The Hazelden Betty Ford Foundation, which ought to know a thing or two about behavioral disorders, once defined insanity as "doing the same thing over and over again and expecting a different result."

By that definition, the world's central bankers - "hopium" pushers to the global markets - are all barking mad.

They've continuously inflated assets to stratospheric heights in a doomed quest for growth and inflation that never, ever comes.

And what's really insane is that they have absolutely no idea how to stop what they're doing... without sending those "hopium"-addicted markets into a lethal tailspin.

They'll get the tailspin anyway. Or should I say, we will - central bankers never lose.

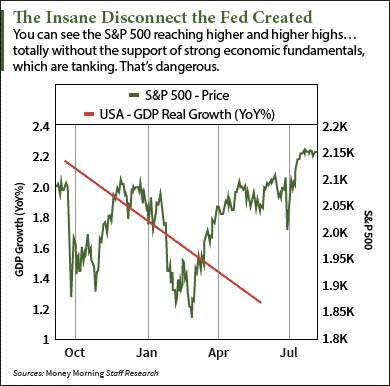

The United States is a perfect example of what central bankers have wrought on the markets.

Here's what I mean...

The Fed Has Less Than Nothing to Show for Its Efforts

All of the low, zero, and net negative interest rates over the past 10 years just helped the U.S. economy register a seasonally adjusted 1.2% annual GDP growth rate in the second quarter.

Wow...

All this, plus a downward revision of the first quarter's growth rate from 1.1% to 0.8%.

Wow...

All those cheap, low-interest-rate loans consumers are using to consume "stuff" sure is helping. Personal consumption in the second quarter rose 4.2%. That breaks down to a whopping 6.8% rise for goods and a 3% rise for services.

All those cheap, low-interest-rate loans consumers are using to consume "stuff" sure is helping. Personal consumption in the second quarter rose 4.2%. That breaks down to a whopping 6.8% rise for goods and a 3% rise for services.

More than 66% of the U.S. economy is driven by consumption, so on the surface, it's stunningly good to see robust growth in consumption like that. The media likes to shout it from the mountaintops, in fact.

Trouble is, nobody is talking about all the borrowing, at low rates, that's happening to fuel all that consuming.

So why on Earth would anyone borrow and leverage themselves to consume? Well, for one thing, it feels good. It's part of the "wealth effect." The thinking goes like this...

"The stock market looks good, so our investments and retirement accounts must be getting fatter, so let's go spend (okay, borrow and spend) to feel good and do good by helping the economy."

It's not just the American Way, it's the Federal Reserve's Way...

But non-residential fixed investment, meaning plant and equipment to build and produce things - you know, the kind of activity that requires hiring and keeping folks employed - actually fell 2.2% this quarter. That makes three quarters in a row that non-residential fixed investment has fallen.

No one's talking about that, either.

And if you think the housing market is bringing up the rear, think again. Residential fixed investment fell a much larger than expected 6.1% in the second quarter.

And the band plays on.

Growth Won't Happen... but Big Short-Side Profits Sure Will

Stocks just made new highs and then fell off. And sure as September follows August, you can bet they'll hit new highs once again. The consensus on the Dow's long-term target is 21,000. It looks impressive, sure, but to me it looks like an awful long way to fall - and I'm going to be in position to profit when it does.

Stocks aren't alone: Oil bounced higher and so have commodities. Bonds rallied.

It's just one giant, happy, free-for-all concert. "As long as the music's playing, you've got to get up and dance."

But all is not right with the U.S. market... with global markets... with oil... with commodities... and most definitely with almost $15 trillion worth of government bonds bid up so high their yields are negative.

The growth isn't here and it isn't coming. You can bank on that.

Sure, "the trend is your friend" and you ride it as long as you can. But when financial assets get so pumped up on the tune being played by central banks, it's all going to give way at some point.

It's not a question of "if," but of "when."

Ladies and gentlemen, we're getting close to the "when" point.

The biggest reason the market here is so high is that cheap money is being borrowed by corporations to buy back their own shares, inflating their earnings per share metrics without increasing earnings.

It's crazy.

The list of companies buying back record amounts of stock is increasing -- at the height of the market, no less! They're buying their own stock on its highs!

Are you kidding me?

Here's the Profit Play

We're going to make a killing when those idiots (and believe me, I have a good, long list of who they are) get caught out when the music stops. Investors will realize they've burned through trillions of dollars in cash and loaded their balance sheets with debt.

Not even the Federal Reserve will be able to help them. It's coming.

Take luxury goods makers, for example. Their earnings are getting hit everywhere, but their stocks aren't just holding up, they're going up. Let's see... slowing worldwide economic growth... falling earnings... and yet their stocks are rising. Something smells!

The easiest way to make money when this whole racket collapses is to take a position in ProShares Short S&P 500 ETF (NYSE Arca: SH). But there are ways to make even more potential gains, too...

In my Short-Side Fortunes trading service, for instance, we're heading back into my nice, long list of pumped-up stocks that are ready to burst and shorting them.

We're already loading up on one, Tesla, the luxury electric car manufacturer that doesn't have enough money to build the cars it has orders for and will have to borrow, yep, borrow, another $10 billion in the next five years.

Then there's China.

Good grief... China's been off the radar because of everything else going on in the world. But it's sinking, and it's sinking fast.

The latest evidence of the troubles there has everything to do with their "wealth management products," which were supposed to create wealth, but are now a $3.5 trillion bomb about to blow huge chunks of the Chinese economy to smithereens.

Enjoy the up-trend boys and girls, it's got a little ways to go yet.

But the music is going to stop... Be ready when it does.

Follow Shah on Facebook and Twitter.

About the Author

Shah Gilani boasts a financial pedigree unlike any other. He ran his first hedge fund in 1982 from his seat on the floor of the Chicago Board of Options Exchange. When options on the Standard & Poor's 100 began trading on March 11, 1983, Shah worked in "the pit" as a market maker.

The work he did laid the foundation for what would later become the VIX - to this day one of the most widely used indicators worldwide. After leaving Chicago to run the futures and options division of the British banking giant Lloyd's TSB, Shah moved up to Roosevelt & Cross Inc., an old-line New York boutique firm. There he originated and ran a packaged fixed-income trading desk, and established that company's "listed" and OTC trading desks.

Shah founded a second hedge fund in 1999, which he ran until 2003.

Shah's vast network of contacts includes the biggest players on Wall Street and in international finance. These contacts give him the real story - when others only get what the investment banks want them to see.

Today, as editor of Hyperdrive Portfolio, Shah presents his legion of subscribers with massive profit opportunities that result from paradigm shifts in the way we work, play, and live.

Shah is a frequent guest on CNBC, Forbes, and MarketWatch, and you can catch him every week on Fox Business's Varney & Co.