Last week I mentioned how concerned analysts and journalists were at the "advanced" age of this eight-year, six-month-old bull market - though, in fairness, these same folks were fretting about age when the bull turned four... five... six...

Now, age is certainly something to keep in mind (preferably at the back of your mind) when you're in the markets, but by no means should it be the thing driving your thinking or trading.

It bears repeating: The market's all-important narrative - the "case for investment," the broader economic picture driving prices and earnings, and informing the trading public's perceptions - should be uppermost on your mind.

That's because the narrative will tell you which stocks and sectors are likely to advance and decline - where money is flowing in the markets. More importantly, the narrative will point you to the profitable price "extremes" like the ones we exploit when we take down triple-digit gains in Stealth Profits Trader.

Right now, the narrative is still driven by growth prospects, though it's competing with a Fed policy-driven narrative. That competition's not going to last forever, and when the changeover happens... watch out.

Fortunately, I've got some charts that will show us how we can measure, empirically, the strength and state of the bull market, and how likely it is to drop at a given week.

More importantly, these indicators can warn us about trouble ahead - before it breaks all over the markets and chews into returns.

Here Are Numbers I Watch All the Time

In the old days, miners were said to have carried a few song birds underground with them at all times. The thinking was, they say, that any dangerous gas slowly creeping into the miners' subterranean workspace would overwhelm the canaries first, giving the humans time to get out of Dodge before the air grew totally lethal.

So having a "canary in the coal mine" is useful for giving you advance warning of any changes you need to know about.

I've got a couple of canaries that fit the bill perfectly:

- The cumulative advance/decline line that shows how many stocks are participating in the bullish ride; and

- The strength of the global market

Let's have a look...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

"Canary" No. 1: The Cumulative Advance/Decline Line

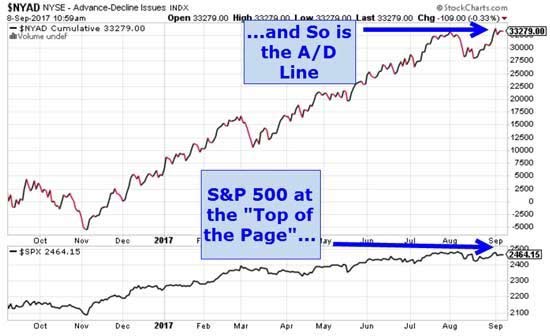

I've shown you charts of the cumulative advance/decline (A/D) line before, but it's worth looking at again, especially now.

This indicator starts with a daily breadth number. Breadth is simply the number of stocks on the New York Stock Exchange that closed higher than yesterday, minus the number that closed lower. That's where the term advance/decline comes from.

When we add that breadth number day after day, we "accumulate" the daily breadth numbers, giving us a cumulative advance/decline line. Here's what that looks like as of Friday:

This is the chart of a normal, healthy bull market. Many stocks are participating in the move that's keeping the market at or near all-time highs.

When things get dicey: When the market starts making new highs and the cumulative A/D line fails to follow, then we have something to be concerned about.

But we're not there yet...

"Canary" No. 2: The Strength of Global Markets

I could show you lots of different markets that are strong - Europe, China, and Japan are all at the top of the page.

Not only that, but so are the smaller economies that make up the Emerging Market Index. Here's that chart:

As long as most global markets are strong, it's hard to make a case for why a downturn is imminent here in the United States, one of the strongest of all.

The bull marches on until further notice! (And that means you should put on bullish trades and buy quality stocks until further notice.)

But, it has to be said that the "narrative" that's been fueling gains recently is going to change. The low-volatility, high-profit "Easy Money" market we've been profiting in for years is going to "flip," and charts like the ones I just showed you will look very different.

Once that monumental change in narrative happens, the entire market will, too... and present investors with an entirely new market, full of new opportunities and, for the unwary, potentially ruinous losses.

I'm showing my 10-Minute Millionaire readers how we can spot the change easily and get set up for the maximum possible profits in what I'm calling the "New Millionaires' Market." If you're already a Member, stay tuned.

And if you're not in my 10-Minute Millionaire wealth-building service yet, just click here. It's totally free to join, and you'll get my market updates and recommendations in your inbox three times a week.

Follow D.R. on Facebook and Twitter.

About the Author

D.R. Barton, Jr., Technical Trading Specialist for Money Map Press, is a world-renowned authority on technical trading with 25 years of experience. He spent the first part of his career as a chemical engineer with DuPont. During this time, he researched and developed the trading secrets that led to his first successful research service. Thanks to the wealth he was able to create for himself and his followers, D.R. retired early to pursue his passion for investing and showing fellow investors how to build toward financial freedom.