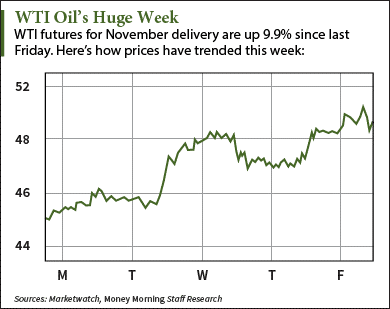

Oil prices today (Friday) moved higher following yesterday's FOMC minutes release and the ongoing Syrian conflict. Today's rise puts oil prices on track for the biggest weekly gain in more than six years.

WTI Crude Oil Prices Today

WTI Crude Oil Prices Today

At 9:40 a.m., WTI crude oil prices were up 1.2% to $50.04 a barrel, it's highest level in two months. The U.S. benchmark has soared 9.9% this week and could see its largest weekly rise since 2009.

West Texas Intermediate (WTI) is the oil price benchmark for the New York Mercantile Exchange. WTI is considered "sweet" crude because it contains 0.24% sulfur.

Brent Crude Oil Prices Today

Brent crude oil prices today gained less than their U.S. counterpart. They were up 0.02% and trading at $53.39 a barrel. The international benchmark is up 9.4% this week and 8.8% this month.

Brent crude is the international price benchmark. It's considered "light" crude because of its low density and sulfur content.

Here's why oil prices are surging to a six-year high...

Two Reasons Why Oil Prices Today Are Climbing

The boost in oil prices today came after the U.S. Federal Reserve released minutes from last month's meeting. The FOMC meeting minutes showed that the majority of policymakers agreed to keep interest rates near zero. Chairwoman Janet Yellen cited a global economic slowdown, low U.S. inflation, and market volatility as reasons for not hiking rates.

"With a slowdown in both the U.S. and the global scene, the U.S. Federal Reserve seems to be growing more dovish," said Daniel Ang, analyst at Phillip Futures, to The Wall Street Journal. "Oil prices gain support as a result of a weaker U.S. dollar strength as this makes USD-denoted oil cheaper."

Russia's involvement in the Syrian civil war has also supported oil prices. On Wednesday, Russia launched military airstrikes against rebels trying to oust Syrian President Assad. The conflict interrupts oil transports in the region, which increases global demand.

But Russia is involved in another conflict that has big implications for the future of oil prices...

Why Russia's Truce with OPEC Will Boost Oil Prices

On Oct. 3, Russian Minister of Energy Alexander Novak announced his country is ready to meet with OPEC and non-OPEC producers to discuss the crash in oil prices. He stated Russian and Saudi officials already plan to meet at the end of October.

According to Money Morning Global Energy Strategist Dr. Kent Moors, this is an important development for the energy industry. That's because Russia and OPEC haven't played nice recently.

You see, OPEC has tried to establish relations with Russia for years now. That's because it wants to partake in Russia's massive oil reserves and geopolitical dominance. After all, adding Russia to the 12-member cartel would boost OPEC's market share by about 33%.

Russia played hard to get last November when it refused OPEC's call to cut production. The country declined in order to defend its own share of the oil market.

But major producers like Russia are watching their export revenue crumble alongside prices. Now the country is desperate to fix the problem before its entire economy falters.

"The stage now seems set for a Russian-Saudi meeting to precede a broader OPEC session," Moors said. "That should be enough for crude prices to find a floor and improve."

Here's what we can expect from Russia-OPEC relations in the months ahead...

Alex McGuire is an associate editor for Money Morning who writes about energy. Follow him on Twitter for all of the biggest oil and gas updates.

Related Articles:

- The Wall Street Journal: Oil Prices Continue to Rally Driven by Weakening Dollar, Syria Tensions