It hasn't been a good year for natural gas investing. Natural gas prices have cratered 21.8% so far in 2015. As of Oct. 6, they're trading at $2.48 per million British thermal units (BTUs).

But natural gas prices are on the verge of a huge rebound. According to Money Morning Global Energy Strategist Dr. Kent Moors, there are some significant changes happening to the industry that will transform natural gas investing forever.

But natural gas prices are on the verge of a huge rebound. According to Money Morning Global Energy Strategist Dr. Kent Moors, there are some significant changes happening to the industry that will transform natural gas investing forever.

"'Brave New World' is going to be an understatement," Moors said in August. "Please understand the importance of what we are rushing into: nothing less than the emergence of an integrated global natural gas market."

According to Moors, new forms of natural gas consumption will boost demand and prices to record highs in the coming decades.

Here are the three "game changers" that will bring in the next generation of natural gas investing...

Natural Gas Investing Game Changer No. 1: Role in Power Production

Electricity companies are switching from coal usage to natural gas usage due to strict carbon emissions laws. By the end of 2015, coal's share of power production should only be about 35.6%. That's down from 38.7% in 2014.

Meanwhile, natural gas' share of power production should increase from 27.4% last year to 31.2% this year. Natural gas should also make up 22% of all new generating capacity coming on line this year.

The massive transition to gas-sourced power will consume a huge chunk of excess supply. After all, natural gas inventory is estimated to reach 3.87 trillion cubic feet by the end of October. That's 69 billion cubic feet above the current five-year inventory average.

"If only 75% of fuel sourcing comes from natural gas, we require almost three times the current surplus inventory just for power generation," Moors noted.

And as consumption skyrockets, natural gas prices will climb accordingly.

Here are two more factors shaping the future of natural gas investing...

Natural Gas Investing Game Changer No. 2: Other Sectors Using Natural Gas

Many industries are increasing natural gas consumption. The two biggest consumers are the auto and petrochemical sectors.

Natural gas-powered and hybrid vehicles are already being developed in North America. In fact, the Canadian arms of General Electric Co. (NYSE: GE) and Royal Dutch Shell Plc. (NYSE ADR: RDS.A) partnered in June to design high-end trucks to run on liquefied natural gas (LNG). The collaboration aims to permanently replace diesel trucks with high carbon emissions.

But the greater impact will come from the petrochemical industry. Many U.S. petrochemical companies are changing their production facilities from oil to natural gas. That shift is huge because these petrochemical companies are crucial to numerous industries, including the American agriculture industry. According to the USDA, the agriculture industry alone contributed $789 billion to the U.S. GDP in 2013.

"There are seven major projects under consideration at the moment," Moors said. "Three facilities are likely to be approved. Beaver County in western Pennsylvania should be one of the three, with the other two probably on the Gulf Coast."

But the most significant game changer will be the burgeoning LNG trade...

Natural Gas Investing Game Changer No. 3: The Growing LNG Market

LNG is natural gas cooled to a liquid state. Natural gas has always been a locally traded commodity since gas cannot be transported long distances. As a liquid, it can be loaded onto tanker ships and transported anywhere in the world.

The United States is expected to start exporting LNG next year to meet rising global natural gas demand. This will be the first time the U.S. Department of Energy has allowed oil and gas exports in more than 40 years.

The United States is expected to start exporting LNG next year to meet rising global natural gas demand. This will be the first time the U.S. Department of Energy has allowed oil and gas exports in more than 40 years.

"The idea of U.S. LNG exports is so strong and unstoppable that it has the power to change the world," Moors explained. "It's the result of one of the biggest reversals of fortune I have ever witnessed."

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

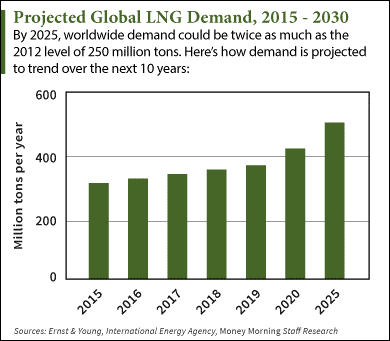

Global LNG demand is expected to reach 420 million tons a year (mt/y) by 2020 and 500 mt/y by 2025. Since 1 billion cubic feet of natural gas is equal to 21,000 tons of LNG, demand in 2020 will equal around 20 trillion cubic feet a year.

The International Energy Agency (IEA) forecasts Japan, South Korea, and Taiwan will make up the highest percentage of global demand. China alone expects to triple its natural gas consumption within five years.

The Bottom Line: The natural gas market is on the brink of a new era. Although prices are beaten down right now, the commodity is starting to replace oil as the primary source of energy in the auto and petrochemical sectors. That - combined with the LNG revolution happening in the United States - will send demand soaring and make natural gas investing the perfect way to profit from the energy sector.

Alex McGuire is an associate editor for Money Morning who writes about energy. Follow him on Twitter for all of the biggest oil and gas updates.

Like us on Facebook: Money Morning.

More on Energy: Master limited partnerships (MLPs) have seen immense growth over the last decade. But it's important to understand how they work. Here's how you can profit from the MLP sector, which has generated 249% in total returns since 2005...