This past March, I asked a highly successful investment advisor what he thought about gold. Since he deals almost exclusively with very high net-worth individuals, his point of view was especially intriguing.

He confided to me that many of his clients had been asking for gold and gold-related investments over the past few years. I can't say that I was surprised.

But what he told me next simply shocked me.

"Gold's much too volatile, it's too risky", he said. "Sure it's up, but I try to discourage my clients from investing in it."

It simply floored me that he thought gold was too volatile. Gold is only up 580% since it bottomed in 2001, without a single losing year to date.

That's not something you can say about the stock market or any other type of investment.

I can hardly imagine what he must think of silver, as silver prices are up by 725% since 2001.

Today, silver is trading around $34, but our 2013 silver price forecast now has the shiny metal going much, much higher.

What will power that rise?

Since it's slaved to its richer cousin, all the fundamentals for higher gold would apply.

I wrote about them yesterday in my 2013 gold price forecast.

As history has shown, silver moves almost in sync with gold, but exaggerates its movements, both on the up and down sides. That's why I like to think of silver as "gold on steroids".

2013 Silver Price Forecast

For 2013 I think silver, like gold, will set a new all-time nominal price record, likely reaching as high as $54 an ounce.

Despite silver's dependency on gold, it does have some distinct fundamentals, too.

In fact, here are my key drivers for silver prices in 2013:

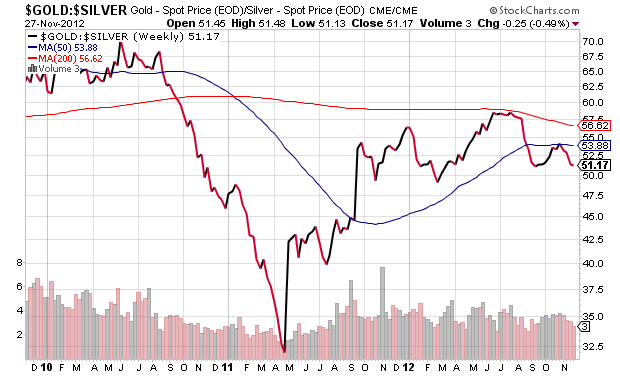

- The Gold/Silver Ratio: Before the financial crisis, the gold/silver ratio was around 50 (meaning an ounce of gold would buy you 50 ounces of silver) and trending downward. In late April last year silver exploded higher, pushing the ratio down below 30.

That was short-lived, as silver's dramatic rise was unsustainable. I had said so at the time. The ratio recently returned to a high level near 60. In 2013, look for the ratio to head back down again, meaning silver will rise faster than gold.

On a long-term basis, I think we'll see this ratio move down closer to 20. So right now, silver is looking rather undervalued relative to gold.

- Four More Years of Obama: The President has been very good for silver prices. In fact, he was so good, he helped make silver the best-performing major financial asset during his first term.

Now that Obama has earned another four years, and Federal Reserve Chairman Ben Bernanke's still in place and relying heavily on the printing press, I'm fully expecting a repeat performance. Thanks, guys, for more of the same.

- Higher Investment Demand: Physical silver investment demand is growing. Despite a number of existing silver ETFs, the Royal Canadian Mint is launching its own. That has suddenly removed 3 million ounces from the physical market.

The Sprott Physical Silver Trust (NYSE: PSLV) is expanding its size as well, likely having bought 7.5 million ounces of silver to accomplish this. That's over 10 million ounces in a single month. Meanwhile, the U.S. Mint has sold more silver coins versus gold coins so far this year than in any since the coin program started.

- Higher Industrial Demand: Solar panel demand is exploding and silver is used to make them, of which the average panel requires about two thirds of an ounce. Since 2000 the adoption of solar panel technology has meant a 50% annual increase in silver usage each year, going from 1 million ounces in 2002 to 60 million ounces last year, representing nearly 11% of all industrial demand. Adding fuel to the fire, Japan has recently offered to pay utilities three times the price for electricity generated from solar versus conventional methods.

Unlike gold, silver has a wide range of industrial uses. There's currently growing demand from an increasing number of industrial applications, including lighting, electronics, hygiene and medicine, food packaging, and water purification, to name but a few. That's bullish for silver.

So for these reasons, as well as silver's historical role as an inflation hedge/monetary asset, look for silver prices to keep rising in the years ahead.

That being said, 2013 is likely to be pivotal for the more affordable precious metal. Now that gold has set and may soon surpass its own all-time highs, look for silver to be next.

It now looks like $54 is the next price target in silver's relentless and historic climb.

Related Articles and News:

- Money Morning:

2013 Gold Price Forecast: Expect Gold to Deliver Another Record-Setting Year - Money Morning:

Why Silver Prices in 2013 Will Continue to Perform - Money Morning:

By The 2016 Election Gold Could Be $3700 an Ounce - Money Morning:

Is Gold Still "The Next Greatest Trade Ever"?

[epom]