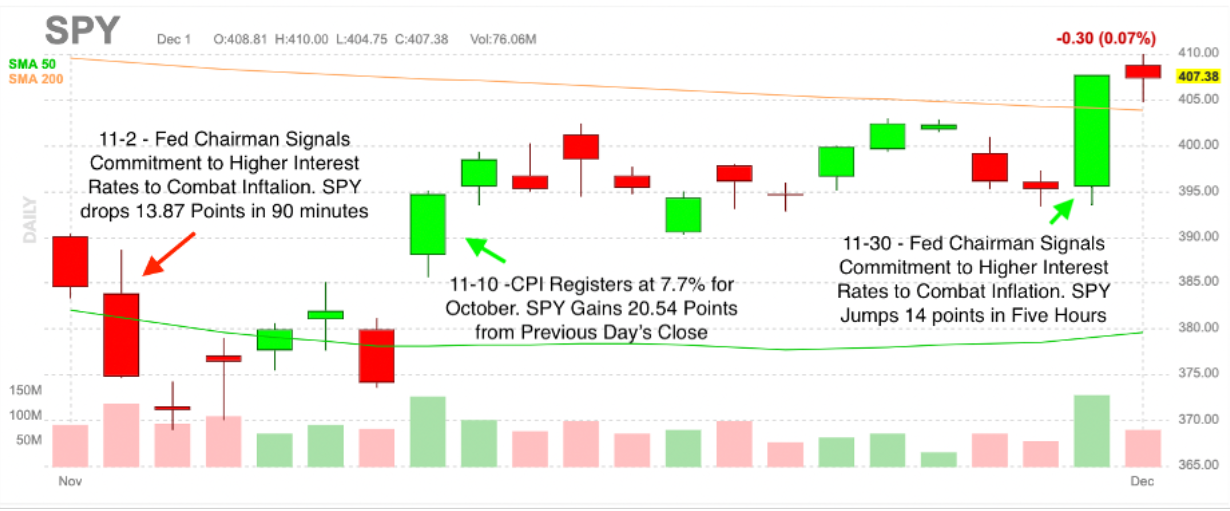

I want you to look at a chart - the SPDR S&P 500 Trust ETF (NYSEArca: SPY), which tracks the S&P 500 index. It's how mere mortals like us can play the stock market for essentially pennies on the dollar.

Here's what you're looking at...

In November, markets experienced dramatic swings up and down based on statements coming out of the Federal Reserve. Following the November 2, 2022 Fed meeting, Fed Chair Jerome Powell reminded investors that the central bank would continue raising rates to reach its 2% inflation target.

Powell's statement fueled the worst one-day performance ever on the occasion of a Fed Open Market Committee meeting. That specific selloff is marked by the red arrow on the chart's left side.

Then, on November 30, Powell spoke at the Brookings Institution. Again, he said the Fed would aggressively raise rates to reach 2% inflation, albeit at a slower pace of hikes. Speculation of a 50-basis point hike fueled a short-covering S&P 500 rally over the last two hours of the trading day. That's the green arrow on the right.

Then the S&P 500 rallied to 4,100 on Thursday, hitting that key support number.

Here's the thing, though: Nothing had changed in Powell's language. Like at all.

But markets delivered two much different outcomes.

It was a reminder of how contrarian approaches based on various technical levels and neverending speculation can fuel dramatic rallies and breakdowns.

It's clear that the markets are set for another move - likely lower - and I'll be quoting a few

people along this weekend's journey.

Without a pivot, we will soon return to our regularly scheduled bear market moves... and

Friday's jobs report signaled that we are starting to experience real economic pain.

But start with the macro-view of how bear markets actually work. For this, I find Peter Boockvar, CIO of Bleakley Financial Group, has a particularly compelling point of view:

"Bear markets usually come in three stages. The first one is that we take a lot of the

frothy excesses and euphoria out of the market in terms of the sexy names that we

saw in 2021 and take the P/E ratio down. We've done that; we went from 22 times

earnings, to, call it, 16 to 17," says Boockvar.

According to Boockvar, the second stage begins when investors calculate the impact of interest rates on earnings expectations and the economy. That's the earnings valuation compression that we've discussed in the past. In this phase, investors are also going to start to focus on key lagging indicators, like the jobs report that we saw Friday. That revealed sizeable losses in manufacturing and gains in seasonal demand.

Come the third phase, Boockvar says, "everyone throws in the towel. No one wants to own a stock again, and that's your bottom, and that's when you need to buy stocks hand over fist."

And that brings us to the $22 trillion question: Where the hell are we now?

For his part, Boockvar says: "I feel like we're just beginning to start that second phase."

Agreed.

Get the latest trading and investing recommendations straight to your inbox.