The most recent star to form in the AI Universe – Super Micro Computer (SMCI) – collapsed over 35% in the last two trading days. It’s part of a massive run higher, and now lower, that the stock has made over the last few weeks.

The reason for the drop is relatively simple and is best expressed by referring to a childhood game, musical chairs.

Before we get to the metaphor, allow me to give you some numbers that highlight the difference between Nvidia (NVDA) and Super Micro. I should say two numbers besides the obvious.

The obvious two numbers are 220% and 700%+. Those are the returns for NVDA and SMCI, respectively, over the last year. The returns are dramatically different, but there are two other numbers that made that disparity, their float.

What is the float? The simple definition comes from Investopedia: “The regular shares a company has issued to the public that are available for investors to trade.”

That last part of the sentence is the most important…

“that are available for investors to trade.”

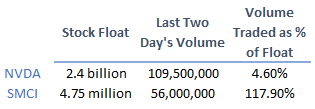

Currently, the float for NVDA is 2.4 billion shares. The float for SMCI, 47.5 million. That’s a ratio of 50:1 shares available to trade for NVDA and SMCI respectively. This is key to the difference in performance between the two stocks.

Let’s add one more number to the stack, the volume NVDA and SMCI have traded over the last two days.

We’ve seen an increase in trading on both names, but SMCI shares have traded 56 million shares compares to 109 million traded on NVDA.

And there’s your reason for a 35% drop in SMCI and a return to our childhood game reference.

SMCI investors have been playing a game of musical chairs during its meteoric rise. With fewer chairs available – float, or shares available to trade – traders have been left scrambling to sell their stock before the profits go away, which forces the stock to plummet.

That simple fact means that the stock is more susceptible to huge pops and drops.

In comparison, NVDA shares – with their enormous float – have plenty of “chairs” available for buyers and sellers, meaning that the “game” stays more orderly and less volatile.

For reference, the last time that NVDA shares replicated the one-year return that Super Micro is now posting was 20 years ago.

My point? These types of returns diminish as time passes and the float rises for a stock.

Bottom Line

I’ve already hinted at the next move.

With SMCI’s incredible show of fundamental growth, there will be another “street fight” to get back in the shares when the selling music stops. The stock’s low float will create another buying frenzy that should propel shares to their next inflated price, which will likely be over $1,000.

Right now, technical support for SMCI sits at $650 per share with $600 as a secondary support level for those looking to buy the dip.

Keep in mind that the stock’s low float will cause turbulence over the next year or more, so those of you that don’t like the bumpy ride should consider another AI option.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.