The Money Morning Stock VQScore™ - derived from our proprietary valuation system – gives you a distinct advantage before you buy (or sell) a stock.

That’s because it tracks the 1,000 most profitable companies on the market to find stocks that are priced to get you the biggest returns.

Here’s how it works:

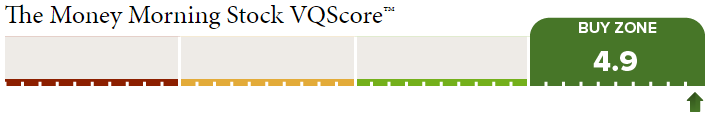

The VQScore takes the most useful valuation strategies available and boils them down into one simple number. Knowing that one number will tell you whether to buy, sell, or hold a stock.

Specifically, the VQScore formula values a stock’s earnings power and whether EPS is accelerating or decelerating. Then, it compares that to the momentum of recent demand for the company’s shares and whether that’s increasing or decreasing.

The higher a stock’s score, the better.

A VQScore of 4.0 or higher puts a stock in the “Buy Zone.” These are the stocks priced to make you money.

You can find a stock’s VQScore on its profile page.

You can find a stock’s VQScore on its profile page.

The Power of the VQScore

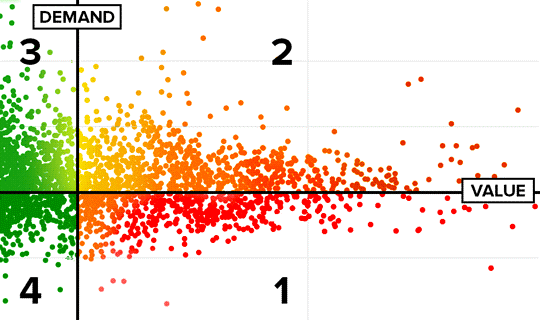

A stock’s VQScore is determined by its position our Value Quadrants. Each Value Quadrant represents a different combination of a stock’s value, demand, and growth prospects.

Stocks in Quadrant 4 – meaning they have a VQScore of 4.0 or higher – give you the best opportunity at the biggest returns.

Stocks in Quadrant 4 – meaning they have a VQScore of 4.0 or higher – give you the best opportunity at the biggest returns.

Buying these shares is like picking up Netflix stock before it soared to today’s record highs. A $1,000 investment in NFLX when it had a VQScore of 4+ would be worth more than $16,000 today.

Quadrant 3 stocks – which have scores ranging from 3.0 to 3.9 – are also undervalued. They do not have the market in their favor though, like those in Quadrant 4. That limits their future share-price growth.

Quadrant 2 stocks have scores from 2.0 to 2.9. A lot of these stocks are tied to healthy companies, but their shares aren’t priced to give you the maximum returns. They are trading closer to their fair value and, in some cases, are about to fall out of favor in the markets. A lot of these stocks used to have a VQScore of 4.

Quadrant 1 stocks have scores of 1.0 to 1.9. They are both overvalued and out of favor in the markets. This means you are not buying strong future growth when you pick up these shares at their current price.

Profit opportunities from stocks scoring 1.0 – 3.9 take a much closer analysis to find - and that's what our experts are looking out for every day. We regularly release such opportunities and detailed stock research here.

[mmpazkzone network="9794" site="307044" id="137008" type="4"]