The Etsy Inc. (Nasdaq: ETSY) IPO exploded out of the gate last month.

The Etsy Inc. (Nasdaq: ETSY) IPO exploded out of the gate last month.

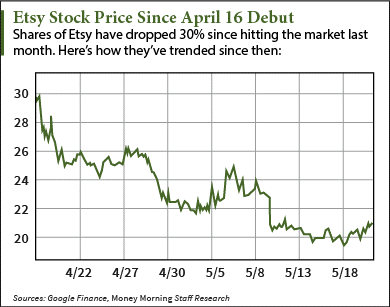

The ETSY stock price was $31.86 when ETSY started trading on the Nasdaq April 16. That's a huge 99% pop from its $16 IPO price. Etsy settled the day at $30 a share.

Since the IPO, the Etsy stock price has fallen dramatically. It has tumbled 30% in a little more than a month and closed at $21 a share yesterday (Tuesday).

The e-commerce company hit a milestone yesterday when it reported its first quarterly earnings as a public company. Here's a rundown of Etsy's first-quarter numbers, and how they contributed to Etsy stock's tumble...

How Has the Q1 Earnings Report Affected the ETSY Stock Price?

First, the good news in the Etsy earnings report...

Revenue of $59 million was up 44.4% from $40.5 million in Q1 2014. Etsy posted earnings of $6.7 million for the first three months of 2015 - a 9.3% increase from $6.1 million in Q1 2014. Its sales of $58.5 million was slightly above Wall Street estimates of $58 million.

Overall activity on the site jumped significantly from the first quarter last year. The number of active sellers increased 25.8% from 1,135 to 1,428. Active buyers increased 36.5% from 15,260 to 20,837.

But, Etsy posted a loss of $0.84 per share.

Costs were up, too. Total operating expenses were up $42.7 million in the first quarter. That marks a 72.6% increase from the same period last year. The costs came from marketing, increased hiring, and product development expenses.

The good wasn't enough to outweigh the EPS loss. Etsy stock price responded horribly to the earnings report. Shares plummeted more than 19% to $17 in after-hours trading.

The company's mixed earnings raises the question...

With the ETSY Stock Price Down 19%, Is ETSY Stock a Buy?

The biggest risk with buying Etsy stock is the company's lack of profitability.

In fact, Etsy openly stated in its IPO filing that it may never make money.

"We have a history of operating losses and may not achieve or maintain profitability in the future," Etsy said in its IPO filing.

The company has seen annual revenue growth of 72% over the last nine years. Most of it comes from advertising and fees users pay to buy and sell items.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

But its operating expenses have skyrocketed as well and are projected to keep growing. They increased 81.4% in 2013 and 67.6% in 2014. Etsy's expenses of $42.7 million in the first quarter alone show that the company isn't slowing it down.

The second red flag is Etsy's lack of concern over its lack of profitability - which stems from its B Corp. status.

The B Corp. status defines Etsy's mission and culture. The certifications are awarded by B Lab, a non-profit that, according to its website, "uses the power of business to solve social and environmental problems." B Corp. certifications are awarded to companies that meet various social, environmental, transparency, and accountability standards. Some B Corp. initiatives are providing employees bikes for their commute and composting food wastes.

But these values threaten Etsy's ability to turn a profit. Company management prioritizes shareholder and community well-being over Etsy's success.

Etsy wants investors to embrace its mission to be both socially conscious and financially successful.

"It's like a beautiful test in a way to see if it's possible to have a mission beyond money," said Rett Wallace, CEO of Triton Research, to Bloomberg. "You see these situations all the time where even management is doing their best to take every penny off the table - regardless of what it does to the widows and orphans - you often see fund managers saying, 'You're not doing enough to make money.'"

Don't miss any updates on the ETSY stock price - follow us on Twitter at @AlexMcGuire92 and @moneymorning.

More on 2015 IPOs: There were more IPOs last year than any year since the height of the dot-com era in 2000. The tech sector is poised to dominate again as massive startups like Uber and Snapchat are rumored to go public. Here are 15 tech IPOs that will explode onto the market this year...

Related Articles: