Activist investor Bill Ackman is having one heck of a year. After starting up Pershing Square Holdings Ltd. (AMS: PSH) with $54 million in 2004, the hedge fund manager now oversees a whopping $18 billion - and counting.

Activist investor Bill Ackman is having one heck of a year. After starting up Pershing Square Holdings Ltd. (AMS: PSH) with $54 million in 2004, the hedge fund manager now oversees a whopping $18 billion - and counting.

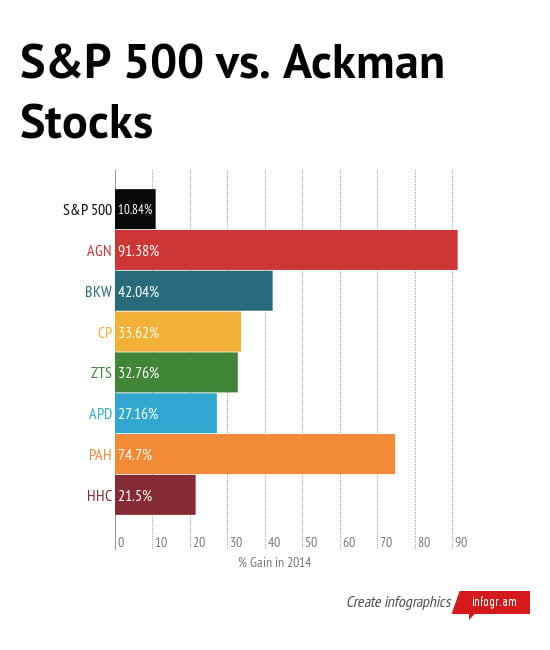

Seven notable "Bill Ackman stocks" - companies in which he owns a large stake - have crushed the S&P 500 in 2014, despite the index's 43 record highs and nearly 11% gain.

One of those seven, Allergan Inc. (NYSE: AGN) just made headlines Monday. The Botox maker accepted a $66 billion cash-and-stock offer to be bought by pharma firm Actavis Plc. (NYSE: ACT).

The deal illustrates perfectly how Ackman managed to outperform the stock market in 2014...

Bill Ackman's Allergan Chess Match Was Investor Genius

Pershing Square is the largest shareholder in Allergan, with a 9.7% stake. When Allergan accepted Actavis' bid, Ackman's position profited $2.2 billion from the deal.

The twist is that for the past seven months, Ackman worked with Valeant Pharmaceuticals Intl. Inc. (NYSE: VRX) to force a hostile takeover of Allergan.

At first glance, it may seem like Ackman lost when Allergan went with Activis and not Valeant, despite Pershing's efforts.

But take a closer look and you'll see the genius of Bill Ackman at work.

First, Ackman helped Valeant approach Allergan. Second, when Allergan resisted, he helped Valeant up its bid with his pool of cash.

Once Allergan faced a higher bid, the board naturally felt pressure from shareholders. Allergan was forced to look at other offers. When an even higher one came in from Actavis, Allergan took it.

Ackman created a situation that made his stake in Allergan worth more money. He got Allergan into takeover talks. He kicked off a bidding process.

And in the end, he won.

We found out last week that Zoetis Inc. (NYSE: ZTS) - another of Ackman's stocks that's outperformed the S&P 500 this year - may be the next acquisition target for the Pershing Square-Valeant Pharmaceuticals team.

Here's a look at seven of Ackman's biggest gainers in 2014 - including Zoetis...

Seven Bill Ackman Stocks That Crushed the S&P 500 in 2014

Check out how much these seven notable Bill Ackman stocks have outperformed the S&P 500 in 2014:

| Company |

Stake |

Sector | Notables |

| Allergan Inc. (NYSE: AGN) |

9.7% |

Healthcare | This is Ackman’s largest position, at roughly 38% of Pershing’s U.S. long portfolio. AGN is up nearly 50% since PSH and VRX announced their intentions April 22. |

| Burger King Worldwide Inc. (NYSE: BKW) |

10.9% |

Services | Ackman helped Burger King go public in 2012. Since then, he’s more than doubled his money on the investment. His stake is up 40% this year, and he made $203 million on Aug. 25 when BKW revealed it was in talks to merge with Tim Hortons Inc. (NYSE: THI). |

| Canadian Pacific Railway Ltd. (NYSE: CP) |

8% |

Services | Ackman’s second-largest position is up 35% in 2014. It has quadrupled since he first bought a stake in 2011. PSH is CP’s second-largest shareholder, and Ackman currently serves as director. He won a shareholder proxy battle and got the position in 2011. |

| Zoetis Inc. (NYSE: ZTS) |

8.5% |

Healthcare | On Nov. 11, Ackman announced that PSH took an 8.5% stake in animal health company Zoetis for about $1.54 billion. ZTS stock spiked 8.4% on the news. |

| Air Products & Chemicals Inc. (NYSE: APD) |

9.8% |

Basic Materials | This is Ackman’s third-largest position. On June 18, after much pressure from Ackman, the company announced it would appoint a new CEO. APD stock jumped nearly 9% on the news. |

| Platform Specialty Products Corp. (NYSE: PAH) |

26.1% |

Basic Materials | On Jan. 27, Ackman disclosed a 22% stake in PAH. Oct. 3 SEC filings revealed the stake had been upped. PAH stock is up nearly 80% in 2014. |

| Howard Hughes Corp. (NYSE: HHC) |

13.2% |

Financial | Ackman boosted his stake in HHC in January. Shares have risen more than 20% this year. |

Now here's exactly how much each of these seven stocks has crushed the S&P 500 this year:

There's a way regular, everyday investors can piggyback on the profits that activist investors like Bill Ackman raked in this year. Here's how...

There's a way regular, everyday investors can piggyback on the profits that activist investors like Bill Ackman raked in this year. Here's how...

Related Articles:

- The Wall Street Journal: Ackman Takes Stake in Animal-Health Company Zoetis