Several years ago I made the comment that I thought Apple Inc. (Nasdaq: AAPL) may be the world's first $1-trillion company. Now, I think Alibaba Group Holding Ltd. (NYSE: BABA) is the better bet.

Sacrilege? Not if you think about the big picture.

Today I want to talk about why Apple investors should switch horses and what the Alibaba IPO means for your money. Then, we'll dive into two profit plays you can make right now that could help you capture some truly outrageous profit potential in the months ahead.

Let's get the tough stuff out of the way first.

The decision to back Alibaba over Apple really comes down to numbers. It's not all that difficult to see why. What's difficult is that millions of Apple fans simply can't take off their rose-colored "iGlasses" to do so objectively.

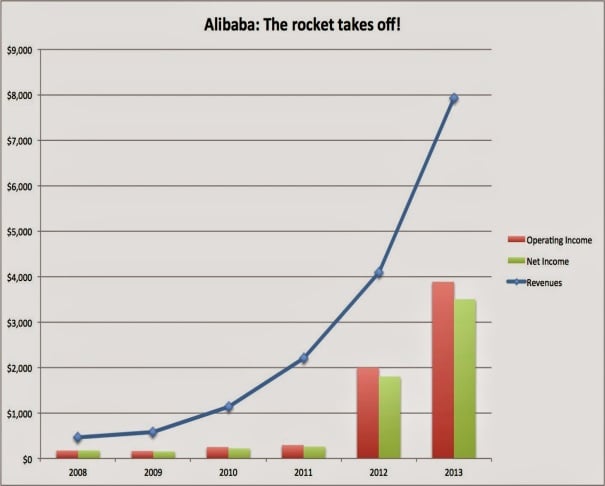

Let's start with sales growth. Apple's sales growth topped 45% in 2012, dropped to 9% in 2013, and may only hit 3% to 5% this year. By 2016, the company may hit just 2%. Alibaba's growth, on the other hand, may hit 50% or more in the next 12 months.

Clearly, though, the bottom line is important, so you can't talk about top-line growth without looking at what comes home at the end of the day.

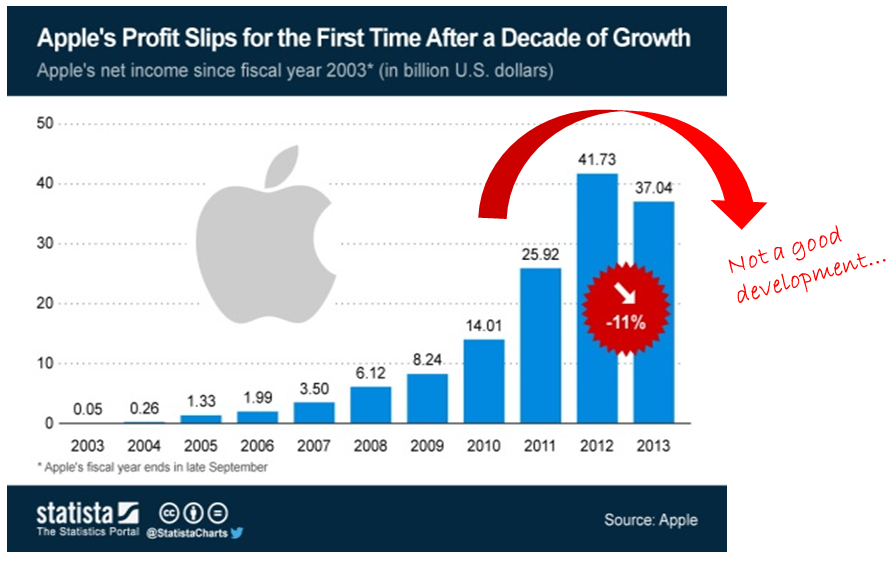

Here, too, Apple is in serious trouble. A once-proud brand with seemingly bulletproof margins, the fact that its profit has rolled over for the first time in a decade is a serious development that calls to mind the likes of Blackberry, Sony, and Nokia - all of which are struggling to remain relevant in markets they created.

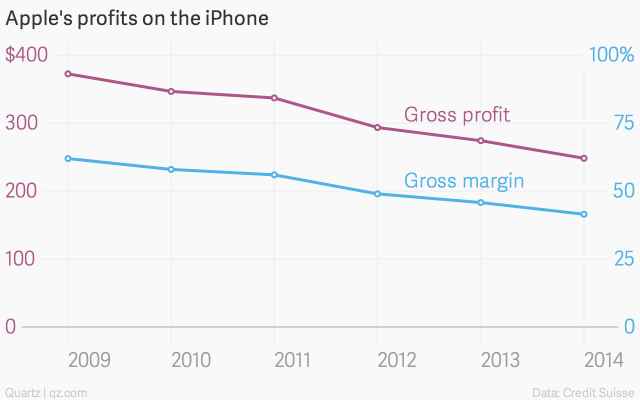

Interestingly, I was challenged on exactly this point earlier this week by my good friend Charles Payne on FOX Business, who noted that the iPhone is a screaming success. I agree. It is.

But what I couldn't say because the broadcast timing didn't allow for it, was that the iPhone reportedly costs Apple $350.60 a unit to produce and results in a gross profit of $248.40 or 41.5% per unit, according to Quartz and various other financial reporting institutions. That's nowhere near the 60% to 70% achieved with earlier models.

Apple's operating margin in 2013 was 28.7% versus Alibaba's margin of 51%, according to USA Today. So here, too, the numbers are going in the wrong direction.

Still, the Apple-istas don't give up easily and I don't blame them. Apple is a tremendous brand. Yet, there were seven Android phones sold in 2014 for every one iPhone sold. Apple's smartphone market share is only 11.7% in 2014, and it's poised to drop further even as Google and Samsung charge ahead.

Even more telling is that Apple's latest and greatest, the iPhone 6, is just catching up to the Nexus 4 released on November 20, 2012.

That's right... the much ballyhooed 4.7-inch screen, the NFC payments, the widgets, the cross-app communication, the cloud backup, and the battery stats are nothing more than a "me-too" product that merely plays catch-up with a competitor's offerings from several years ago.

Tablets are much the same story. Apple virtually created the tablet market and at one time was even viewed as threatening the entire PC industry with extinction because of it. Yet, today Apple retains only a 26.9% market share, which is down from the 33% it enjoyed as recently as Q2 2013, and falling further.

Even its much-vaunted Apple Pay is a rehash. The New York Times put it bluntly: "Buying things with a credit card isn't nearly as onerous a process as [Apple makes] it out to be."

I couldn't agree more. Anecdotally, we've been using our cell phones in Japan to buy everything from groceries to subway tickets for a decade.

And, as you might expect given the focus of today's article, the numbers are very telling. There are nine million U.S. retailers accepting credit and debit cards but only 220,000 where you can begin using Apple Pay next month. Put another way, Apple Pay won't work at 97.6% of the places America shops at until at least 2015, which is when credit card issuers are going to require merchants to switch to the NSF chips or face footing the bill for fraudulent charges themselves. It's even more limited than American Express.

"They will adapt," goes the rallying cry of the diehard Apple crowd. True... they could. But only if Apple can convince consumers that their data is secure and that's a hard sell in the wake of the naked-selfie scandal that just rocked the iCloud. CEO Tim Cook believes that Apple Pay is safer than credit cards which is interesting but, again, a tough row to hoe.

Merchants are already forking over 2% of a transaction per swipe. It's very unlikely they're going to fork over more to pay for scanner upgrades, processors and training, because they are going to have to pass those costs along to already skittish consumers.

I could go on but at the end of the day, Apple isn't providing anything new. Almost every offering is entirely defensive, or shades of something already on the market.

Alibaba, on the other hand, is seen as being almost entirely about good old-fashioned, completely raw growth, and with $284 billion in transactions last year, I agree.

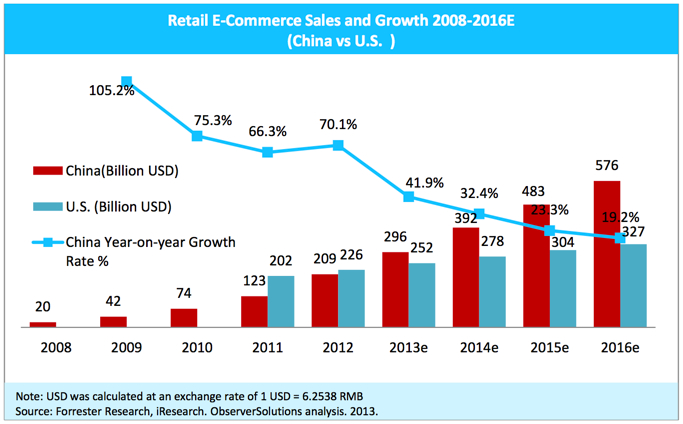

The company is moving aggressively to create strategic partnerships that are about Chinese web dominance. It's already bigger than Amazon and Ebay combined and is now launching an e-commerce platform in the United States called 11 Main that's going to have popular categories like fashion, home, and collectible items pre-sorted for western consumers.

It's worth noting that in classic Chinese form, Alibaba is going after smaller merchants first with lower commissions and fees that will undoubtedly attract their attention. Then, when U.S. banks are maneuvered into a corner, it will target the bigger revenue players who will see no other option but to change over.

And finally, China's got 632 million Internet users and is expected to top 800 million within two to three years. The Internet e-commerce market is growing so fast there that it's expected to be larger than the e-commerce markets of United States, German, Britain, and France combined by 2020.

Call me crazy, but I think Apple knows that its days are numbered even though it won't admit this in public in a million years. It's clear that Apple needs Alibaba - not the other way around. To that end, Apple blinked first and opened a storefront on Alibaba's flagship B2B and C2C e-commerce platform, TMall in January of this year.

There's something else... I think it's very telling that CEO Tim Cook couldn't come up with anything really substantial to say to interviewer Charlie Rose once he got off his pre-arranged talking points besides noting how good it "feels when you hold the iPhone 6" and that the "screen is to die for."

Where were the "this is going to change your life" considerations Steve Jobs would undoubtedly have offered? I can only wonder if last week's debut actually marks the specific point in time that is - or, as the case may be, was - Apple's apex.

Now let's get to the fun part: making money.

Time to Profit from Alibaba (NYSE: BABA) Stock

Unless you're an institutional investor or a deep-pocketed venture capitalist, you're going to have to trade Alibaba on the NYSE when it opens under the ticker BABA on September 19.

Various press reports suggest BABA will price in the $60- to $70-per-share range on September 18, which means BABA is not going to be cheap. I believe we could see $70 to $75 based on the chatter I'm hearing back channel. Perhaps even more if the markets catch a breather.

Admittedly, these things are always hard to guestimate. There's a fair amount of wiggle room in any IPO depending on the market conditions when it's priced, but in this case we could see some pretty dramatic moves when the news breaks given how hotly anticipated this offering actually is.

As for the first day of trading, guestimates suggest that we could see everything from a 5% decline to a 30% increase. The former is a possibility, but I think there's so much demand for shares that a 30% pop in price may prove conservative when the closing bell clangs Friday afternoon.

Here are three ways to play:

- For U.S. investors hoping to get in on the action and profit directly from the IPO, you'll have to call your broker. All orders for allotted shares must be placed by 4 p.m. EST on Wednesday September 16.

- Otherwise, you can place your order the morning BABA opens and hop in "at Market," meaning you'll pay whatever price is then available. Limit orders probably won't do you a whole lot of good given how volatile I expect Alibaba to be when it starts trading.

- There are several exciting "backdoor" ways to play this historic offering, too. I recommended one such stock to members of our premium service months ago. Investors who followed along have enjoyed total returns of more than 30% - with more ahead. Of course, it wouldn't be fair to paying members to share those plays here. But if you're interested in joining them, click here.

Have your cash ready for the BABA bounce because it could be good for nimble traders and GREAT for long-term investors who are willing to grab a proverbial tiger by the tail.

I'm betting Alibaba will hit $1 trillion before Apple does.

NOW: There's a dangerous "Helicopter Money" delusion spreading around Wall Street. Here's the truth behind this radical idea that's gaining popularity...

[epom]

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.