Three stock market crash indicators are suggesting that the current bull market may be running out of steam and is susceptible to a significant correction.

Two of the stock market crash indicators are weakness in key sectors, and the other is a technical development on the Standard & Poor's 500 index chart.

Let's start with the chart.

The S&P 500 is bobbing in the 1,880, range which is not far below the all-time high of 1,890.9 reached on April 2.

The S&P 500 is bobbing in the 1,880, range which is not far below the all-time high of 1,890.9 reached on April 2.

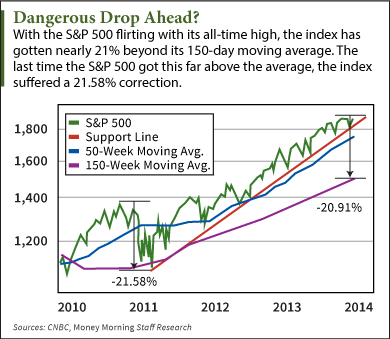

Its steady climb over the past couple of years has put the index more than 20% above its 150-day moving average.

The last time the S&P 500 got that far above the 150-day moving average was in 2011, when it got slammed with a 21.58% correction.

Richard Ross, global technical strategist at Auerbach Grayson, told CNBC that investors should take the parallel seriously.

"I think that we're in exactly the same scenario," he said, noting that a similar decline now would shave about 20% off the S&P 500, taking it down to the 1,500 level. "I think that's what we're staring at right here."

Ross also pointed out that the S&P 500 has sputtered for most of 2014.

"We've stalled out at the high end of the trading range. It's really been a holding pattern for the last two months," Ross said. "Now look, when a market stalls and moves sideways, that's not necessarily a bad thing. But when that occurs at the tail end of a five-year bull run, with the market up almost 300% over that time... that's a problem."

Meanwhile, Gina Sanchez, founder of Chantico Global, said she sees weakness in the housing sector as a stock market crash indicator.

Pending home sales are down 7.4% on the year, and the National Association of Realtors is projecting sales of existing homes to fall nearly 4%. And new home sales for March plunged 13.4% from the same period a year ago and 14.5% from the previous month.

"If you look at the pillars of the economy that should be holding us up, one of the biggest that's been doing poorly is housing," Sanchez told CNBC. "If we see further falls in housing - that could be very negative. So, I do think that there is some reason for caution right now."

Finally, Gina Martin Adams, Senior Equity Strategist for Wells Fargo Securities, sees a stock market crash indicator in a faltering sector that until recently was one of the main engines pushing stocks higher.

Stock Market Crash Indicators: The Consumer Discretionary Sector

Adams is concerned with the performance of the consumer discretionary sector, which includes retailers, media companies, apparel companies, and automakers - in short, anything consumers buy that isn't a necessity such as food.

During the recovery, the consumer discretionary sector has had a strong run, but so far in 2014 it is down about 4%.

"The fact that the discretionary sector is down on the year while stocks are up just a touch suggests that we've lost some leadership from discretionary," Adams said. "This is the sector that had been leading the market since the bottom in 2009."

And in the past that has often been a sign of broader trouble in the market, Adams said, noting that historically a slumping discretionary sector has "signaled at least a sideways trading range, and may even signal something a little bit more ominous."

Adams said Wells Fargo had looked at the consumer discretionary sector all the way back to 1972 and found that every time it started to underperform the market, "it has led to a near-term top in the S&P 500."

So now we have three markedly different stock market crash indicators telling us that at least a significant correction may be looming in the near future. What should investors do about it?

Money Morning Chief Investment Strategist Keith Fitz-Gerald says that the timing of a market correction matters less than the certainty that one will happen - and probably sooner rather than later.

"A market correction is long overdue and would be a welcome sign that things are, in fact, working normally," Fitz-Gerald said. "People forget that nothing goes up forever. Markets have to buy and sell for there to be price discovery. Up and down is part of the process."

Here's what Fitz-Gerald recommends:

- Double-check your trailing stops. If the markets do fall, you'll have the chance to capture plenty of profits, just as Fitz-Gerald describes in his Money Map Method guide. (Click here to find out about getting a copy of the Money Map Method.) If the markets rise, you can go along for the ride and raise your stops to ensure even larger profits.

- Add an inverse fund to your portfolio right now. Fitz-Gerald likes the Rydex Series Trust Inverse S&P 500 Strategy Fund Class Investor (MUTF: RYURX) fund or the ProShares Short S&P 500 (NYSE ARCA: SH). Both, he says, appreciate as the S&P 500 falls.

- Get your buy list ready. When markets fall, good stocks get cheap. Think Tesla Motors Inc. (Nasdaq: TSLA) at $150 or Amazon.com Inc. (Nasdaq: AMZN) at $250. Other companies may be similarly discounted, so investors just need to be ready to pounce.

Are you prepared for a stock market crash? What have you done to your portfolio to protect it from a pullback? Share your ideas on Twitter @moneymorning or Facebook.

One sector has been suffering even without a stock market crash: biotech. That has some critics sniping at the sector and calling it a "bubble." But those critics are looking at biotech all wrong. This is why there is no biotech bubble...

Related Articles:

- Yahoo Finance: This Chart Says We're in for a 20% Correction

- CNBC: Wells Fargo Strategist Presents Scary Chart

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.