Should we abolish the Federal Reserve?

Should we abolish the Federal Reserve?

Millions of Americans assume the Fed acts in the nation's best interest and that our nation has always had a Fed.

In fact, neither is true according to Money Morning Chief Investment Strategist Keith Fitz-Gerald.

"The American Fed, as it operates today, is an insult to anybody who believes in economic and political freedom. In an era of globally linked finance, the very concept of the Fed is an abomination."

You see, the Fed's original, century-old purpose no longer applies to modern-day markets.

Far worse than that, the Fed's actions actually damage the U.S. economy...

Federal Reserve History 101

"The American Fed, as it operates today, is an insult to anybody who believes in economic and political freedom. In an era of globally linked finance, the very concept of the Fed is an abomination."

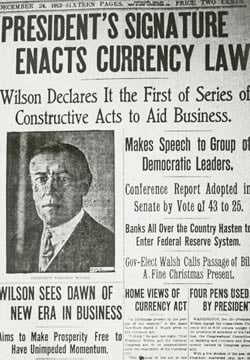

To understand how dangerous the Federal Reserve is today, we have to look closer at how it started...

Not many people realize this, but our nation hasn't always had a Fed. In fact, the Fed we have today is our third attempt at a central bank. The first two didn't work - "which ought to tell you something," Fitz-Gerald noted.

Further, the greatest economic growth in our nation's history happened between the Civil War and 1913 when there was no Fed and hard-money policies supported industrialization. Between 1869 and 1879, for example, real GDP grew at 6.8% a year. Compare that to the anemic 1.5% to 2% we have today after spending trillions.

But back to the Fed as we know it today...

Its original purpose was simple: to prevent banking failures.

At the time, the United States had just gone through the vicious bank panic of 1907. That crisis was significant because it saw the failure of Knickerbocker Trust (one of the largest banks in the U.S. at the time), which sought - but failed - to receive financial support from its peers. Unable to obtain liquidity from any source, Knickerbocker Trust collapsed.

At the time, the United States had just gone through the vicious bank panic of 1907. That crisis was significant because it saw the failure of Knickerbocker Trust (one of the largest banks in the U.S. at the time), which sought - but failed - to receive financial support from its peers. Unable to obtain liquidity from any source, Knickerbocker Trust collapsed.

This affected public psychology deeply because Knickerbocker's peers not only failed to rescue Knickerbocker, but also suspended payments to each other. The effect boomeranged through the system and came to roost at the retail level when the public figured out they couldn't access their money.

Bank runs and closures became the norm. The New York Stock Exchange fell 50% before financier J.P. Morgan famously locked banking executives in his personal library and formulated a liquidity injection that ultimately calmed everything down.

Loath to waste a good crisis, U.S. lawmakers stepped in and agitated for centralized banking.

And so the U.S. Federal Reserve was born under the guise of a politically independent institution that would stabilize the financial system, protect the monetary supply against inflation, and maintain credit as needed. The Fed could do this by injecting stimulus when the economy flagged and withdrawing it when things were overheated.

"The Fed was viewed as giving elasticity to the dollar, which would, in turn, establish more effective control over the banking system," Fitz-Gerald said. "The Comptroller of the Currency observed that the Fed would supply a circulating medium that is 'absolutely safe.' What irony."

You need only take a look at the Fed's track record today to see the damage it has wrought.

"Getting rid of the Federal Reserve is no longer a fringe, lunatic theory," Fitz-Gerald said. "In reality, there are very real reasons to abolish the Fed..."

Why We Should Abolish the Fed: What It Has Done to the U.S. Dollar

The Fed has devalued the U.S. dollar.

According to the U.S. Census Bureau, the median income of male workers in 2010 was $32,137 while the median income of male workers in 1968 was $5,980. On the surface this looks good. It's a 437.4% increase over 42 years - or an average income gain of 10.41% a year, over the same time period.

However, if you run the numbers the other way, using 2010 dollars, this very different picture emerges...

Median-earning male workers actually have less purchasing power today than they did 42 years ago ($32,844 vs. $32,137).

Fitz-Gerald points out that every 1913 dollar is now worth $0.04. Goods and services that cost a dollar back then now will set you back $21.

Putting this in terms that really hit home, Fitz-Gerald observes that, "Every year you have a paycheck that doesn't go up, you're actually getting a pay cut."

Where's the stability in that?

In November 2008 under former chair Ben Bernanke, the Fed began printing money to presumably create economic value (a policy called "quantitative easing"). It bought $4.5 trillion in assets until QE was halted in October 2014.

"QE eviscerated the dollar. Bernanke believed printing money was the same thing as raising prices by managing inflation," Fitz-Gerald said. "In fact, inflation is actually defined as the artificial increase in the supply of money and credit. It's a tax by any other name. So what Bernanke and the Fed really did was artificially tax the American public by debasing its currency and force millions to take a pay cut at the same time."

While the modern-day Fed plays at devaluing the dollar, its original purpose as a liquidity failsafe has become useless in the wake of derivatives...

Why We Should Abolish the Fed: Derivatives Have Changed the Game

The Fed was originally envisioned as a source of liquidity for U.S. banks doing business in the United States. The presumption was that any specific failure in the banking system subject to the Fed's oversight would be offset by the available cash from the government. The Fed centralized credit risks associated with the banks' lending portfolios.

But Fitz-Gerald points out that in today's environment credit is diffused globally - beyond the Fed's reach. For example, there's an estimated $600 trillion to $1.5 quadrillion in derivatives products worldwide right now.

That's why, in addition to bailing out U.S. banks, the Fed spent $350 billion bailing out 35 foreign banks between Oct. 27 and Aug. 6, 2009, and has spent hundreds of billions since (the latter point is one most people don't realize).

In other words, there's so much money sloshing around, the risk it holds actually dwarfs the Fed's liquidity capacity.

"The Feds around the world could print money till the end of time and they still wouldn't be able to print enough to guarantee liquidity," Fitz-Gerald said. "Yet they will continue to try because that's the only way they keep the illusion going."

Finally, even acting in its role as an interest rate watchdog, the modern-day Fed does more harm than good to the American economy...

Why We Should Abolish the Fed: The Interest Rate Myth

The Fed spends a good deal of its time and our money promoting and maintaining low interest rates. It's doing so on the assumption that low rates prompt everyone to put money to work by making savings less appealing.

But that assumes the savings are there in the first place.

"In reality, America and other 'Fed' nations are flat broke. They're functionally bankrupt. There is no savings pool to draw upon, which means the foregone assumption is a bust," Fitz-Gerald said. "At some point, people who do not have cash cannot pay for the goods and services they need - no matter how much liquidity is in the system. Just ask Japan how much demand there was when money was free - the answer is next to none."

International capital markets actually exacerbate the problem because other governments purchase that very same dangerous, unbacked excess liquidity. They use it as collateral for their own expansion, and the "bad money" spreads even further.

Why We Should Abolish the Fed: Takeaways

People forget that the discipline of failure is integral to capitalism.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

"When the Fed creates money out of thin air, the risk of failure does not exist," Fitz-Gerald said. "Without the risk of failure, the big banks know they can place one-way bets and not worry about losses because they are literally 'too big to fail.'"

When Wall Street players' one-way bets pay off, they get up to 50% of the profits. But when it goes bad, shareholders and the public eat the losses - risk is socialized when it should be privatized.

"The Fed takes more than $100 million an hour from our children, our unborn grandchildren, and generations of future Americans," Fitz-Gerald said. "If you reduced it to dollar bills laid end to end, the chain would be so long that it would circle the equator nearly 50 times. The Fed is in good measure responsible for why the once proud United States is now the biggest debtor in the history of the world."

Additionally, those who support abolishing the Fed are in good company.

Henry Ford and other prominent businessmen of their time saw the writing on the wall. None other than Thomas Edison noted in the Dec. 6, 1921, edition of The New York Times that "If our nation can issue bonds, it can issue real currency. The same elements that make our bonds good make our bills good."

The Bottom Line: Why should we abolish the Federal Reserve? Fitz-Gerald boiled it down:

- Not having a Fed would force the government to live within its means.

- It would restore the appropriate level of risk to the global financial community.

- It would nullify the risks that have been involuntarily forced upon the public in the name of political priorities.

Follow me on Twitter @TaraKateClarke.

Make More Money This Year, No Matter What the Market Does... You can make 2015 your wealthiest year in a few simple moves. You just need the three common investing habits to dump immediately, the single most effective strategy for your portfolio, and five stocks to get you started to a wealthier you. Get all of that right now in this exclusive guide...