In the early days when Bitcoin was the only digital currency of note, to obtain cryptocurrency, you had to mine it. However, times have changed, and there are now many options for buying crypto, like online exchanges, Bitcoin ATMs, and peer-to-peer trading. As the cryptocurrency market has expanded, so too have crypto terms.

The following lesson will talk you through how to buy cryptocurrencies while highlighting popular exchanges and detailing their pros and cons.

Where to Buy Cryptocurrencies

Cryptos like Bitcoin, Dogecoin, and Cardano have grown in popularity, and there are many options for where to buy cryptocurrencies. Choose from cryptocurrency exchanges, Bitcoin ATMs, crypto vouchers, or peer-to-peer transactions, all of which provide a secure format for purchasing crypto.

Cryptocurrency exchanges

Cryptocurrency exchanges are platforms that allow buyers and sellers to trade cryptocurrencies and they are perhaps the most commonly used way to buy crypto. Most exchanges provide a user-friendly purchasing option and while payment methods vary on each platform, it is typical for exchanges to accept PayPal, bank transfers, and credit card payments.

Be sure to check what currency your preferred exchange accepts before setting up your account. Some exchanges only allow crypto to be purchased with crypto and if you are buying crypto for the first time, these exchanges will not work for you.

In addition, be aware that if you decide to buy crypto with a credit card, this purchase is treated as a cash advance and is subject to higher interest rates and additional fees as compared to other purchases.

Before purchasing any cryptocurrency, you'll want to know how to find the best cryptocurrencies to invest in and this requires research.

Once you successfully purchase crypto from an exchange, the coins are stored in a digital wallet. You can choose from multiple wallet storage options, including:

- Crypto wallet on the exchange - You can store your cryptocurrency in a wallet on the exchange.

- Hot wallets - These wallets are stored online and run using devices like cell phones or computers that are connected to the internet. This wallet offers convenience at the cost of less security.

- Cold wallets - Cold crypto wallets are the most secure way to hold cryptocurrency because they are not connected to the internet and use external devices such as a USB drive instead. Should you lose the physical wallet or misplace a keycode to gain access to the device, there is a chance you could lose access to your cryptocurrency.

Keep in mind, there may be a small fee associated with transferring your crypto off the exchange's wallet.

Bitcoin ATMs

Another option for how to buy cryptocurrencies is by using Bitcoin ATMs. These standalone devices or kiosks work much like regular ATMs and work by connecting buyers directly to a Bitcoin exchange via the internet. Buyers pay for their cryptocurrencies by depositing cash.

Bitcoin ATMs provide a way for people who do not have access to bank accounts or credit cards to buy Bitcoin. To use a Bitcoin ATM, you must have a digital wallet in which to store them. Exodus, Wasabi, and Edge are among the most common wallets used.

It is worth mentioning that Bitcoin ATMs charge customers a service fee that is usually a percentage of the transaction.

Gift cards

This may surprise you, however, you can also purchase cryptocurrencies easily using gift cards. In this case, you trade gift cards from various retailers for crypto.

Sites like Paxful or Localbitcoin offer these services on a peer-to-peer basis. When you visit a site like Paxful, you'll see a list of crypto available for sale from members in exchange for gift cards.

Transaction methods vary depending on each platform, but usually, you sign up, search for offers, and begin the trade if you agree with the terms. When you complete your transaction, your crypto money is stored in the site's digital wallet.

Crypto vouchers

Another way to buy digital currencies is with crypto vouchers. The investor purchases crypto vouchers online and then redeems them for cryptocurrencies. These are available from online stores like:

- Recharge.com

- Coingate.com

- Cryptovoucher.io

- Bitrefill.com

How to buy cryptocurrencies with vouchers

Instructions for how to buy and redeem cryptocurrencies with vouchers may vary from site to site, so we'll use recharge.com as our step-by-step example:

- Create a digital wallet to store your cryptocurrency.

- When you get your voucher code, go to the website and accept the terms and conditions.

- Add your contact number and wait for the confirmation code via text.

- Choose your cryptocurrency and add your virtual wallet address.

- Click on the "I understand and agree" button.

- Finally, redeem your voucher.

Peer-to-peer

Lastly, it is possible to buy cryptocurrencies directly from sellers without going through an intermediary. This type of purchase is called peer-to-peer (P2P) trading.

Cryptocurrency peer-to-peer exchanges are marketplaces like any other. The sites use match engines to connect buyers and sellers and they can negotiate the transaction between them.

Alternatively, users can search the various offers available and initiate a conversation with the seller. If a sale is agreed upon, the site holds the currency in escrow until the deal is complete.

The obvious advantage of P2P trading is there is no need for third-party involvement. However, while you have more control over the transaction, there are higher risks involved. For example, there is a lack of security, and you have no way of knowing if the buyer is genuine.

What Are the Best Cryptocurrency Exchanges?

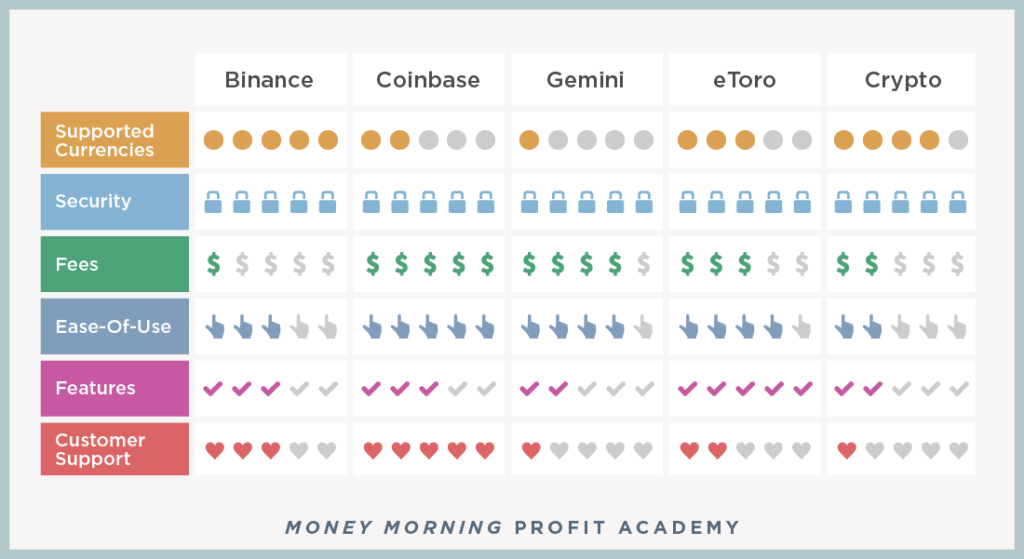

As the popularity of cryptocurrencies soar, so do the number of cryptocurrency exchanges. Detailed below are some of the best exchanges. When determining how to buy cryptocurrencies, evaluate which exchange is most beneficial for your specific needs and always stay current with cryptocurrency news.

Binance

Changpeng Zhao founded Binance in July 2017 and this exchange has steadily grown in popularity since then.

Binance offers a wide variety of trading pairs, making it easy for traders to find their desired pair with relative ease, whether looking for flat-crypto or crypto-crypto trades.

Pros:

- One of the fastest exchanges on the market, quick to deposit funds and withdraw them

- Some of the lowest trading fees on the market at 0.1%

- Very streamlined and straightforward KYC (Know Your Customer) process, even without ID verification

Cons:

- Lack of support for flat currencies

- Government regulations mean Binance isn't available in some U.S. states, including New York

Coinbase

Coinbase is a popular digital wallet and exchange. Brian Armstrong and Fred Ehrsam founded Coinbase in 2012 and it has grown into one of the world's most well-known and trusted global cryptocurrency exchanges.

On Coinbase, you can buy Bitcoin, Ethereum, Dash, and Litecoin.

Its user-friendly website makes it easy to purchase Bitcoin online with a credit card or bank account without requiring any additional knowledge of cryptocurrency trading or blockchain technology.

Pros:

- Easy to use user interface

- Secure mobile app for trading coins on the go

- High liquidity

Cons:

- High fees if not using Coinbase Pro

- Users are unable to control their own wallet keys

- Requires KYC verification to buy/sell crypto

Gemini

Gemini is one of the most secure global exchanges. Aside from Gemini cryptocurrencies, the platform also gives users access to other crypto markets, such as Bitcoin and Ethereum.

Gemini offers an intuitive interface with charts, real-time order books, limits for placing orders, order history, and deposit information.

Additionally, it provides users with a detailed overview of their portfolio, which includes their account balance in both flat money (USD) and cryptocurrency (Bitcoin) and, as well as the market value of each coin.

Pros:

- New York State Department of Financial Services (NYSDF) regulates Gemini

- Simple interface

- Quick verification process

- High-security standards

Cons:

- Limited payment methods

- Higher fees

eToro

eToro is a crypto trading and investment platform founded in 2006 by brothers. It is now one of the leading financial services providers in Europe, with clients in over 140 countries.

The company provides traders with access to global markets to trade online or limit their risk by holding assets.

The company has more than twenty million registered users and offers trading on stocks, forex, commodities, indices, ETFs, and cryptocurrencies.

Pros:

- Easy interface

- Fast, efficient, and trusted

- Demo accounts and copy trading make it suitable for beginners

Cons:

- Limited tools

- High purchase and trade fees

- Variable minimum deposits, dependent on the country

Crypto.com

Crypto.com is a blockchain-based, decentralized system with the goal of making the purchase and sale of cryptocurrencies as straightforward as possible for the everyday person.

The company focuses on three main points:

- Making crypto more usable for those who are new to it

- Providing an easy way for people to purchase and store their coins

- Adding more security features so people can access their funds easily

Users can trade various cryptocurrencies at competitive prices on this platform and the company has a deep understanding of the market as its team consists of top-level professionals from major companies like PayPal or Visa.

This platform offers a trustful environment for doing transactions as it meets all the requirements to be compliant with the regulatory laws of different countries.

Pros:

- Low fees

- Strong security

- Earn interest on crypto holdings

Cons:

- Not available in all countries

- Difficult to navigate

Knowing How to Buy Cryptocurrencies Also Means Understanding the Risks

Whether you're buying peer-to-peer, through exchanges, or from voucher sites, buying digital currency is easier than ever before.

While cryptocurrency is offered on many trusted platforms, investing in any currency comes with inherent dangers. It's vital that you're well-informed about potential cryptocurrency risks so you can continue to make smart decisions with your investments.

To learn everything you need to know about the inherent risks involved when investing in crypto, read our next lesson, Cryptocurrency Risks.