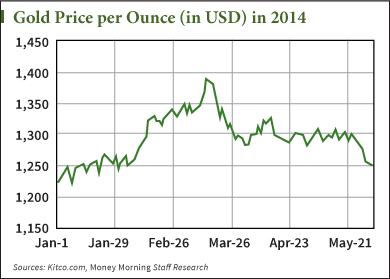

Gold shifted higher today (Monday) following recent record lows - our up-to-date gold price chart shows that in late May, gold tumbled to its lowest level in four months, to $1,243.00.

Today, gold for August delivery was up 0.1% at $1,253.90 a troy ounce on the Comex division of the New York Mercantile Exchange. London gold was up 0.1% at $1,253.77 an ounce.

Here's the top market news that's affecting gold prices right now...

Top Stories Affecting Gold Prices Now

Friday's release of U.S. payroll data came in a little better than what analysts forecasted. But the slight beat wasn't enough to get a gold market reaction one way or another, as seen by today's flat numbers.

"Most major players remained on the sidelines at the end of last week," VTB Capital bullion analyst Andrey Kryuchenkov wrote in a note to clients, reported by The Wall Street Journal. "From the investor perspective, Europeans would rather choose blue-chip equities or a stronger dollar given improving risk sentiment."

Recent data from Reuters revealed that money managers' bets on gold have settled back to the depressed levels last seen in January, when gold prices were at a similar low, as is reflected in our gold price chart. According to data released on Friday by the Commodity Futures Trading Commission, money managers who trade futures and options are net "long" 51,000 contracts - around half the level a month earlier. Barron's reports that the number of gold futures and options contracts currently outstanding in the market (the "open interest") is also near 2014 lows.

Still, the case for owning gold has never been more clear, according to Money Morning Chief Investment Strategist Keith Fitz-Gerald.

"Many investors are asking themselves if now is the time to buy gold. I think that's the wrong question," Fitz-Gerald said in May. "What they should be asking themselves is if they can afford not to buy gold."

Fitz-Gerald highlighted the fact that central banks are trillions of dollars in the hole, so they are buying gold as a means of supporting their currencies. According to the World Gold Council (WGC), in 2013 net purchases totaled 369 tonnes. That represents 12 consecutive quarters in which the central bankers have reported net inflows.

But it's the most recent gold news that corroborates Fitz-Gerald's bottom line...

You see, Fitz-Gerald also stressed that consumers in India and China - who jointly represent three out of every five people alive today - generally believe that gold is going to increase in price over time. Yet few actually own it, according to the WGC and U.S. Global Investors.

"As the economic development in these two countries continues at a rapid pace, overall demand will increase, even if it falls off in developed countries like the United States and in the European Union," Fitz-Gerald said. "Already the statistics are proving this point. Consumer demand in China rose 32% in 2013 to a record 1,066 tonnes, while in India, demand rose 13% to 975 tonnes."

Indeed, Barron's reported on Friday that although gold will likely remain depressed for the next three weeks, demand out of India and China should bolster gold prices in the second half of 2014.

"We expect the weak physical demand seen in Asia of late to pick up again in the second half of the year, which should result in a rising gold price, especially since the headwind from ETF investors is likely to further abate," analysts Barbara Lambrecht and Michaela Kuhl said to Barron's. "We are confident that gold demand in India will pick up noticeably as compared with the first half year and last year once the import restrictions have been eased. China is also likely to demand more gold again in the coming months."

If Asian demand picks up, look for our gold price chart to include an upswing in the latter half of the year.

Money Morning recently detailed for our Members the importance of owning gold now - and delivered a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.

Related Articles:

- The Wall Street Journal:

Gold Prices Nudge Higher After Jobs Data - Barron's:

Hedge Funds, Money Managers' Gold Bets Fall to Lowest Since January - Barron's:

Gold Headed to $1,400 on Asia Demand?