When leaving the Florida Republic, it's important to pack wisely.

Midjourney: "An Alligator Packs for an Adventure"

Midjourney: "An Alligator Packs for an Adventure"

There's a stark difference between the Florida Republic... and 45 miles northeast of the Banana Republic's capital.

I'm visiting Baltimore for three days... again. [I'm in Hunt Valley, the home of McCormick & Co. (MKC), this morning. The place smells like pepper.]

It's easy to forget that the weather can be under 70 degrees on an October evening.

Too many times have I made this mistake.

The socks are too thin... as is the blood.

So, I double-checked three times. I think I'm ready for a season not named Humidity.

Yesterday was my mother's birthday. It's a football game with friends today and even bigger plans tomorrow. We're planning for the official launch of the Florida Republic.

Logistics must be addressed: i's dotted and t's crossed.

We're barreling toward 2024, and things are progressing.

I'm very grateful to our founding members.

We have a lot of work to do in the year ahead - both as investors - and getting on with our lives in a world fraught with insanity and absurdity. Good times are ahead.

Weekly Market Update

I wish I had better news about these markets.

We're in the middle of a duration crisis, and bonds are repricing in a way that reflects the end of the era of Zero Interest Rate Policy (ZIRP).

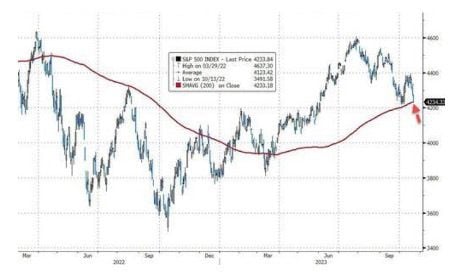

Our Equity Strength Signal has been in a downward trend for two months.

We don't ask questions.

We follow the signal... and get out of the way when the red reading comes.

This chart shows the signal since January 2022. It's an absolute rollercoaster, but we're standing tall.

You should notice that the S&P 500 is never at the absolute peak or bottom when our signal turns negative or positive, respectively... It usually comes a few days or a week later (the selling typically occurs when the MACD turns negative, and we see large amounts of "quantitative selling" on the end of the bell curves).

We don't know the core reason for the selling until a week or two after the cascading has begun. In June 2022, the selling was fueled by hedge funds.

Last October, it was the crisis in England. In March, we found out a week later that we had a regional banking crisis. And our current selloff is fueled by the bond duration crisis.

We're out in front of these moves. As I said, the price movement has already happened by the time the headline hits.

We've been negative three times since mid-August - as market squeezes create new rounds of selling and then take us lower. That's the trend: Lower highs and lower lows.

The movement is reminiscent of last summer before a crisis rocked the United Kingdom. There, the country had a bond crisis - as pension systems cracked under the pressure of liquidity woes.

Now, the U.S. faces a duration crisis. The U.S. 10-year bond is screaming higher - having just crossed 5%. As I noted last night, there's still plenty of room for U.S. Treasury bond yields to climb.

Meanwhile, the bears are roaring in the equity markets as the S&P 500 tests its 200-day moving average.

Source: Zerohedge

Source: Zerohedge

That's quite bearish.

We've largely sat in cash for a month - as a single day of positive Equity Signals proved false and took us lower once again. The only positive sector now is energy... and even the hedge fund world is trying to push the sector lower.

Let's hang out until we see some stabilization.

Okay, America! Choose Your Fighter

In 2024, America will choose between two candidates that very few want to be President. I advocate that we just take the year off and instead turn our attention to voting for the person who has a much bigger impact on our lives.

The Federal Reserve Chair.

Over the last two years, the Federal Reserve has lost control of the economy to the bond markets. In an excellent article at Bloomberg this week, Lisa Abramowicz notes that the bond market is moving away from any predictions from the Fed. The message is clear. No one seems to know what they're doing, and they are simply shooting from the hip regarding monetary policy.

With Federal debt exploding and no one doing anything to reign in government spending, it might be time to start thinking about a new Federal Reserve chairperson next year.

Therefore, I've put together five candidates for Fed Chair when it's time for a vote...

Option 1: Janet Yellen

The most influential person in Washington is Treasury Secretary Janet Yellen, whose fingerprints lie all over the financial alchemy storming our government's finances today. She's been working behind the scenes driving the fiscal expansion of 2023.

Yellen must navigate an unprecedented refinancing of government debt in the year ahead - and she's acting as a de facto central banker as fiscal expansion continues.

How would she hold up in an election against other candidates, though?

Midjourney: "Janet Yellen at a Money Bonfire"

Midjourney: "Janet Yellen at a Money Bonfire"

Economic School: New Keynesian Economics

Pros: It probably can't get worse.

Cons: She'll find a way to make it worse.

Option 2: Jerome Powell

Jerome Powell has been Fed Chair since 2018 and has resided over five years of general instability in the economy. There was the bond crisis/Fed pivot in 2018, the COVID helicopter drop of $5 trillion, the miss on "transitory inflation," and now, whatever we want to call this world of 8% mortgage rates and 5% 10-year T-Bills.

The man has been asleep at the wheel for a while. But if you're part of the 3% of Americans (likely D.C. contractors) who think the current economic conditions are excellent, Jerome Powell is your guy. (Seriously, where does Gallup find them?)

Midjourney: "Jerome Powell asleep at the wheel."

Midjourney: "Jerome Powell asleep at the wheel."

Economic School: PBS kids videos: Econ and Me

Pros: Name recognition.

Cons: Have you been paying attention to what is happening right now?

Option 3: Lael Brainard

Lael Brainard was the Vice Chair of the Fed Open Market Committee but bolted to the White House to become the Director of the National Economic Council.

And as we know, the economy is just doing great.

Brainard is unique in that she is a very adamant proponent of the Fed tackling "climate change" outside of the Federal Reserve's dual mandate on price stability and unemployment. She's notoriously dovish on monetary policy, and a third mandate would give the Fed unprecedented ability to engage in more dirigisme.

I've predicted that climate change would become the source of the next wave of financialization of the economy - and push our debt higher. So, if you've got a government grift scheme like Solyndra, Brainard is your candidate.

There's chatter that Brainard could be the next Treasury Secretary or Fed Chair.

Or both... because why not?

Midjourney: "Lael Brainard, as Don Quixote, tilting to windmills."

Midjourney: "Lael Brainard, as Don Quixote, tilting to windmills."

Economic School: QE Infinity

Pros: She didn't go to Yale.

Cons: Adamant about adding climate change to the Dual Mandate, meaning we'll forever engage in constant emergency spending fighting an invisible enemy.

Option 4: Pope Elsiana Dúmdúms, Ph.D.

Elsiana Dúmdúms is the guard dog of the Florida Republic.

But she could soon find herself elevated to handling the money supply, given the incompetence of other candidates.

She's the ideal candidate to run the monetary policy of the Florida Republic, given her propensity to avoid things she doesn't understand.

Midjourney: "Elsie as pope of the Florida Republic."

Midjourney: "Elsie as pope of the Florida Republic."

Economic School: Honorary Ph.D. from the School of Hard Knocks

Pros: Does not understand how money printer works. Fan of commodities - particularly food stocks. She barks at CNBC's Steve Liesman whenever he's on TV.

Cons: Sleeps more than Jerome Powell. Very elusive (escapes yards quite often, meaning she may miss important meetings).

"Elsie as Will Hunting"

"Elsie as Will Hunting"

Option 5: Sandwich Joe

Sandwich Joe lives in a Box Car yard, lives on beans, and converts all of the physical money he obtains into silver specie (coins).

He doesn't have a physical address, once toured with the Grateful Dead in the mid-80s, and has a remedial understanding of economics.

He firmly believes that gold and silver are real money and that fiat money has already led to economic peril. He got off the grid in 1997, and he's wealthier than the average American despite owning just two outfits.

School: "Accidental" Austrian School of Economics

Pros: His prized possession is a folded picture of him and Phil Lesh in Chicago in 1991. Career economists working in the Fed with Ph.Ds would likely resign if he's in charge. Gold and silver prices would rise precipitously.

Cons: Americans aren't prepared for gold and silver-backed currencies given that only 12% own gold, and 15% own silver. Sandwich Joe may get distracted during FOMC speeches and start talking about setlists from Dead shows back in the 1980s.

Choose wisely, America.

Your life savings... and every day of your labor... depends on it.

Let's look at the week ahead... and put some of these moments into Republic Speak.

Monday, October 23

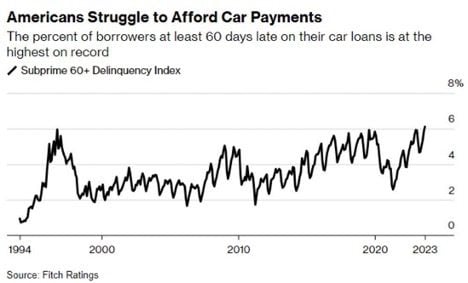

Event: The United Auto Workers will kick off another week of a paralyzing strike. The union has threatened new strikes against Ford Motor (F), General Motors (GM), and Stellantis (STLA).

Republic Speak: Perhaps it's a better thing for the auto industry that it's not producing automobiles in this environment. Because the percentage of Americans who are 60 days behind on their car payments is the highest ever...

The previous record was 6.0% in 1994.

Even during the 2008 crisis, the worst that figure hit was... 5.0%.

Analysts have noted that the average new car payment is now $740 monthly.

And keep in mind that student loan repayments just restarted.

The Kobeissi Letter notes, "Average student loan payments are at $500/month, and the average new car payment is at $740/month. This means just to buy a car and pay off your student loans, the average American is spending $1,240/month."

Something tells me that we're in the early innings of this crisis.

We'll keep our eyes on Ally Financial (ALLY), Credit Acceptance Corp. (CACC), and Capital One (COP). This will be a very difficult bottom to pick in this market.

Tuesday, October 24, 2023

Event: Earnings from Microsoft (MSFT) and Alphabet (GOOG)

Republic Speak: The good: Alphabet is a strong momentum stock right now.

Alphabet is currently hovering near a 52-week high. But there's news: I read a report that Alphabet pays Apple $20 billion annually to make its search engine the default in all Apple devices. That figure is reportedly 75% of Apple's R&D. So... Google pays for the bulk of Apple's product development. The Department of Justice is currently suing, claiming this cash bonanza is anti-competitive.

Meanwhile, there's Microsoft... I'm sure that their executives will say "A.I." at least 132 times during the earnings conference call to try to spike the stock higher (algorithms react positively to anyone who says "AI" these days).

But let's take a step back and look at this from a fundamental perspective.

Does anyone pay attention to valuations anymore?

Microsoft is still trading at 11.4 times sales. This is where the ETFs and fund managers have hidden a lot of money. But it doesn't change the fundamental reality of MSFT's valuation. I'm reminded of that 2002 famous quote from former Sun Microsystems CEO Scott McNeal whenever I see a Price-to-Sales over 10. It goes:

"At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes which is very hard. And that assumes you pay no taxes on your dividends which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don't need any transparency. You don't need any footnotes. What were you thinking?"

Just saying... if the levy breaks... or price discovery accelerates, we'll find out.

Wednesday, October 25, 2023

Events: Earnings from Meta Platforms (META).

Republic Speak: At one point, Mark Zuckerberg planned to spend enough money (adjusted for inflation) on the Metaverse that only the United States government's entire Apollo Mission rivaled in terms of capital expenditures. Since shareholders shook CEO Mark Zuckerberg by the shoulders and the company slashed spending, META stock rebounded to 52-week highs.

I don't know what is happening at META anymore. I know that Jim Cramer got upset about it on air last October and apologized for recommending the stock. And then, shares increased by 137% after he abandoned the position.

Thursday, October 26, 2023

Events: Amazon (AMZN) earnings, the Q3 GDP reading, and a rate decision by the European Central Bank.

Republic Speak: Wedbush went very heavy on Amazon in Barron's this weekend, and FANG stocks are well positioned this week. This week's big story isn't in the earnings numbers: It's in Amazon's pending plans to invade the AI space. Amazon's Andy Jassey started his tenure with a big focus on cost control that now sets it up for a sprint against its rivals in Microsoft and Alphabet. The Information ran a great piece on Amazon's plans this week.

Friday, October 27, 2023

Events: Exxon (XOM) and Chevron (CVX) earnings, Consumer Sentiment readings.

Republic Speak: We're watching the Energy Sector reading all week. Two Mondays ago, it broke lower thanks to strong selling on the fund front. But the Hamas attack on Israel changed the geopolitical calculus on oil prices. Be very cautious... there remains significant weakness in the energy sector as profit-taking remains a major short-term factor from investors who missed the last opportunity to sell.

The Exxon/Chevron earnings date could serve as a surprise. We remain long-XOM through a deep out-of-the-money put sale. We're currently waiting to make a move on Chevron once we get a better understanding of their profit potential from production expansion in Venezuela.

Consumer sentiment? Who are these optimistic consumers in the U.S. economy? What antidepressants are these consumers taking to help them overcome the reality of rising credit card interest rates and prices?

Can they share with everyone?

Stay positive,

Garrett Baldwin

Secretary of Defense