Tucker Carlson will release an interview tonight with Argentine presidential candidate and front-runner Javier Milei.

Follow the U.S. media focus on Milei, and you’ll see he’s labeled as “right-wing,” “radical”, and “libertarian.”

The attacks on his economic plans are all-out nuclear assaults… largely because he’s exposing the endgame of problems still building in the United States.

They can’t have that…

You see, Milei has exposed an economic system in Argentina rife with graft, poverty, and human and capital flight.

Out of a population of nearly 46 million, around 55% of workers work in the public sector - the government. Roughly 7 million people work in the private sector.

That’s one-seventh of the nation’s population supporting the entire country. But, in a play to buy favor, politicians just raised the minimum taxable threshold. There are now only 800,000 people who will be paying income taxes in a nation of 45 million people.

That’s a complete disaster… and it’s unsustainable.

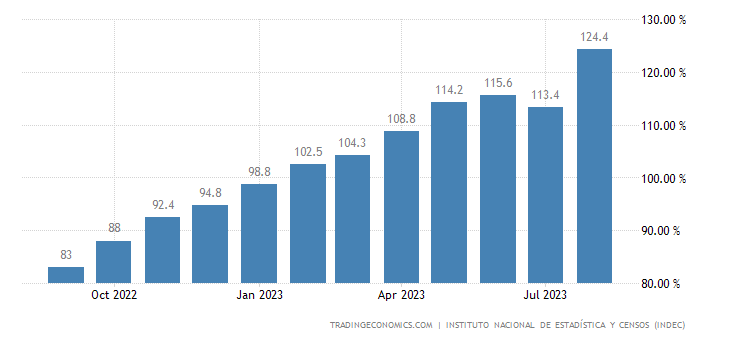

Since the economy can’t grow, Argentina’s politicians simply print more and more money. The average person in the nation loses 10% of their wealth to inflation every single month.

Inflation runs north of 100% annually in the country.

Inflation runs north of 100% annually in the country.

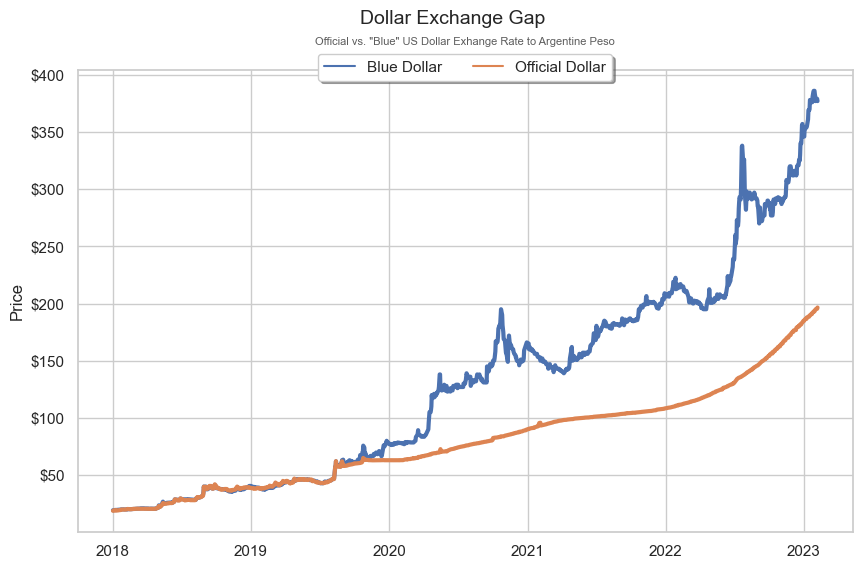

But it’s worse than that: The government has a two-tiered system of exchange rates that enrich the politicians, while keeping everyone else poor.

And they constantly lie about it.

I know about it. I’ve exploited these exchange rates myself.

As the United States reels toward even greater money printing, more debt, and increasing politicization, I worry that the U.S. will follow Argentina down the same path.

It’s my biggest economic fear.

The "Blue Dollar Black Dollar" Exchange

In 2012, I walked down the streets of Rosario, the agricultural hub of Argentina.

I spoke to a local academic, who couldn’t stop talking about the economic struggles of the country. That was 11 years ago.

Politicians blatantly keep people poor for power. The local told me a story of a woman walking up to a local union member, who asked the name of the politician she was voting for. The union member handed her a shoe. “Once you vote, come back for the other one.” They were bribing people with shoes to vote.

Argentina is a beautiful country. But it’s backward as it gets.

The academic then told me about the "blue dollar." This is the unofficial exchange rate for the Argentine peso against the U.S. dollar.

There’s an official exchange rate: 1 USD to 349 ARS.

Then there’s the real exchange – which is significantly higher.

Tucker Carlson visited a “Cave” – an unofficial bank that would exchange U.S. dollars for local currency. He received so much currency in exchange for a $100 bill that he had to put it all into a shopping bag.

At the time I visited, the exchange rate was 5.2 pesos to 1 dollar.

But the "blue dollar" rate was somewhere around 13 to 1.

In fact, I exploited this gap in a hotel in Rosario that night. I had $500 in U.S. cash on me. I exchanged all $500 for roughly 9.5 to 1 USD (which is a crime). The young man who bought my U.S. dollars raised the money in the air and said “I’m rich.”

He would either hold those dollars… or exchange them for the “13 rate” with someone else.

Meanwhile, I took the 4500 Pesos back to the airport, where I exchanged them for – get this - $825.

I made money.

As another economist explained, this was common. People were smuggling in U.S. dollars into Buenos Aires, the nation’s capital, and exploiting that gap. He suggested that there were plenty of millionaires in the city… but no one really worked.

And you could tell based on the places I visited, who had access to the foreign exchange markets… and who did not. You could see who was stuck getting pesos in the local economy… and who could exploit the system. Some people lived very well. The bulk simply did not.

Can the U.S. Do The Same?

If the U.S. falters, is it possible that the nation has a similar set up where politicians and well-connected officials have access to protect their assets compared to others?

I hate to say it, but we already have “dual systems” today.

Politicians can engage in insider trading – actively betting on the stock market based on information they know will enter new bills or laws in the future. This is how a person who makes $174,000 a year for 20 years can build a $40 million net worth.

If we - you and I - tried to trade on similar information, we’d be in prison.

Meanwhile, the Federal Reserve system is entirely a dual-class system. Only the Too Big to Fail Banks have access to the overnight lending window – allowing Jamie Dimon to park money at the Fed and collect north of 5%, while community and regional banks must buy bonds to try to scratch out a yield that’s lower than the repo rate.

This is precisely what caused our regional banking crisis in March because banks had to buy long-term bonds that paid less than the overnight yield provided to the Fed’s favorite banks.

And then, there are the basic Fed operations…

The Fed’s operations favor financial institutions at the expense of ordinary Americans.

When inflation is created by the Fed, the banks and institutions don’t feel it. In fact, they exploit it and buy up risk assets like stocks, benefiting from the expansion of the Fed’s balance sheet and interest rate cuts.

Only the people at the bottom of the pyramid – pensioners and the working class - feel the sting in the form of higher prices, with nothing positive to show for it.

Which now begs the question.

Could there be a dual-exchange system in the future?

Absolutely. It’s my biggest fear as a person who wants nothing to do with the political class that lives off the productive.

Yet our journalists – who have very little understanding of monetary or fiscal policy – all do their best to protect the status quo.

They all desperately want to fit in… and attend the White House Correspondents Dinner in 2024.

This is sadly how so many people in Washington think…

Which is why I continue to argue that your best case is to follow momentum, liquidity, and other critical metrics to use the stock market to your advantage.

You can build wealth and protect yourself against whatever new curveball they throw us in the future.

Stay positive…