Investors who live in a "five-day" world have a mighty short collective memory. In the markets, 38 days might as well be 100 years.

Certainly no one in the financial media is looking back to June 24, 2016, anymore. As you'll see, that could be a costly mistake.

Of course, that's the day after the United Kingdom's historic European Union membership referendum ended in a shock "Leave" result; the day that saw global markets plunge by more than 5% in most cases, wiping out trillions in wealth, and sending the pound sterling to multi-decade lows.

Then again, since U.S. markets have gone on a historic rocket ride in the weeks since, with all indexes repeatedly crushing record highs, it's understandable that investors have "forgotten" the Brexit's initial shock and moved on.

Now that might be okay... if only for the fact that Britain hasn't actually done anything yet. The real Brexit - the day the UK grabs its bags and steps out of the EU's door - is yet to come, and there are ominous signs that things could get downright ugly as that day approaches. It has the potential to make the Brexit vote shock look tame by comparison.

That means there's plenty of time (and upside) left in this "high-tech gold" defense maneuver I'm about to show you...

Of Grexit, Brexit, Bitcoin, and Blockchains

Despite its proven value as a currency, Bitcoin just isn't getting much love in the mainstream investing world, here or in Europe.

But there are concrete signs that state of affairs is changing in Europe. That's largely down to two events.

But there are concrete signs that state of affairs is changing in Europe. That's largely down to two events.

One was the Brexit vote.

You see, as the vote drew closer and "Leave" versus "Remain" options appeared to be in a statistical dead heat, gold jumped 3% in a week.

That was exciting, and a great development, but it was totally expected. British and European investors with massive exposure to sterling were making a run to safety.

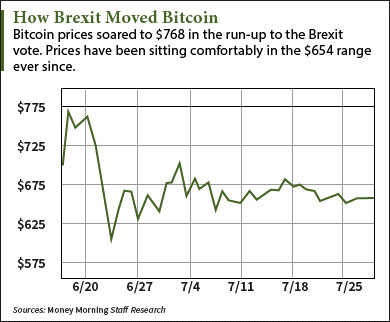

But gold wasn't all they were buying... At the time of the vote, massive amounts of cash began to boost Bitcoin's value, sending it soaring nearly 9% to around $768.

Gold owners looked good, Bitcoin owners looked even better, but Britons who kept their holdings in sterling wound up looking close to 8% poorer.

Investors, analysts, and politicians who once threw shade on Bitcoin's prospects are starting to change their tune, in a bid to catch up to the visionaries who always had a grasp on the cryptocurrency's true potential.

Bitcoin is fast becoming more than a viable safe haven for computer users and privacy activists, in part because it's got a proven history of delivering during times of European instability and volatility.

Here's what I mean...

The "Grexit" First Clued Investors In to Bitcoin's Value

Last summer, during the "Grexit" saga, Greeks suffered under tight capital controls which saw them limited to just €60 per day in cash withdrawals. Alternative currencies - especially Bitcoin - and bartering naturally flourished in such an environment. At the time, in 2015, the turmoil surrounding the Greek debt crisis sent Bitcoin on its best 18-month run to date.

Some Greeks interviewed by Reuters went so far as to credit Bitcoin with saving them from going hungry or broke. That's not likely to happen in the UK, among the top tier global economies, but that reliability and liquidity helped "set the stage" for Bitcoin's outstanding Brexit performance.

And so the renegade currency is entering the European mainstream, comfortably. As of right now, more than 200,000 Bitcoin transactions are made each and every day.

There's a lot more ahead.

Just last week, European markets got a taste of their first asset-backed Bitcoin exchange-traded instrument (ETI) invested solely in Bitcoin. iStructure PCC BitcoinETI (DAX, GSX: BTCETI) is available to trade on the Gibraltar Stock Exchange and Deutsche Börse, well-supported by management and with strict transparency enforced.

That's why it's so strange Bitcoin is having a somewhat tougher time across the Atlantic.

On these shores, Bitcoin's influence, usefulness, virtue, and even legal status is still in debate.

Earlier in July, a Florida judge threw out a money laundering case because she said that Bitcoin was "more akin to poker chips," and because you couldn't "hide it under your mattress" it wasn't currency.

Ironically, the defendant paid his expert witness for his testimony... in Bitcoin.

Ironically, the defendant paid his expert witness for his testimony... in Bitcoin.

Of course there has always been this kind of tension with Bitcoin. On one hand, it's a completely anonymous currency. On the other, its value is based on its limited availability, like a precious metal.

You see, you can't have a currency without some source of value behind it. Most traditional currencies, like the U.S. dollar, were once backed by gold, and are now backed by the relative economic strength of the national economic output.

But in this world of central bank shenanigans, like negative interest rates and cheap-as-free money, traditional currencies are becoming more abstract than Bitcoin.

What's more, Bitcoins are held anonymously. This is possible because of a novel bit of technology known as the "blockchain." The blockchain allows everyone and anyone who's interested to see the transactions that are taking place, but it encrypts the identity of the buyers and sellers.

This unique development is now taking the finance world by storm. Because of the blockchain's near-immediate settlement speed, robust security, and frank transparency, many financial, real estate and "fintech" firms are looking into developing blockchains.

According to CoinDesk, a Bitcoin news service, 10 stock and commodities exchanges around the world are building blockchains at this moment. They include Nasdaq, the New York Stock Exchange, the London Stock Exchange, and other major global players.

According to CoinDesk.com, Bitcoin and the blockchain have about $650 million in venture capital in the space now and lots of market players investing for the long haul.

So "slow adopter" governments, like the United States, are at a real risk of getting bowled over by Bitcoin. It's clear at this point that, to be ahead of the game, forward-looking governments, institutions, and individual investors and traders have to be using this.

It's simply the "smart money" move... considering the turmoil that could be just around the corner...

Why Bitcoin Volatility Can Be a Good Thing

For all the past profits and potential profits ahead, I understand Bitcoin has a justified reputation for volatility.

It helps to think of Bitcoin as a lightly traded small-cap stock. With shares, you have to make a distinction between times when volatility is spurred by market makers and day traders, and those times when volatility actually represents broadening interest in the stock.

Both look similar on the surface.

But when you look at a longer-term picture, and you see volume increase, prices begin to moderate, and an influx of long-term investors, then something fundamental is shifting.

Bitcoin isn't a bit different.

For quite a while, the bottom feeders looked like they were running the show. Governments told people that only crooks and drug dealers used Bitcoin, as they scrambled to "break the blockchain."

Then, smart thieves built companies for individuals to buy and store their Bitcoins. And then took all their money.

But today, I see a new investment vehicle that has withstood global government aggression and confidence-sucking scandals. It's stronger than ever.

This once-abstract source of value has endured and is now coming into its own.

And not a moment too soon...

June 24, 2016, Was Just a Taste of What's Ahead

The EU referendum vote, subsequent volatility, and the gains that followed aren't the end of uncertainty or trouble in the UK or Europe.

This was only the beginning.

Once the so-called "Article 50" negotiations are complete, the United Kingdom will be ready to actually leave the EU.

Europe wants to rip the Band-Aid off and get the UK out as soon as possible, if only to stabilize the bloc's remaining economies, while the UK wants to stretch out the exit because it wants stability for its currency and its less than totally robust economy.

We don't know what kind of terms anyone will get yet, whether the departure will be friendly, antagonistic, or in the most extreme scenarios where regional separatist tendencies shift from simmer to boil, or whether the UK as we know it today will even exist anymore when it's ready to leave.

But we do have proof now, from the Grexit panic and the Brexit vote, that Bitcoin is a superb "safe harbor."

And when you consider that Daesh's murderous mischief in Southwest Asia isn't stopping anytime soon, that the dollar is strong and getting stronger, and that central banks are likely to continue printing money, the case for Bitcoin as a hedge and haven becomes that much stronger.

This kind of instability plays into Bitcoin's "hands" and pads Bitcoin owners' bottom lines.

Up Next: Silicon Valley Enters All-Out War

A new type of technology has emerged that has the three biggest companies in Silicon Valley battling each other for control. One of them led a funding round worth $542 million. Another invested $2.1 billion. According to Wired magazine, this technology will "set off a period of 'economic Nirvana.'" But that's not even the most amazing fact. Click here for the full story.

Follow Money Morning on Facebook and Twitter.

About the Author

Michael A. Robinson is a 36-year Silicon Valley veteran and one of the top tech and biotech financial analysts working today. That's because, as a consultant, senior adviser, and board member for Silicon Valley venture capital firms, Michael enjoys privileged access to pioneering CEOs, scientists, and high-profile players. And he brings this entire world of Silicon Valley "insiders" right to you...

- He was one of five people involved in early meetings for the $160 billion "cloud" computing phenomenon.

- He was there as Lee Iacocca and Roger Smith, the CEOs of Chrysler and GM, led the robotics revolution that saved the U.S. automotive industry.

- As cyber-security was becoming a focus of national security, Michael was with Dave DeWalt, the CEO of McAfee, right before Intel acquired his company for $7.8 billion.

This all means the entire world is constantly seeking Michael's insight.

In addition to being a regular guest and panelist on CNBC and Fox Business, he is also a Pulitzer Prize-nominated writer and reporter. His first book Overdrawn: The Bailout of American Savings warned people about the coming financial collapse - years before the word "bailout" became a household word.

Silicon Valley defense publications vie for his analysis. He's worked for Defense Media Network and Signal Magazine, as well as The New York Times, American Enterprise, and The Wall Street Journal.

And even with decades of experience, Michael believes there has never been a moment in time quite like this.

Right now, medical breakthroughs that once took years to develop are moving at a record speed. And that means we are going to see highly lucrative biotech investment opportunities come in fast and furious.

To help you navigate the historic opportunity in biotech, Michael launched the Bio-Tech Profit Alliance.

His other publications include: Strategic Tech Investor, The Nova-X Report, Bio-Technology Profit Alliance and Nexus-9 Network.