After speculation last week that online real estate search engines Zillow Inc. (Nasdaq: Z) and Trulia Inc. (NYSE: TRLA) would combine their assets for a merger, the companies made this move official before markets opened this morning (Monday).

Trulia stock opened up 12% on the announcement, and Z opened down 4.2%.

Z will acquire TRLA in a $3.5 billion stock-for-stock deal expected to close in 2015. TRLA shareholders will receive 0.444 shares of Z for each share of TRLA, and will own about 33% of the combined company after the deal closes.

"Consumers love using Zillow and Trulia to find vital information about homes and connect with the best local real estate professionals," Zillow Chief Operating Officer Spencer Rascoff said in a press release. "This is a tremendous opportunity to combine our resources and achieve even more impressive innovation that will benefit consumers and the real estate industry."

This isn't the first time Z has made moves to acquire another brand, though it is by far its largest and most expensive.

In 2011, Z spent $6.5 million to buy up Diverse Solutions Inc., a real estate branding company, and Postlets LLC, which provides a platform for renters and sellers to post listings.

In 2012, Z had an even busier year of acquisitions, spending another $67.6 million to acquire RentJuice, an online tool to manage relationships for landlords and property managers; Buyfolio, another broker-client portal; Mortech, a software company providing mortgage quotes; and Hotpads, a home rental search engine.

Then in 2013, Z made its biggest single transaction with a big ticket purchase of StreetEasy, a New York City property-listings website, for $42.7 million.

To this point, none of Z's acquisitions have helped the company sustain profits each year, as the real estate website had accumulated $84.1 million in deficits at the end of 2013.

And it's hard to imagine how this $3.5 billion deal will help pull Z out of its profit slump...

TRLA Won't End Zillow's String of Losses

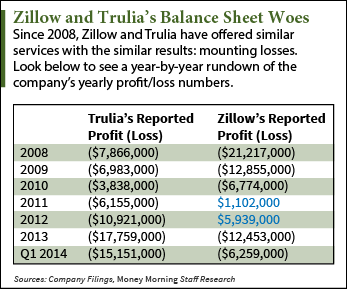

In 2011, when Z made its first round of acquisitions, it was able to generate $1.1 million in profits, the first time in the black in its earnings history since 2007. In 2012, when Zillow continued to expand and purchased four more companies, its profit increased to $5.9 million.

But that wasn't the case in 2013, when Zillow purchased StreetEasy, and Z plunged back into the red, reporting $12.5 million losses on the year.

If Z was looking to reverse this trend of repeated losses - 2011 and 2012 were the only two years where Z reported actual profits, and Z has already netted $6.3 million in losses in the first quarter - then TRLA may not be the company to look toward.

Unlike Z, TRLA hasn't posted a single profitable year since reporting in 2008, and has already reported losses of $15.2 million in the first quarter. This is compared to 2013, its worst performing year where TRLA netted $17.8 million in losses on the whole year. TRLA had $64.9 million in deficits at the end of 2013.

This deal will essentially be merging two money-losing companies that are both very similar in the business they do.

Short selling data reflects a lack of confidence from investors on these company's upsides. Both are heavily shorted - meaning investors are looking to profit if share prices tumble. About 27.8% of Z shares floated are shorts. That figure is even higher at 37.2% for TRLA stock, according to FinViz.com.

That may help to explain part of why TRLA stock shot up 41.1% last week, and Z surged ahead 25.4%. As share prices soared, short sellers looking to limit their losses clamored to close their short positions and buy long.

"It's just natural that the stock would rise because anybody being put in play would just cause the shorts to get the heck out," Said Shah Gilani, Money Morning's Capital Wave Strategist and editor of Short-Side Fortunes investment service. "There's fundamentally no reason to be in that trade anymore."

In a recent newsletter from Bespoke Investment Group, the financial research firm urged caution when looking at the current valuations for Z and TRLA.

"Forgetting any concerns over whether the deal may be accretive or not in terms of either margins or net income, an all-stock deal of this kind between two tech companies with extremely high sales multiples (as of yesterday Z 21.1x price-to-sales; TRLA 8.3x price-to-sales) is the type of behavior we haven't seen since the last dotcom boom," Bespoke wrote. "It also should serve as signal or warning that valuations (if you can even call it that) in certain isolated areas of the market are reaching excessive levels."

While Gilani doesn't recommend considering these companies for short trading at least until the deal is fully realized and all the information is available, he has been shorting other companies and investments tied to the housing market.

Z and TRLA are currently operating in a real estate market that is quickly beginning to lose its upside. Gilani said the optimistic numbers indicating a recovery in the housing market are being prompted by the cash infusions of big money investors and foreigners looking for high-yielding investments in a low-rate environment.

Middle-income Americans, those that could help push housing even higher, just don't have the money to compete with Wall Street and are not flooding to the market in droves.

"I don't see that class of people flush with money or readily able to get a lot of credit necessary to move the housing market higher," Gilani said. "I just don't see where the strength is in the big picture."

More from Shah Gilani: The so-called resurgence of the housing market is not coming on the backs of individuals buying homes, but rather institutional buyers "trading up," dampening prospects that Middle America will continue to feed this housing recovery...