The Alibaba IPO value saw another bullish estimate yesterday (Monday), when Piper Jaffray analyst Gene Munster projected that the Chinese e-commerce giant is worth $221 billion, including cash.

Before yesterday's update, many analysts had settled on an estimate of $168 billion for Alibaba's valuation.

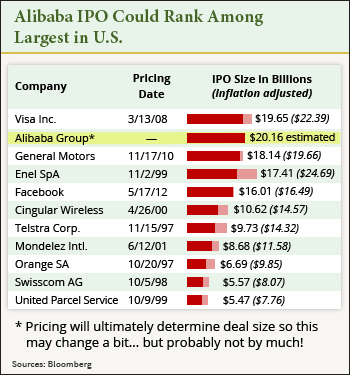

That total was based on similar projections that have Alibaba raising between $15 billion and $20 billion in its initial public offering later this year. If Alibaba can raise $20 billion, it will be the largest U.S. IPO in history, eclipsing the $19.65 billion Visa Inc. (NYSE: V) raised in 2008, and the $18 billion General Motors Co. (NYSE: GM) raised in 2010.

That total was based on similar projections that have Alibaba raising between $15 billion and $20 billion in its initial public offering later this year. If Alibaba can raise $20 billion, it will be the largest U.S. IPO in history, eclipsing the $19.65 billion Visa Inc. (NYSE: V) raised in 2008, and the $18 billion General Motors Co. (NYSE: GM) raised in 2010.

"An offering of this size would give Alibaba a $168 billion market cap - making it smaller than Apple Inc. (Nasdaq: AAPL) and Google (Nasdaq: GOOG, GOOGL), but larger than Facebook, Amazon.com Inc. (Nasdaq: AMZN), and eBay Inc. (Nasdaq: EBAY)," Money Morning's Executive Editor Bill Patalon said.

The Piper Jaffray estimate is the latest in a string of bullish projections for the Alibaba IPO. Last week, the investment research firm Morningstar estimated that Alibaba could raise an incredible $26 billion in its IPO. Before that, financial research company Sanford C. Bernstein estimated Alibaba's value at $230 billion.

The estimates continue to grow more bullish as the Alibaba IPO date approaches, and there is a simple reason why. Alibaba is worth the hype...

Bullish Figures Pushing the Alibaba IPO Value Higher

When Alibaba officials filed their IPO prospectus in May, the company reported having $5.66 billion in revenue and $2.85 billion in net income for the nine months ending Dec. 31.

Alibaba also noted that its network of sites handles 80% of all online retail sales in China.

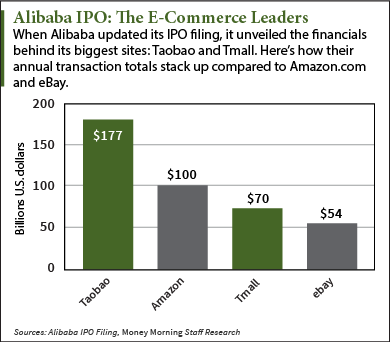

In 2013, its most popular site, Taobao, handled $177 billion in transactions. Approximately $70 billion exchanged hands over Alibaba's second largest site, Tmall, during the same time. For perspective, Amazon.com Inc. (Nasdaq: AMZN) handled $100 million and eBay Inc. (Nasdaq: EBAY) handled $54 billion.

In 2013, its most popular site, Taobao, handled $177 billion in transactions. Approximately $70 billion exchanged hands over Alibaba's second largest site, Tmall, during the same time. For perspective, Amazon.com Inc. (Nasdaq: AMZN) handled $100 million and eBay Inc. (Nasdaq: EBAY) handled $54 billion.

And here's why those figures will continue to grow...

"[W]e believe Alibaba could grow 40% in FY15 and 30% in FY16 (Alibaba's fiscal year ends in March). We believe this would imply $15.3B in revenue in Alibaba's FY16," Munster said in the Piper Jaffray research note.

But that's not the full story when it comes to Alibaba's growth potential. Patalon has been following this historic IPO very closely and thinks the $20 billion IPO total is justified.

"Alibaba is the dominant e-commerce player in a marketplace - China - that's seeing incredible growth in online commerce," Patalon said. "In Private Briefing, we've been talking about this for several years now, and our folks have cashed in on such stocks as Baidu (30%) and Bitauto (60%)."

"According to the latest research I've seen, e-commerce in China is projected to hit $540 billion by 2015, and that's just for starters. By 2020, China's e-commerce market will be worth more than the United States, the United Kingdom, Japan, Germany, and France combined. So we know that growth is coming... and we know that Alibaba is the No. 1 gun."

"Look at it another way: the number of consumers and business folks connected to the Internet in China - whether you're talking about computers, tablets, or smartphones - is bigger than the entire U.S. population. And the government there is actually pushing growth. Beijing has mandated that 1.2 million folks - 85% of its population - will have broadband connections (3G or 4G) by 2020."

No official date has been set for the Alibaba IPO, but according to multiple reports, the shares could be priced as soon as early August.

The company has announced, however, that its shares will trade under the ticker "BABA" and will be listed on the New York Stock Exchange.

Clearly the Alibaba IPO is going to be an enormous deal. And the best news about this looming IPO is that it has created a major profit opportunity that most investors haven't yet noticed... It's happening now, months before Alibaba hits the market...

In fact, this could be your one and only chance to make the kind of gains normally reserved for the high-net-worth investors and bankers. You can learn more about this Alibaba profit play here.

Do you plan on investing in the Alibaba IPO when BABA stock hits the market? Join the conversation on Twitter @moneymorning using #Alibaba and #BABA.

Related Articles: