This month's Housing Market Index numbers make this so-called housing recovery appear as if it's picking up steam.

Figures released yesterday (Monday) show that homebuilders are both more confident in the current housing market than they were in the beginning of the year and are more optimistic for the six months ahead than they were last year.

The index, which is a survey administered by the National Home Builders Association and Wells Fargo & Co. (NYSE: WFC), asks homebuilders to weigh in on the current state of new housing starts and their prospects for the future. Homebuilder confidence is represented on a 0 to 100 scale, with a higher number reflecting more positive sentiment.

This month, homebuilders gave current home sales a 52, a 2-point gain on the month before, and future prospects of home sales a 65, also 2 points ahead of the month before. Any number above 50 indicates that more of the participants responded to the survey positively than negatively.

In an ideal recovery, home prices would rise in tandem with new first-time homebuyers and homebuyers foreclosed on during the crash re-entering the market.

Rising home prices would then be an indicator that middle-income Americans were better off, and more are achieving the dream of home ownership. And those homebuyers would eventually see their return on investment through an appreciation in their homes' values.

But that is not the case, even as some will try to spin this narrative with every release of seemingly optimistic housing numbers...

Wall Street's Play on Housing

The current recovery is seeing the value of homes pushed up not by average Americans, but bankers on Wall Street and wealthy foreigners playing the markets.

In a low-interest rate environment, big investors are looking anywhere they can to find yield. They have set their sights on real estate.

"Middle Americans aren't buying homes in droves again," said Money Morning's Capital Wave Strategist Shah Gilani. "It worries me a lot that middle-class Americans aren't buying houses."

Institutional investors and foreigners holding large dollar reserves are bidding up the prices with all-cash purchases. And while the real estate market may have worn the appearance of a recovery, the underlying weaknesses still remain.

"They bid up home prices so quickly that regular folks can't buy those homes at favorable prices... but now have to step up and pay the highest prices since the housing market implosion," Gilani said.

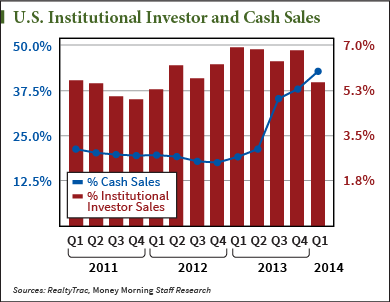

In the first quarter of this year, all-cash purchases of homes made up 42.7% of total purchases, the highest figure since RealtyTrac began monitoring these numbers in 2011.

And the current generation of new homebuyers isn't coming into the market with a wad of cash to compete with Wall Street's deep pockets. In fact, many of the new potential homebuyers are entering the market with mounting student debt, tightening credit standards, and at a time when there is an overall shift from buying to renting homes.

"I don't see that class of people flush with money or readily able to get a lot of credit necessary to move the housing market higher," Gilani said. "The number of buyers that were once looking for homes simply isn't there."

In the absence of homebuyers, the current housing recovery will not be able to sustain itself on just the cash flowing into the market by institutional investors alone. And if those players do exit the market, there won't be anybody to pick up the slack.

There is evidence that this is already beginning to happen.

The most recent numbers in the S&P/Case Shiller Home Price Index, an index that tracks home prices in 20 cities, have shown the first decline since January 2012, when the housing market was bottoming out. Not surprisingly, at this same time, RealtyTrac reported that home sales to institutional investors have fallen to 4.7% in the second quarter from 5.2% in the quarter before. Also, all-cash sales have dropped from 42.7% to 37.9% in the same span.

With the leading housing index dropping alongside the pullback of big money in home buying, the market's weaknesses have really begun to rise to the surface.

"Housing is going to remain sloshy," Gilani said. "I just don't see where the strength is in the big picture."

More from Shah: We're five years on from the mortgage meltdown, housing prices have bounced back dramatically, and interest rates are at near-record lows. So, why are there still dark clouds over our supposed economic recovery? Because the housing rally is fabricated...