No two bull markets are ever the same, and gold is no exception.

During the last secular gold bull market in the 1970s, gold rose from $35 in 1968 all the way to $200 by late 1974.

Then the unthinkable happened. Between late 1974 and mid-1976, gold prices were cut in half, dropping from about $200 to $100.

At the time, many gold investors sold out in disgust, never to return.

But then a funny thing occurred. Gold prices started to climb again, rising from $100 in mid-1976 all the way to $800 by January 1980.

And anyone who was fortunate enough to own gold at $35 earned better than 20 times their investment in just 12 years.

Twenty-one years later, a new bull market began. Since 2001, gold has consistently performed in what now appears to be a record-setting run.

In fact, since 2001 the average return on gold is now just shy of 18% annually over the last 11 years.

I know of no other major asset that has turned in this kind of performance -- ever. This rise in gold prices is simply unmatched.

This is what a stealth bull market looks like, one that I fully expect will keep powering on.

Now, let's have a look at where gold prices might be headed in 2013...

2013 Gold Price Forecast

Gold began the year at $1,600 an ounce. Should we get average returns in this calendar year as well, gold could finish 2012 around $1,880. At those levels, gold prices would begin 2013 just shy of the all-time high set last year, right around the $1,900 mark.

If we assume an average return again next year, then gold could reach $2,200 or better in 2013. In fact, I believe $2,200 gold is quite likely in 2013.

After all, none of the fundamentals supporting gold prices have gone away. Instead, they've only become even more entrenched.

In fact, here are five factors I've identified that will power the gold bull market upwards for several more years to come.

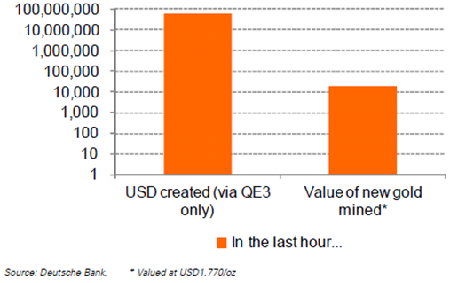

- The Feverish Growth of Fiat Money: Take a look at this chart. It's a picture that tells you what you need to know about fiat money. As you can see, the U.S. and most of the developed world is printing money much faster than the amount of new gold being brought to the market. Here's the thing: The chart only shows you what was created in an hour. Imagine what the same chart would look like if it were a year. Better yet, how about five years -- or more. The bottom line is that the printing presses are bullish for gold.

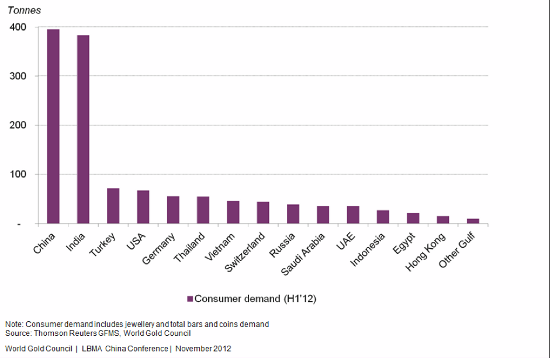

- The Feverish Demand For Gold: As central banks continue to print, individuals are continuing to feverishly buy gold, especially in the world's two most populous nations, China and India, which in 2002 accounted for 23% of world gold demand. Today, just these two nations alone make up nearly half of all demand at 47%. This is just the beginning.

- Even Central Banks Are Buying: Central banks, especially in developing nations, are buying and hoarding gold at a breakneck pace. So far in 2012, they've bought 493 tons, already surpassing last year's 457 tons. Many believe this is part of a long-term trend, providing solid support for gold prices in 2013.

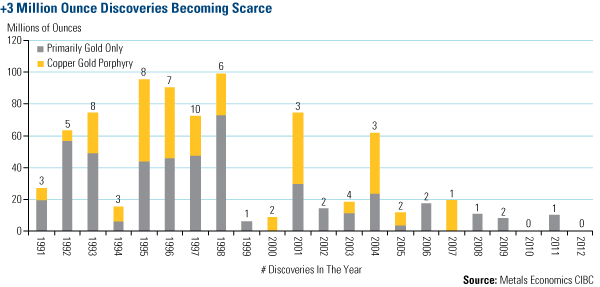

- High Demand Meets Short Supply: The other side of the equation is supply. The gold mining industry is struggling to find more gold. According to Barrick Gold Corp.'s (NYSE: ABX) CEO, the industry as a whole spent a record $8 billion in 2011 to explore for gold. And even with such massive resources on the hunt for this precious metal, discoveries are declining. Bloomberg reported that in 1991 there were 11 gold discoveries, yet in 2011 there were only three. Of course, you know what happens when there's an imbalance like this-prices rise.

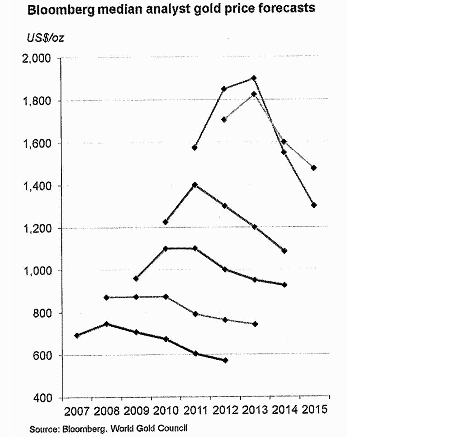

- My Favorite Reason For $2,200 Gold in 2013: Here's another reason to be bullish: The vast majority of analysts consistently forecast too low and are even predicting declining gold prices farther out. But guess what?... They've been consistently wrong for years. Take a look:

The truth is that signs the yellow metal's bull market will soon end are scarce indeed. Meanwhile, breakeven costs continue to rise among gold producers, meaning the price floor keeps rising.

That's why I expect gold prices to set a new all-time record nominal price in 2013, and to reach the $2,200 level in the process. Smart investors will embrace this trend.

Related Articles and News:

- Money Morning:

By The 2016 Election Gold Could Be $3700 an Ounce - Money Morning:

While Banks Crumble, The Next Leg Up For Gold Prices Draws Near - Money Morning:

Forget the Punch Bowl, With QE3 Ben's Party is Open Bar - Money Morning:

Is Gold Still "The Next Greatest Trade Ever"?

[epom]