You know I get stoked when a stock I've recommended to you does well. So you can imagine how excited I am when I get to recommend a stock all over again.

I'm talking about U.S. Silica Holdings Inc. (NYSE: SLCA) stock, which I first recommended back in February.

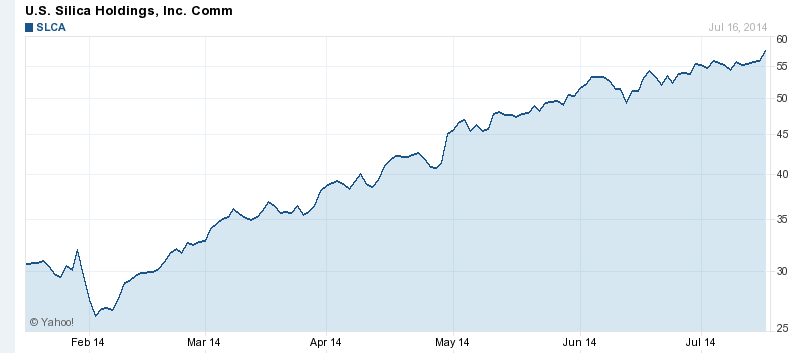

Thanks to a sell-off shortly before I first shared SLCA with you, we were able to buy this stock relatively cheaply. And since then, just five months ago, SLCA stock has soared 105%.

And I think today's price, about $58 a share, is still too cheap.

Over the last three years, U.S. Silica Holdings has increased earnings per share by an average of 73%. For now, I'm going to be conservative and assume it grows by only one-third that amount going forward.

That would give us an earnings growth rate of 24%. At that rate, profits and the SLCA stock price could double again in as little as three years.

This is a stock that provides us with a buffet of choices.

We can sell it and make our double. We can keep it and watch it quadruple. Or we can buy some more and then watch our portfolios soar higher and our retirements grow more secure.

Today, I want to explain why SLCA continues its upward trajectory and why it's one of the best stocks to buy now.

You see, U.S. Silica Holdings' products are a big part of the technology that provides our best defense in a global energy war that has just started. And that makes this a "defense" technology we can feel proud about profiting from...

The Quiet War

On June 6, I noted that Russia and its president, Vladimir Putin, had just reached a $400 billion agreement to supply natural gas to China. The massive deal is part of Putin's scheme to use Russia's abundant energy supplies to grow his nation's economy.

This 30-year pact threatens to upset the delicate global balance of power. In fact, this deal was one of the first shots in Russia's energy war against the United States and Europe.

Europeans rely on Russia for energy supplies, and so they could pay higher prices once all that gas starts going to China. It's a quiet war that again pits the United States against its longtime adversaries.

And that's not the only front in this quiet war.

According to an article in Foreign Policy, the head of NATO recently alleged that Putin is financially and strategically backing environmental groups in order to "demonize" hydraulic fracturing, aka "fracking," in Western Europe.

There's just one problem with Putin's agenda...

The United States is itself in the midst of a major natural gas boom. And we'll likely be supplying Europe with natural gas exports in the near future.

And it's all because of fracking, the breakthrough technology process of using water, sand, and other agents to fracture rocks and earth deep underground - releasing previously inaccessible oil or natural gas.

It's a highly lucrative technology that gives energy companies economically practical access to vast new deposits of oil and natural gas in those underground bands of shale. And it's the key technology paving the way for America's new "energy independence."

From Imports to Exports

It's almost impossible to overstate what a huge impact the field of hydraulic fracking has had on the United States.

Consider that as recently as 2007, the U.S. government was seriously considering importing natural gas from Russia. And this came from President George W. Bush, a former Texas oil man.

Today, the U.S. Energy Information Administration says our country could soon become a net exporter of natural gas.

This prediction brings up another key but often overlooked point about the U.S. energy industry. While the United States still imports far too much foreign oil, we rank as the world's third-largest energy producer.

The sector includes 500,000 wells and 16,000 production facilities whose annual output is worth some $134 billion. We're also the epicenter for the growing use of fracking to unleash new supplies of oil and natural gas.

Indeed, according to a recent essay in Foreign Affairs magazine, because of fracking, "the resulting uptick in energy production has been dramatic." It goes on to say that America's use of energy technology means the nation is poised to become an "energy superpower."

The authors noted that, between 2007 and 2012, U.S. shale gas production rose by more than 50% each year. This sector's share of total U.S. gas production jumped from 5% to 39% in the period, a nearly eightfold increase.

But fracking doesn't stop there. It's having a dramatic effect on oil production as well.

The Foreign Affairs writers noted that during those same five years, output of what's known as "light, tight oil" entered a massive boom. This is high-quality petroleum found in shale or sandstone, and production here soared some 18-fold during the period.

SLCA Stock: Reap Profits in "Silica Valley"

Because of the promise of fracking - not to mention that 105% gain I mentioned - I think we should take another good look at U.S. Silica Holdings stock.

I first told you about this key energy supply firm back on Feb. 7. I predicted that this Frederick, Md.-based outfit faced a "profitable future."

At the time, we stood to earn a huge payout because SLCA had recently sold off, and I said Wall Street was wrong to punish this stock. I went on to say that U.S. Silica would be a big winner in what I have called the Golden Age of Materials Science.

Miracle Materials have become critical factors in our tech-driven world. I'm referring to things like advanced composites that make jetliners more fuel-efficient and new discoveries like graphene that promise to revolutionize computing and biotech.

And then there's sand...

It's one of the simplest and most abundant materials on Earth. But when used for things like hydraulic fracking, industrial sand, known as silica, unleashes a gusher of profits for U.S. Silica and its investors.

Since we first talked about U.S. Silica Holdings, SLCA stock has soared more than 105% - in just five months. But don't worry. I still see plenty of upside left.

This midcap company, which dates back to the late 1800s, remains a leader in supplying the silica sand the energy industry must have for hydraulic fracking.

U.S. Silica is a company with strong barriers to entry. It is often the only supplier its customers have. And here's another exciting part of the story - the firm usually ships the sand by its own rail, truck, or barge assets to all the major shale plays in the United States.

That transportation network gives the firm control over its own destiny - and makes it even more attractive to investors. It also means regulators can't deny freight permits a new company in the field would need to get its fracking sand business up and rolling.

Plus, the company is set to continue an expansion drive it began several years ago. Earlier this month, it received approval from the town of Fairchild, Wis., to begin development of a new fracking sand mine and processing plant.

U.S. Silica says the facility will produce 3 million tons of fracking sand and is expected to open by the fourth quarter of next year. U.S. Silica sold 8.2 million tons of the material last year, so the Wisconsin mine will be a significant growth factor over the next several years.

But the company is much more than just a "pure play" on fracking sand.

Besides its Oil & Gas division, U.S. Silica's Industrial & Specialty Products division accounts for 40% of sales. The unit provides materials used in auto and mobile device glass, housing and construction chemicals, and even golf courses and volleyball pits. That means we benefit from multiple revenue streams.

With so much going for the company, you might wonder why SLCA stock sold off a few months back in the first place.

Shortly before my first column appeared, U.S. Silica issued preliminary fourth-quarter guidance that missed expectations. The company said severe weather in December limited drilling, which negatively affected sales.

The news sent shares down nearly 13% in two days.

It was a classic Wall Street overreaction.

Since then, U.S. Silica has shown this was a one-time event. In this year's first quarter, the company said profits rose 6% from the year-ago quarter and raised full-year earnings guidance to the upper end of its previous estimates of $180 million to $200 million.

Trading at roughly $58 a share, SLCA has a $3 billion market cap. It has operating margins of 19%, a return on equity of 26%, and a three-year sales growth rate of 35%.

And remember: I'm predicting an earnings growth rate of 24% over the next few years. That would give us another double in just a few years.

In other words, if you missed U.S. Silica when we first talked about it in February, you still have a chance to cash in on this Miracle Materials winner - a company that empowers fracking, the technology that is the United States' best defense against Russia's quiet energy war.

SLCA stock is one of those stocks you'll be glad you bought, because a growth firm like this can really help improve your net worth.

More from Michael Robinson: If you follow the headlines, you'd think the last place to invest your hard-earned money is in healthcare. But if you picked the right investment over the last two years, you would have beaten the S&P 500's returns by more than 50%. Here's why...

Related Articles:

About the Author

Michael A. Robinson is a 36-year Silicon Valley veteran and one of the top tech and biotech financial analysts working today. That's because, as a consultant, senior adviser, and board member for Silicon Valley venture capital firms, Michael enjoys privileged access to pioneering CEOs, scientists, and high-profile players. And he brings this entire world of Silicon Valley "insiders" right to you...

- He was one of five people involved in early meetings for the $160 billion "cloud" computing phenomenon.

- He was there as Lee Iacocca and Roger Smith, the CEOs of Chrysler and GM, led the robotics revolution that saved the U.S. automotive industry.

- As cyber-security was becoming a focus of national security, Michael was with Dave DeWalt, the CEO of McAfee, right before Intel acquired his company for $7.8 billion.

This all means the entire world is constantly seeking Michael's insight.

In addition to being a regular guest and panelist on CNBC and Fox Business, he is also a Pulitzer Prize-nominated writer and reporter. His first book Overdrawn: The Bailout of American Savings warned people about the coming financial collapse - years before the word "bailout" became a household word.

Silicon Valley defense publications vie for his analysis. He's worked for Defense Media Network and Signal Magazine, as well as The New York Times, American Enterprise, and The Wall Street Journal.

And even with decades of experience, Michael believes there has never been a moment in time quite like this.

Right now, medical breakthroughs that once took years to develop are moving at a record speed. And that means we are going to see highly lucrative biotech investment opportunities come in fast and furious.

To help you navigate the historic opportunity in biotech, Michael launched the Bio-Tech Profit Alliance.

His other publications include: Strategic Tech Investor, The Nova-X Report, Bio-Technology Profit Alliance and Nexus-9 Network.