The U.S. Federal Reserve's Federal Open Market Committee (FOMC) meeting today went according to plan - meaning as far as monetary policy is concerned, nothing changed. The Fed will continue to taper bond purchases and maintain hushed tones on interest rate increases after the third round of quantitative easing (QE3) ends.

Every Fed observer this week has been searching for any hints that the Fed would work toward higher interest rates sooner than expected - but they were disappointed.

The Fed has been offering the same ambiguous language since the taper began, maintaining that interest rates will remain at their near-zero levels for a "considerable time" after the Fed's exit from the asset-purchasing program.

Next month, in the Fed's October meeting, the central bank plans to slash the last $15 billion and QE3 will come to its official end, after having celebrated its two-year anniversary last week. The Fed has pursued a policy of bond-buying to the tune of $85 billion a month in mortgage-backed securities and long-term U.S. Treasurys since September 2012. It began scaling back the scope of those bond purchases this past December under for Fed Chairman Ben Bernanke.

At that time, Bernanke announced that improvements in labor markets would allow for a deceleration of the Fed's aggressive monetary policy. He cut purchases from $85 billion a month to $75 billion. With each Fed meeting to follow, the nation's central bank cut another $10 billion.

What is worth noting, however, is that today's FOMC meeting brought with it another contrarian to the mix of FOMC participants who are largely endorsing a dovish monetary policy...

Whereas after last meeting, it was only Federal Reserve Bank of Philadelphia President Charles Plosser who objected to the Fed's policy recommendations, stating that he objected to the phrase "considerable time," this meeting saw another defector in Federal Reserve Bank of Dallas President Richard Fisher.

Fisher "believed that the continued strengthening of the real economy, improved outlook for labor utilization and for general price stability, and continued signs of financial market excess, will likely warrant an earlier reduction in monetary accommodation."

While today's FOMC meeting failed to change the script, it has one more chance to delay the end of QE when the committee meets again for two days starting on Oct. 28.

Now on to what the Fed's message is doing to the markets...

How Markets Move on FOMC Days

As is typical of FOMC meeting days, markets stayed subdued as they waited for cues from the central bank. Before 2 p.m. EDT, the Dow Jones Industrial Average was up 0.2%, or 25.78 points, while the S&P 500 was up 0.1%, or 2.32 points.

Since 1995, on FOMC meeting days the S&P 500 has moved an up average of 0.4%, and since the Fed first dropped rates to their near-zero levels in December 2008, Fed meetings have moved the S&P up an average of about 0.5%, according to data from BeSpoke Investment Group.

Since 1995, on FOMC meeting days the S&P 500 has moved an up average of 0.4%, and since the Fed first dropped rates to their near-zero levels in December 2008, Fed meetings have moved the S&P up an average of about 0.5%, according to data from BeSpoke Investment Group.

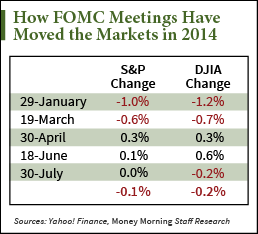

As the chart to the left shows, in the five 2014 FOMC meetings preceding today's, the S&P fell a marginal 0.1% on average, and the Dow Jones Industrial Average fell an average of 0.2%.

In the first few minutes after the statement was released, both the S&P and Dow saw a quick drop. For the S&P, it fell 7.59 points, while the Dow fell 54.68.

However, as the statement settled in investor's minds and Chairwoman Janet Yellen spoke at the post-FOMC press conference, both pushed back up above intra-day highs, well above this morning's open.

As of 3:15 p.m., the S&P had gained has much as 11.76 points, and the Dow as much as 49.06 points.

The story was different for commodities.

By shortly after 3 p.m., gold futures contracts for December delivery were down 0.3%, silver futures were down 0.4%, crude oil futures were down 0.8%, and corn futures were down 0.7%.

James Rickards has been speaking out on the dangers of Federal Reserve policy for several years. Recently Money Morning conducted an exclusive interview with Rickards that covered not just the Fed, but an entire series of economic threats that he believes could send America into a 25-year depression. To watch this must-see interview, click here.

[epom]