[Editor's Note: CNBC has been buzzing about the high valuations of private companies and what these big numbers mean for stocks. Our Chief Investment Strategist Keith Fitz-Gerald warned investors about this Aug. 5, in an alert to his Money Map Report subscribers. Take a look...]

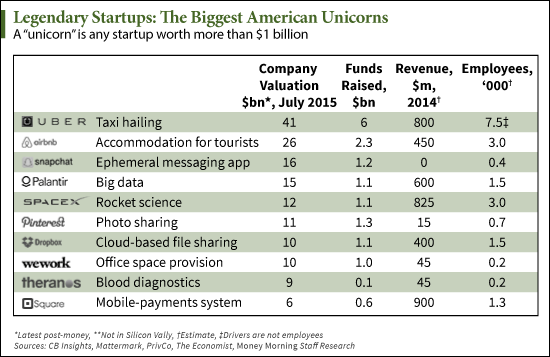

According to The Economist, the top 10 highest-valued private equity companies are valued at $156 billion despite having revenue of only $4 billion.

This makes each of the 19.5 thousand employees they have on staff worth $8 million, according to Zerohedge.com.

Naturally, Silicon Valley doesn't see it this way, even as they crow the six most dangerous words in the English language: "It will be different this time."

No it won't.

Here's how these high-valued private companies rank in valuation and funds raised:

Every one of these unicorns - meaning a private startup valued at more than $1 billion in investing lexicon - makes something that can be replaced at the click of a mouse. Worse, most are sold on potential, not results, like they would have been a decade ago.

I recognize that it's hip to glom onto the latest IPOs, but doing so is exceptionally dangerous for your money. And risky.

To paraphrase the legendary and controversial billionaire investor, George Soros, "if investing is entertaining, you're probably not making money. Good investing is boring."

Yep.

To find out more about these winning stock picks, and to find out how to get Keith's investment alerts as soon as they are sent to Money Map Report subscribers, continue here...

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.