There was a time when small-caps didn't offer any of the market's best dividend-paying stocks, but that's changing.

The number of issues in the S&P SmallCap 600 Index presently paying a dividend has jumped 10.2% since the end of 2013. Now some of the best dividend-paying stocks in the small-cap sector include a health REIT yielding 4.61%, a natural gas company yielding 3.92%, and a regional bank yielding 3.53%.

The number of issues in the S&P SmallCap 600 Index presently paying a dividend has jumped 10.2% since the end of 2013. Now some of the best dividend-paying stocks in the small-cap sector include a health REIT yielding 4.61%, a natural gas company yielding 3.92%, and a regional bank yielding 3.53%.

"Initiating a dividend represents a broad commitment of future earnings, to which companies need to be very sure of their future cash flow," Howard Silverblatt, Senior Research Analyst at S&P Dow Jones Indices, said in a statement.

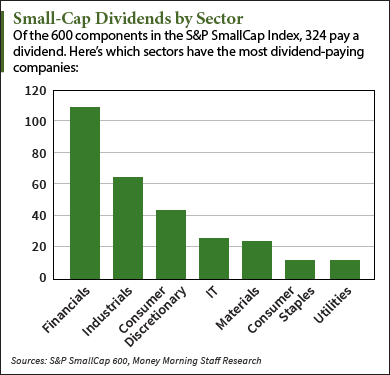

Some 324 of the 600 SmallCap components currently pay regular cash dividends. That gives the benchmark an average yield of 2.24%. Eighteen have increased their cash payouts for at least 20 consecutive years. Nineteen more have increased dividends for at least 10 successive years. And 231 have paid dividends for at least five straight years.

Based on the current dividend rate, 202 companies will shell out more in dividends this year than they did in 2014, according to S&P. In 2014, 255 companies paid more than in 2013. In 2013, 139 companies paid more than they did in 2012.

That's a trend not to be ignored.

Small-cap financials (109) represent the largest dividend-paying sector in the small-cap index. Industrials follow with 65. Consumer discretionary stocks take the No. 3 spot with 44. A smattering of sectors, ranging from information technology to telecommunications, make up the rest.

So what's behind the move of small-caps becoming the best dividend-paying stocks on the market?

Why There Are More Small-Cap Dividend-Paying Stocks

All lot of small companies have decent cash flow, Silverblatt explained.

Indeed, small-cap companies bought back roughly $23 billion worth of shares in 2014. According to Citigroup, that was the most since 2007. About 30% of companies in the sector made repurchases last year.

Mounting shareholder pressure for a regular dividend also likely spurred the payout movement, Silverblatt added.

Mounting shareholder pressure for a regular dividend also likely spurred the payout movement, Silverblatt added.

Six-plus years of a near zero interest rate environment sent yield-starved investors hunting for income wherever they can get it. As a result, investors piled into dividend-paying stocks. Small caps, no doubt, have taken note. They've jumped on the dividend-paying bandwagon.

By initiating dividends, small cap companies show their commitment to investors. They also open up the door to future dividend hikes.

Dividends, increasing dividends in particular, are instrumental in driving portfolios' returns. Since 1926, over 40% of historical stock returns have come from dividends, according to Ned Davis Research.

Thanks to regular, and potentially higher, cash payouts, small-cap investors can now get a steady stream of income along with growth prospects.

You can get in on the profits. Here are five small-cap dividend dynamos.

The 5 Best Dividend-Paying Stocks in Small-Cap Sector Today

Universal Health Realty Income Trust (NYSE: UHT) is a publicly owned real estate investment trust. The company invests in healthcare and human service-related facilities in the United States. These include acute care hospitals, behavioral healthcare facilities, rehabilitation, childcare and surgery centers, and medical office buildings. Founded in 1986, UHT is based in King of Prussia, Penn. UHT has been boosting is dividend every year for the last 27 years. Shares yield 4.62%.

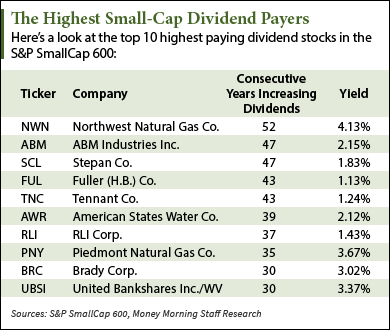

Northwest Natural Gas Co. (NYSE: NWN) stores and distributes natural gas in the U.S. Founded in 1859, NWN is headquartered in Portland, Ore. A dividend dynamo, NWN has increased its dividend without interruption for the last 52 years. Shares yield 3.94%.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

WestAmerica Bancorp (Nasdaq: WABC) provides a range of banking services to corporate and individual customers. It operates through 92 branches in 21 counties in northern and central California. Founded in 1972, WABC is headquartered in San Rafael. WABC has been sweetening its dividend for the last 25 straight years. Shares yield 3.53%.

American States Water Co. (NYSE: AWR) provides water and electric services to residential, industrial, and other customers in the United States. The company also provides water and/or wastewater services at various military installations. Founded in 1929, home base is San Dimas, Calif. AWR has been increasing its dividend for the last 39 consecutive years. Shares yield 2.15%.

ABM Industries Inc. (NYSE: ABM) offers carpet cleaning, dusting, window washing, and other building cleaning services. Customers include educational institutions, health facilities, retail stores, shopping centers, stadiums and arenas, airports and other transportation centers. It also services warehouses, commercial offices, government, and industrial buildings. The company was founded in 1909. Its headquarters are in New York City. AMB has been increasing its dividend for the last 47 consecutive years. Shares yield 2%.

More Money-Making Tips:

- Make This Your Wealthiest Year Yet with 3 Steps and 5 Stock Picks

- 3 of the Best Long-Term Stocks to Buy Now

- ETF Investing Made Even Easier with These 7 Picks

Related Articles:

- FactSet: Earnings Insight

- CBS Money Watch: Why a Stronger Dollar Hurts Corporate Earnings

- S&P Dow Jones Indices: S&P Small Cap 600