Money Morning's "unloved" pick of the week is robotic exoskeleton company Ekso Bionics Holdings Inc. (OTC: EKSO).

An unloved investment is one that's been beaten down - but is actually a great value. Investors then get an amazing entry point into a good long-term investment.

Ekso stock is a favorite pick of Money Morning Chief Investment Strategist Keith Fitz-Gerald. He believes Ekso Bionics stock could rise more than 13-fold over the next five years. He first recommended EKSO on Oct. 2.

Ekso Bionics Holdings (OTC:EKSO) Stock: About the Company

Founded as Berkeley Electronics in 2005, the company changed its name to Ekso Bionics Holdings Inc. in 2011. Ekso stock went public in January. Based in Richmond, Calif., Ekso designs and builds "wearable robots" for people with physical disabilities. Ekso suits allow people with severe mobility disorders, stroke victims, and those with spinal trauma to walk again. The machines strap around the waist and legs and use motors to assist the wearer's movements.

Founded as Berkeley Electronics in 2005, the company changed its name to Ekso Bionics Holdings Inc. in 2011. Ekso stock went public in January. Based in Richmond, Calif., Ekso designs and builds "wearable robots" for people with physical disabilities. Ekso suits allow people with severe mobility disorders, stroke victims, and those with spinal trauma to walk again. The machines strap around the waist and legs and use motors to assist the wearer's movements.

Ekso Bionics Holdings (OTC: EKSO) Stock: Why It's Unloved Right Now

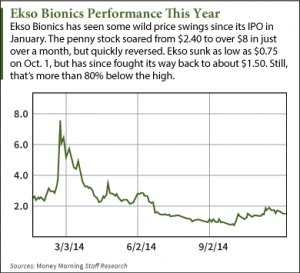

First, it's important to recognize that Ekso is a penny stock that has had a brief but volatile trading history since its Jan. 17 IPO. Some positive articles on the Internet shortly after the IPO pushed Ekso stock over $8. But as an early-stage growth company, Ekso is investing heavily in its business and consistently reports losses.

First, it's important to recognize that Ekso is a penny stock that has had a brief but volatile trading history since its Jan. 17 IPO. Some positive articles on the Internet shortly after the IPO pushed Ekso stock over $8. But as an early-stage growth company, Ekso is investing heavily in its business and consistently reports losses.

Disenchanted investors looking to get rich quick dumped Ekso. Over the following months, EKSO fell below $1. (This is also why we at Money Morning advise waiting to buy IPOs.) A chart that ugly tends to scare off a lot of investors, particularly in the treacherous world of penny stocks today.

To make matters worse, to raise $22.8 million last month Ekso convinced warrant holders to exercise 22.8 million $2 warrants for just $1. The "overhang" from that kind of move often pulls a stock's price toward the exercise price - in Ekso's case, $1.

Ekso Bionics Holdings (OTC: EKSO): Why It's a Penny Stock to Buy

Usually investors should avoid volatile penny stocks, but Ekso is no ordinary penny stock.

Fitz-Gerald actually paid a visit to Ekso headquarters in October. He was blown away by what he saw.

"My trip to tiny Ekso was quite simply the most inspirational visit I've ever made to any company... in any industry... anywhere in the world," he said.

Ekso's wearable robots exemplify the powerful trend of human augmentation - the integration of human bodies and technology, Fitz-Gerald said.

He saw how quickly users can put on an Ekso suit and how easily the suit can adapt to the wearer with just a push of a button. Both traits put Ekso ahead of competing suits, he said.

Those key advantages also caught the attention of the U.S. Department of Defense. Ekso has received more than $35 million in research grants from the DoD. It has also licensed its technology to Lockheed Martin Corp. (NYSE: LMT).

In early October, Boston Dynamics, a Google Inc. (Nasdaq: GOOGL, GOOG) company, chose Ekso to execute a DARPA (Defense Advanced Research Projects Agency) project called "Warrior Web." The goal is to build a low-power, lightweight suit to allow soldiers to walk, run, and climb faster.

Ekso also has received a grant from the National Institutes of Health (NIH) to build a suit for injured children.

As you can see, EKSO can tap into two big markets: medical devices and the military.

The growing interest in Ekso technology from both government and private sector players suggests tremendous potential, Fitz-Gerald said.

"Ekso is not just a great investment for your financial future," Fitz-Gerald said. "It's a great investment for the future of humankind."

Investing in Ekso Stock (OTC: EKSO)

Fitz-Gerald advises averaging into EKSO stock 25% at a time until you reach your target position. He recommends investors devote no more than 2% of their money to EKSO to minimize risk. And he says investors should plan on holding EKSO for at least 24 months.

"By 2020, I think this tiny company will hit at least $20 a share. You simply don't see this kind of potential very often," Fitz-Gerald said. Investors who took Fitz-Gerald's advice in October when EKSO was trading at $1 are already up 50%.

For More Great Investing Ideas: Fitz-Gerald has written about Ekso Bionics himself several times in his free Total Wealth newsletter. A new publication of Money Map Press, the Total Wealth newsletter will introduce you to profit potential others don't yet see or even understand. To get Fitz-Gerald's full, detailed report on Ekso Bionics, as well as all of his Total Wealth research and recommendations delivered twice weekly to your inbox - completely free - click here.

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.