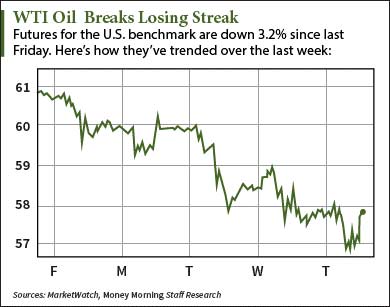

The WTI oil price today (Thursday) broke the benchmark's three-day losing streak amid a surging dollar and new inventory data.

The WTI oil price today (Thursday) broke the benchmark's three-day losing streak amid a surging dollar and new inventory data.

At 3:30 p.m., WTI oil gained 0.47% to $57.78 a barrel. The U.S. benchmark has tumbled 4.3% in May, erasing the bullish momentum from the 14.4% gain in April.

Brent oil prices moved even higher. The international benchmark was up 0.97% at $62.66 a barrel. Brent is down 6.8% this month.

A surging U.S. dollar has pushed the WTI oil price much lower this month. The Wall Street Journal Dollar Index has gained 1.7% in May. The dollar and oil prices are inversely related because oil is priced in dollars. The commodity becomes more expensive to foreign buyers when the greenback rises.

"Crude oil is at the mercy of the dollar index," Bob Yawger, director of the futures division at Mizuho Securities USA Inc., told The Wall Street Journal. "You've got so many other pieces you would think would be supportive, but [the market] is totally discounting them."

The rise in the WTI oil price today came after the American Petroleum Institute (API) released supply data. Late Wednesday, the API reported that U.S. stockpiles increased by 1.3 million barrels last week. The increase came as a surprise following three weeks of inventory withdrawals.

But that information is misleading...

The Energy Information Administration's (EIA) weekly report tells a different story. This morning, it reported a decrease of 2.8 million barrels in crude supplies for the week ended May 22. The data surpassed Platts-polled analysts' expectations of 1.8 million.

Although supply is dwindling and demand is rising, some producers are getting beaten down across the board. According to Money Morning Global Energy Strategist Dr. Kent Moors, exploding energy debt is starting to put significant pressure on the sector.

Here's how the collapse of some producers will open up profit opportunities this year...

How the Rise in the WTI Oil Price Today Suggests Big Gains Ahead

Oil prices are bouncing back this year. WTI and Brent have gained 1.5% and 1.1% respectively since January.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

But the recovery is not accelerating quickly enough to help the most vulnerable companies escape mounting debt.

"There will be fewer oil producers in the United States at the end of the year than there were at the beginning - even if the overall pricing trajectory remains pointed up," Moors explained.

"But well-positioned and well-managed producers will acquire choice drilling assets and leases at a discount that will raise both their bottom lines and our profitability."

Here's how we'll profit when oil prices rebound to the mid-$70 range this summer...

What do you think about the movement in the WTI oil price today? Talk to us on Twitter at @AlexMcGuire92 and @moneymorning.

Related Articles:

- The Wall Street Journal: Oil Prices Fall, Taking Cues from Dollar