S. with 8,133 tonnes, and followed by Germany with 3,384 tonnes and the IMF with 2,814 tonnes.

As we highlighted a short time ago, former Fed Reserve Board Chief Alan Greenspan has been touting gold lately, even for the Chinese.

In his op-ed piece in Foreign Affairs magazine (published by the Council on Foreign Relations) titled "Golden Rule: Why Beijing Is Buying," the "Maestro" said:

If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country's currency could take on unexpected strength in today's international financial system.

The net result is that I have little doubt China's hoarding gold in order to bolster confidence in its currency, with of course the aim of floating it and convincing large players to hold more of it. It's an inevitable step towards greater influence on global economics and, by extension, politics, in addition to bolstering the credibility of the yuan.

The big question today is how we can profit from the trend...

This Payoff Could Be (Really) Big)

There are a couple of ways you can hitch a ride on this trend and make some of your own yuan along the way. The first is the relatively conservative play of betting on the yuan itself.

As the herd comes to realize the kind of status China's yuan is headed for, they will start to bid it up considerably. Meanwhile, you gain diversification through exposure to a major currency. WisdomTree's Chinese Yuan Strategy ETF (NYSE Arca: CYB) is the simplest route. It mimics the value of the yuan relative to the U.S. dollar, while paying money market rates available in China, currently 0.81%.

The second way to benefit from a rising yuan is through Chinese stocks. Today Chinese shares, on a price-to-book value basis, are as cheap as they were in both 2006 and 2009. The SPDR S&P China ETF (NYSE Arca: GXC) tracks the performance of the S&P China BMI Index. GXC gives you broad exposure to the Chinese market, while trading at a paltry P/E ratio of 9 while yielding 1.84%.

China's new economic stature, significance to its largest customer, and growing gold stash are all going underreported, but that doesn't make them any less relevant.

China's rise has a long way to go yet. And its currency, though managed through a "soft peg" for now, is widely viewed as being substantially undervalued.

You can still get in on the trend toward revaluation of both the yuan and Chinese stocks, before the market "gets it."