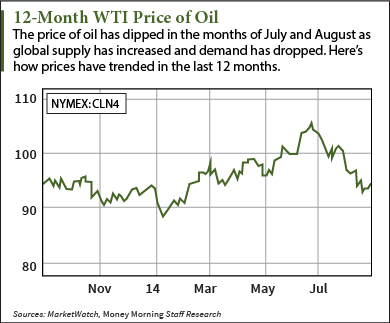

The price of oil has climbed slightly this week with West Texas Intermediate (WTI) hitting an intra-week high of $95.17 for October delivery today (Friday).

Despite this week's price hike, WTI prices are still well below the three-year high of $105 a barrel they hit in June. Brent prices are also down in the last two months, near $103 per barrel today. They had climbed as high as $115 in June.

Despite this week's price hike, WTI prices are still well below the three-year high of $105 a barrel they hit in June. Brent prices are also down in the last two months, near $103 per barrel today. They had climbed as high as $115 in June.

A supply glut has kept the price of oil down throughout July and August, and according to Reuters, analysts expect supply to exceed demand for the rest of 2014.

"There is crude everywhere," Mitsubishi Corp.'s risk manager Tony Nunan told Reuters. "There's just too much supply and we've had terrible demand."

One of the biggest factors driving supply is increased oil production in the United States. According to the Energy Information Administration (EIA), U.S. output grew by more than 4 million barrels per day (bpd) from January 2011 to July 2014.

At the same time, demand has not increased as much as experts had anticipated. Analysts are expecting the ongoing trade dispute with Russia to lower the amount of oil consumed globally, thus keeping demand at muted levels.

Those factors have dropped WTI oil prices roughly $10 in the last two months, but the crisis in Iraq has also played a large role.

The June spike in WTI to $105.55 per barrel coincided with the beginning of the crisis in Iraq. At the time, analysts worried Sunni militants from the terrorist group ISIS would gain control over many of Iraq's oil fields and refineries, which sent oil prices soaring.

Prices dropped in the month of July, however, when it became apparent that ISIS was not targeting southern Iraq oil fields, where the country's oil exports are produced.

Any type of geopolitical unrest is typically a catalyst for oil prices and this summer's spike coincided with three - the situation in Gaza, Ukraine, and Iraq. But now, analysts are unfazed by these crises...

"Traders obviously do not think the crises in Ukraine, Iraq, or Gaza will have a major impact on the global market (at least not yet)," Money Morning's Global Energy Strategist Dr. Kent Moors said. "As a result, they are discounting the impact of the tensions on overall availability."

The price of oil may be trading much lower than it was earlier this summer, but in the words of Moors "we're not out of the woods yet."

In fact, even a small disturbance could send oil prices much higher in a hurry - Moors explains...

What Could Send the Price of Oil Soaring in 2014

"The key here is to recognize that crude oil prices are still determined by the balance between readily available supply and existing demand," Moors said. "That means that even relatively small swings in either supply or demand can have an outsized effect."

And with the situation in Iraq contained to the northern and central regions of the country, away from the southern exports region, analysts expect the supply to remain unchanged by ISIS attacks.

However, Moors says that ISIS could still have a major impact on supply, even if they stay away from the southern oil fields. That's because the northern portion of the country controls much of Iraq's total oil production.

"Right now, Iraq accounts for 4% of the world's global oil production," Moors continued." That may not seem like a big percentage. But if even just a third of Iraq's oil production went offline, former military leaders and energy experts warn that crude oil prices will go up an additional $40 per barrel," Moors said.

Instead, traders and analysts keep pointing to the untouched southern region as a reason oil prices will remain low. According to Moors, they're all missing the point.

"ISIS does not have to control a single well in southern Iraq to be able to impact the price," Moors said. "All they have to do is immobilize the government in Baghdad. Without central administrative control, the western majors running those fields in the south really don't know what they're supposed to be doing next, and that's really the political vice that's being created here."

Because energy traders are dealing with futures contracts when it comes to the price of oil, the "uncertainty factor" plays a massive role in determining prices. Any uncertainty in the region at all could spike prices.

"These traders are attempting to deal with what the price of oil will look like months in advance," Moors said. "That's the very nature of futures contracts. Traders need to deal with the 'uncertainty factor' in determining their contract pricing."

So far, U.S. involvement in Iraq has helped the nation regain control over portions of northern Iraq, including the Mosul Dam. But we're not in the clear yet. ISIS still poses a major threat on the region. Oil prices will continue to react to the situation accordingly.

Editor's Note: Now, according to Dr. Moors, the chaos in the Middle East is about to "go global." As you'll see, a select group of companies is set to benefit in a very big and unique way.

To get the full report, including what it means for your money, go here.

Join the conversation on Twitter @moneymorning and @KyleAndersonMM using #Oil

Related Articles: